News

The bull market is still intact. This pullback is just the cost of doing business, says strategist

Investors are starting the week still in a cautious mood. The S&P 500 SPX closed Friday 4.3% below its record closing high in early December. Surging Treasury yields amid revived inflation concerns seem to be taking much of the blame.

However, according to Keith Lerner, chief market strategist at Truist Advisory Services, such pullbacks may be uncomfortable “but are the admission price to the market.”

Lerner believes the latest selloff represents no more than a reset of prices and sentiment, both of which may have become stretched on a short-term basis, but still leaves stocks within the boundaries of an ongoing bull market.

The record levels of investor optimism seen late last year — including a very high percentage of traders expecting stocks to reach new peaks in coming months — left the market vulnerable. “When expectations are high, a little bad news can go a long way,” he says.

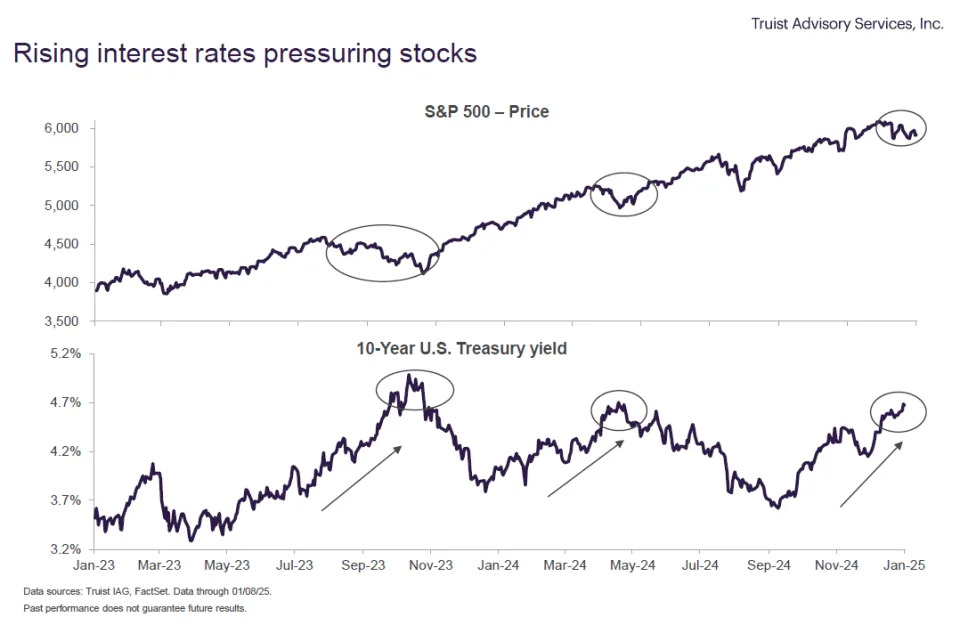

The latest piece of bad news, as noted above, is swiftly rising bond yields. Lerner notes that over the past few years when the 10-year Treasury yield BX:TMUBMUSD10Y has moved above 4% at “an accelerated pace” it has proved a challenge to equities. “It’s not a coincidence that the S&P 500’s recent peak on Dec. 6 coincided with the trough for the 10-year Treasury yield,” he says.

But the important thing for investors to remember is that the spike in interest rates mainly reflects recent better-than-expected economic data — like Friday’s blowout jobs report. “Our long-held view remains that we would prefer a stronger economy with fewer rate cuts than a weaker economy that requires more aggressive rate cuts. One only needs to look back to 2000 or 2008, where aggressive rate cuts did not stem bear markets or recessions,” says Lerner.

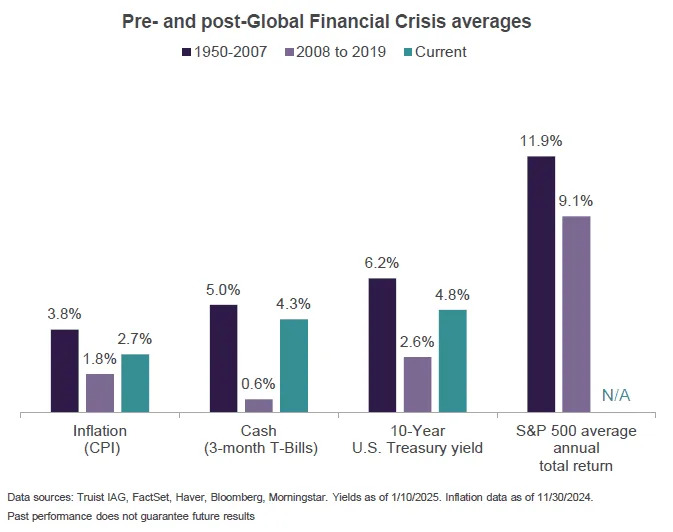

Yes, the move higher in bond yields provides competition for stocks, but Lerner believes all we are seeing is a reversion to the interest rate/equity relationship in play before the 2008 global financial crisis. From 1950 to 2007, the 10-year Treasury yield averaged 6.2% and inflation was 3.8%, he notes. Yet over that period the S&P 500 averaged an 11.9% annual total return.

“A resilient economy should continue to support higher corporate profits and the economy has proven to be somewhat less rate sensitive relative to history over recent years,” he says.

That said, Lerner accepts interest rates may need to stabilize for the stock market to get back its mojo. The good news is that Truist’s fixed income strategists reckon this may soon occur given the U.S. yield spread advantage to its G7 peers is near the highest since 2019. This should attract buyers to U.S. paper.

