News

China’s domestic policy-driven growth vs. international market challenges – GlobalData

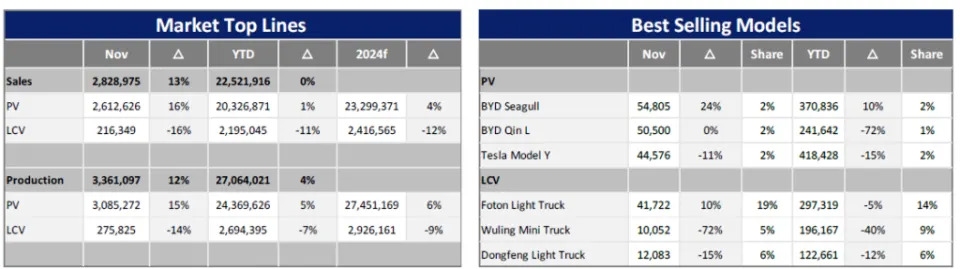

In November 2024, China’s Light Vehicle (LV) market sustained its strong performance from October, with domestic LV sales reaching 2.8 million units (excluding exports). This represents a 13.0% year-on-year (YoY) increase and a significant 12.6% month-on-month (MoM) growth. The ongoing effects of scrapping and replacement policies, along with the "Double Eleven" promotion and the Guangzhou Auto Show, contributed to the steady boost in the market.

By model type, Passenger Vehicle (PV) sales dominated with 2.6 million units, showing a significant YoY increase of 16.3% and a substantial MoM rise of 12.5%. In contrast, Light Commercial Vehicles (LCVs) faced challenges, with a 14.0% MoM increase but a substantial YoY decline of 15.7%. For the first eleven months of 2024, cumulative LV sales reached 22.5 million units, almost matching the same period in 2023, with a YoY growth rate of 0%. Within this total, PV sales amounted to 20.3 million units, recording a marginal YoY increase of 1.3%, while Commercial Vehicle (CV) sales stood at 2.2 million units, indicating a more pronounced YoY decline of 11.1%.

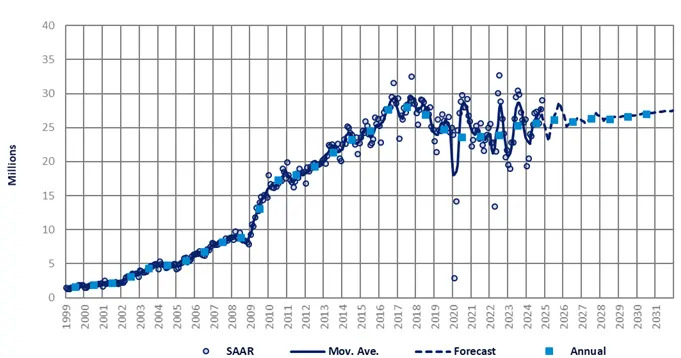

Based on the data, China’s domestic market saw its second consecutive month of acceleration in November. The estimated selling rate reached 28.4 million units/year, marking the highest rate of the year thus far, although it remained below the 29-30 million units/year level seen during the summer of 2023.

Since the introduction of scrapping and renewal policies, along with old-for-new incentives, their impact has outpaced that of real estate stimulus measures. According to the latest data from the Ministry of Commerce, as of November 18, 2024, the nationwide total of applications for automobile scrapping and renewal, as well as replacement subsidies, has surpassed 4 million. Despite the brief implementation period of these replacement and renewal subsidies, the rate of increase is significantly outpacing the growth in scrapping and renewal numbers, indicating a strong underlying demand for vehicle replacement and purchasing among residents.

The national scrapping and renewal subsidy standards offer differentiated incentives, including a CNY20,000 ($2,700) subsidy for the purchase of new energy passenger cars and a CNY15,000 ($2,100) subsidy for the purchase of fuel passenger cars with a displacement of 2.0 liters or less. Since scrapped and updated New Energy Vehicles (NEVs) have an additional subsidy advantage of CNY5,000 ($685) over fuel vehicles, the vast majority of scrapped and updated, and some old-for-new, users choose to buy NEVs. The subsidy policy, in particular, has promoted strong growth in the entry-level pure Electric Vehicles (EVs) and narrow Plug-in Hybrid (PHEV) markets, further consolidating the foundation for the expansion of new energy penetration.

