News

Deutsche Bank says it’s now overweight Europe stocks vs. the U.S. Valuation is just one reason.

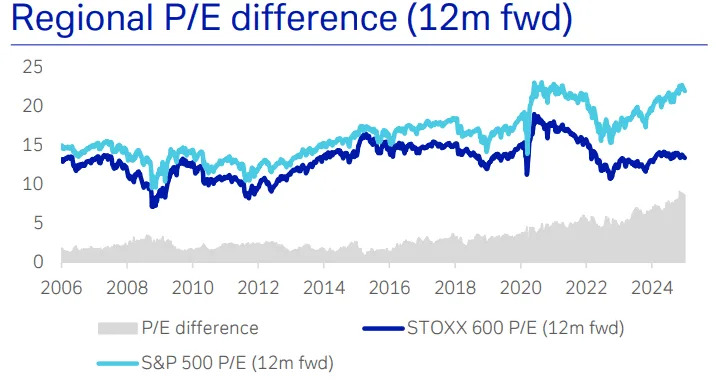

There’s never been a bigger valuation gap between European and U.S. stocks, and that’s not the only reason why Deutsche Bank now says it prefers equities on the Continent on a tactical basis.

Strategists led by Maximilian Uleer say the price-to-equity ratio between the U.S. S&P 500 SPX and the Stoxx Europe 600 XX:SXXP is now the largest on record, at more than 8 percentage points.

And they say even excluding Magnificent Seven stocks such as Apple AAPL and Nvidia NVDA, the valuation difference remains elevated.

But their call, the first time they have preferred European stocks over U.S. equities since June, isn’t just about valuation.

The Deutsche Bank team sees more interest-rate support in Europe than the U.S. as they expect 150 basis points of European Central Bank monetary easing. That’s led to an extreme rate differential between the 10-year Treasury BX:TMUBMUSD10Y and the 10-year German bund BX:TMBMKDE-10Y, according to the analysts.

Economic surprises in the eurozone have been rising since September, and the analysts expect it to continue, driven by falling interest rates, better financial conditions and solid corporate earnings growth, they say.

The impact of a second Trump administration on European profits might not be negative, even with new tariffs. They estimate 2.6% U.S. gross domestic product growth in 2025, which will be a tailwind to European revenue even with tariffs, since service providers are likely not subject to them and manufacturers produce a vast majority of their revenue in their local markets. The analysts also expect a strengthening dollar, which translates into higher profits from the U.S. once the European companies repatriate the income.

The political environment in Europe, meanwhile, is stabilizing after a difficult 2024 where there were elections in the U.K. and France and the break-up of the German governing coalition. There’s now a chance for “constructive reforms” from the snap elections, notably a potential change in the debt brake, and what they call the most stable U.K. government since Brexit. France, however, they acknowledge is in a “challenging spot.”

The analysts also see the first signs of a recovery in China, a key market for Europe, and the National People’s Congress meeting in March could prioritize domestic consumer demand.

They expect 10% earnings growth for European companies excluding energy in the fourth quarter — much higher than the 1% consensus. “Positive earnings surprises should support the positive momentum in European equities,” they say.

Within Europe, the analysts see the best risk/reward in U.K. equities, and the highest upside in France if there’s a luxury recovery.

For the year, the price gain forecasts between the U.S. and Europe are similar, as they see a 16% return for the S&P 500 and a 15% gain for the Stoxx 600.

In terms of sector preferences, Deutsche Bank is overweight on health care, citing its negative correlation to bund yields, attractive P/E ratio and solid earnings growth. The bank also remains overweight on rate-sensitive sectors and consumer-related sectors such as retail and travel and leisure.

Small caps are Deutsche Bank’s favorite factor over the next 12 months, with the bank expecting earnings to outgrow large caps substantially while trading at a discount.