But how much further may this latest pullback have to run. Well, Lerner crunched the numbers since the market bottom in March 2009, and noted 30 S&P 500 declines of a least 5% even as the barometer registered a total return of 1087% over the period. The median pullback was 7.5% over 28 calendar days.

The latest selloff is about 4% over 35 days, and so “we are likely at least halfway through this current setback already,” says Lerner. And he adds: “Moreover, we have also seen other areas of the market, such as small caps, down about 10% and the average stock, as proxied by the S&P 500 Equal Weight index, down 7%, suggesting a decent reset has already occurred.”

In sum, Truist says stick with the longer-term stock uptrend, and any investors who are underweight their target equity position should use the pullback to buy over time. The U.S. is Truist’s preferred region, it favors large caps over small caps, prefers technology, communication services and financials, and suggests a “modest” position in gold.

Markets

U.S. stock-indices SPX DJIA COMP are lower at the opening bell as benchmark Treasury yields BX:TMUBMUSD10Y rise. The dollar index DXY is higher, and gold GC00 is trading around $2,670 an ounce.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5827.04 |

-0.71% |

-3.71% |

-0.93% |

21.90% |

|

Nasdaq Composite |

19,161.63 |

-0.62% |

-3.72% |

-0.77% |

28.00% |

|

10-year Treasury |

4.794 |

15.80 |

38.90 |

21.80 |

85.03 |

|

Gold |

2702.3 |

2.09% |

1.20% |

2.39% |

31.59% |

|

Oil |

77.85 |

6.02% |

10.21% |

8.32% |

7.00% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

U.S. economic data due on Monday include the Federal Reserve Bank of New York’s consumer inflation expectations for December at 11:00 a.m. Eastern, and the federal budget for December, released at 2:00 p.m.

KB Home KBH KBH will release results after the closing bell, ahead of the fourth-quarter earnings season kicking off proper on Wednesday with some of the big banks.

China’s trade surplus rose to a record $1 trillion in 2024 as exporters rushed to send goods ahead of expected tariffs by President-elect Donald Trump.

The White House on Monday announced new restrictions on artificial intelligence exports that will impact companies including Nvidia NVDA.

The Los Angeles wildfires have now claimed 24 lives and firefighters are preparing for more high winds.

The price of U.S. WTI crude CL.1 was near $79 early Monday as traders fretted about more U.S. sanctions on supplies from Russia.

Lululemon athletica shares LULU are higher after the apparel group gave an update on fourth-quarter revenue and earnings .

Shares of Intra-Cellular Therapies ITCI are jumping 35% after the neuroscience group was purchased by Johnson & Johnson JNJ in a $14.6 billion deal.

Shares of Sage Therapeutics SAGE are surging nearly 40% after the biopharmaceutical company received an unsolicited buyout bid from partner Biogen BIIB.

Moderna stock MRNA is plunging 20% after the biotech group delivered sales forecasts below Wall Street expectations .

Best of the web

Fake job postings are becoming a real problem.

Power lines? Old embers? Arson? Investigators, experts, amateurs look for cause of L.A. fires.

Bank of America’s CEO on Trump, King Charles and keeping the brakes on risk.

The chart

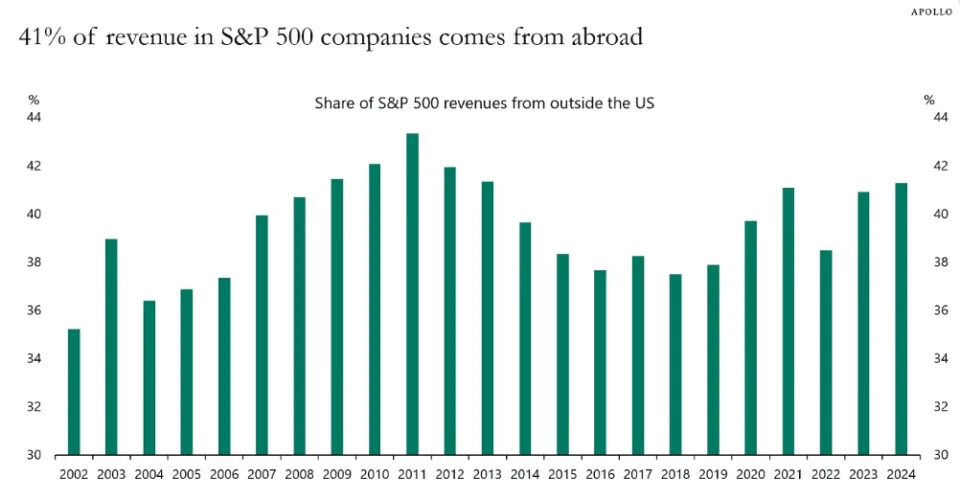

Torsten Sløk, Apollo chief economist, notes that the narrative in markets is that the outlook for the U.S, is great, and the outlook for Europe, U.K., and China is not good.

But the problem with this view, as the chart shows, is that 41% of revenues in the S&P 500 come from abroad. “If we have a recession in Europe and a continued slowdown in China, it will have a significant negative impact on earnings for S&P 500 companies,” he says.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

|

Ticker |

Security name |

|

NVDA |

Nvidia |

|

TSLA |

Tesla |

|

GME |

GameStop |

|

PLTR |

Palantir |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

AMD |

Advanced Micro Devices |

|

RGTI |

Rigetti Computing |

|

MSTR |

MicroStrategy |

|

AAPL |

Apple |

|

HOLO |

MicroCloud Hologram |

Random reads

No-trousers tube day.

Dozens of misplaced anti-tank mines end up at IKEA.

Once-in-a-lifetime comet visible tonight. It won’t return for 1,600,000 years.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.