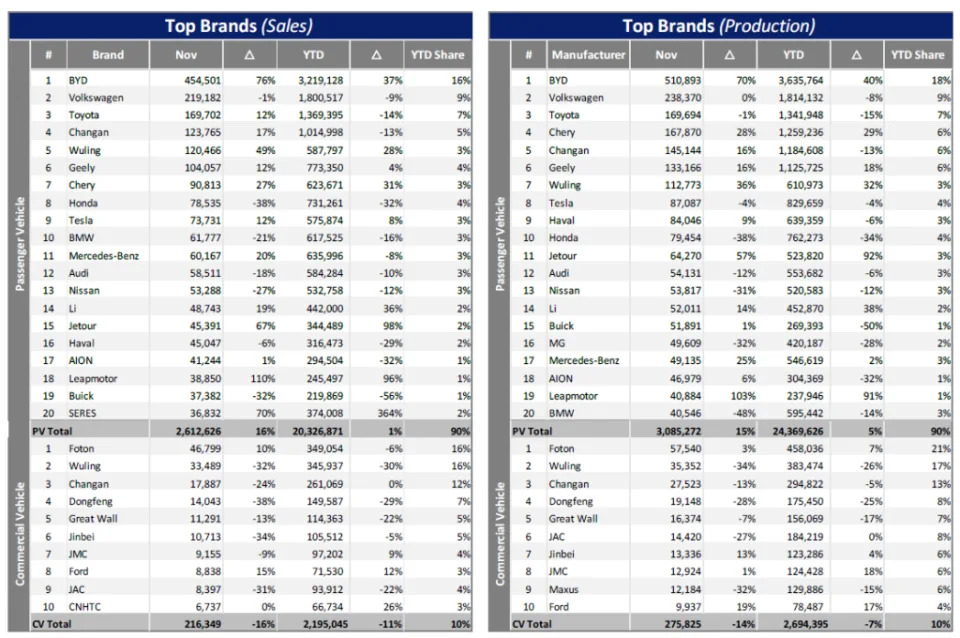

In November 2024, the production of LVs in China reached an impressive 3.4 million units, reflecting a substantial YoY increase of 12.0%. This growth underscores the market’s dynamism and the effectiveness of recent policy measures in stimulating the automotive industry. The PV segment has been a key driver, with a total of 3.1 million units produced, marking a significant YoY increase of 15.0%. Factors contributing to this growth include policy incentives, the launch of new models at the year’s end, and attractive retail promotions that have drawn consumer interest. Additionally, the unexpected growth in exports has significantly impacted production levels. Despite the overall positive trend, the CV sector has experienced a decline, with production falling by 13.5% YoY to 276k units. This downturn may signal broader economic challenges and the effects of regulatory changes within the industry.

On another note, the production of Chinese OEMs shows a positive trend, with a YoY increase of 25.6%. In contrast, the output of joint venture (JV) brands has seen a significant decline of 10.4% YoY. The production cuts by JV automakers have somewhat limited the overall output growth in the Chinese market. This shift highlights the transformation occurring in the country, where local automakers are advancing, while JV brands need to reassess their strategies to maintain competitiveness.

China’s LV export market experienced a modest YoY increase of 2.3% in November, although it saw a significant MoM decline of 10.9%, with a total of 458k units shipped overseas. The overall export momentum has notably decelerated. Breaking down the figures by model type, PV exports reached 414k units, marking a 3.4% YoY increase but a 10.9% MoM decrease. CV exports also faced challenges, with 44k units exported, showing a 7.2% YoY decrease and a 10.8% MoM decline. Cumulatively from January to November 2024, LV exports amounted to 5.1 million units, demonstrating a robust 26.8% YoY growth. The slowdown in exports for November 2024 can be attributed primarily to market fluctuations, shifts in the international environment, and a deceleration in the export of NEVs. These monthly fluctuations also indicate that China’s automobile industry continues to confront numerous challenges in its journey towards globalization. These include policy changes in foreign markets, volatility in overseas demand, and competitive pressures.

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center .

"China’s domestic policy-driven growth vs. international market challenges – GlobalData" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.