News

Downturn in the Indian market expected in December 2024

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center .

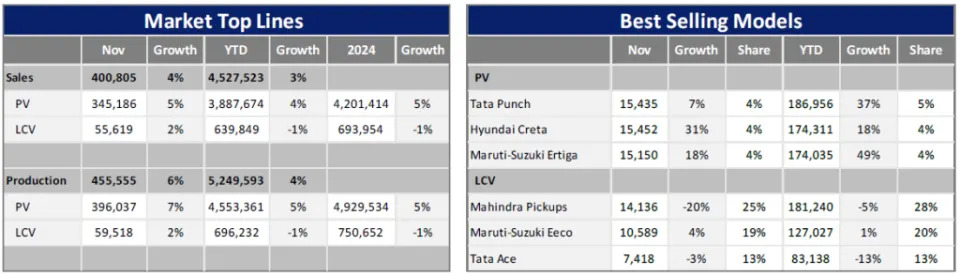

India's Light Vehicle (LV) wholesales predictably declined in November, falling by 13% month-over-month (MoM) to 401k units, following the conclusion of the peak festival period in October. Despite this decrease, the figure represents a 4% year-over-year (YoY) increase.

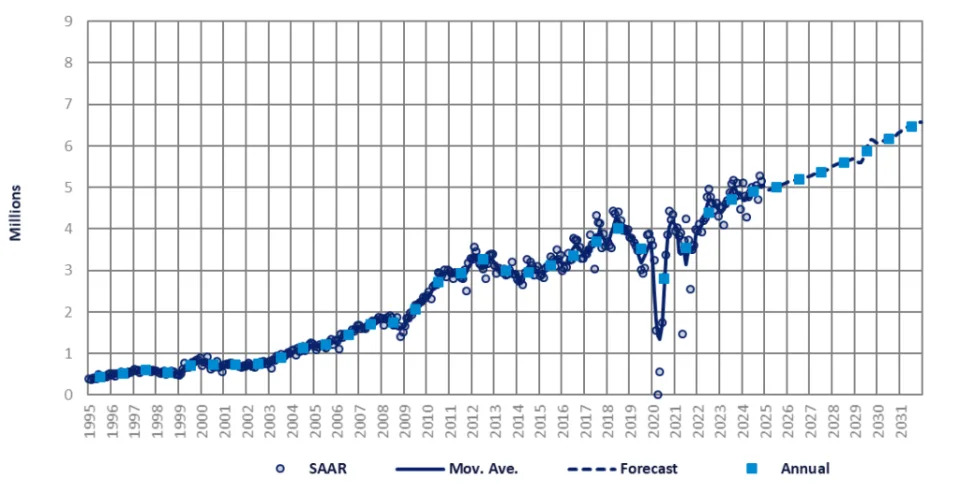

Passenger Vehicle (PV) sales totalled 345k units (-12% MoM, +5% YoY). Light Commercial Vehicles (LCVs) with a gross vehicle weight of up to 6T accounted for 56k units (-18% MoM, +2% YoY). As a result, the November selling rate reached 5.3 mn units/year, marking the second consecutive month that the rate exceeded the 5 mn-unit threshold. Additionally, this was the fifth occasion in 2024 in which the selling rate surpassed 5 mn units.

On the retail sales front, the situation differed significantly. The Federation of Automobile Dealers Associations (FADA) reported a sharp decline in retail sales for both PVs and LCVs in November. Many retail sales appeared to have been advanced to October, as major festivals – an auspicious time for significant purchases – were concentrated in one month, rather than spread between October and November.

In the PV sector, November sales were lackluster due to subdued market sentiment, limited product variety, and a scarcity of new launches, further impacted by the shift of festive demand to October. LCV retail sales also lagged, affected by an aging model cycle, limited product options, and insufficient financing support. Weak industrial activity and elections in certain states further dampened LCV sales.

Inventory levels at dealerships have continued to decrease, yet they remain above the preferred threshold. The days' supply in November was notably high, between 65-68 days, according to FADA data. This figure, however, shows an improvement from the 75-80 days seen in October and a peak of 80-85 days in September. This situation prompted OEMs and dealerships to continue offering aggressive discounts and incentives to reduce excess inventory.

Cumulative LV wholesales from January to November rose by 3% YoY to 4.5 mn units. This included 3.9 mn PVs, up by 4% YoY, and 640k LCVs, down by 1% YoY. Consequently, the year-to-date (YTD) selling rate averaged an impressive 4.9 mn units/year.

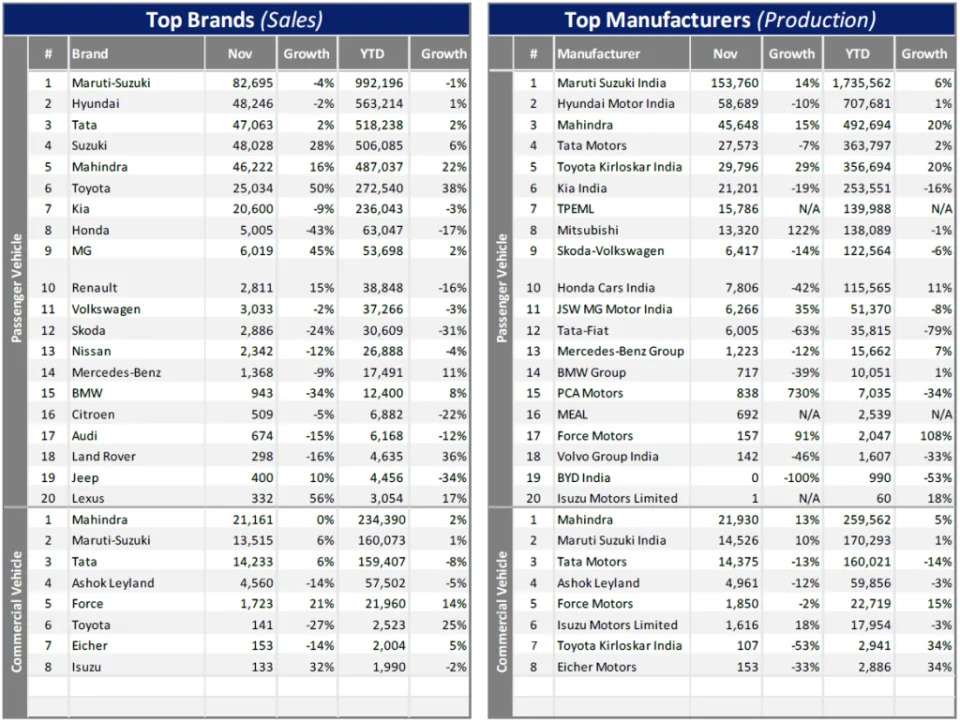

Preliminary data for December from the top five automakers indicates lower wholesales versus the previous month, aligning with our expectations. For example, our forecast for the market leader, Suzuki Group, for December was accurate within a margin of 400 units.

Suzuki Group's PV wholesales declined by 9% MoM. Hyundai's sales decreased by 13% MoM, while Tata Motors' PV total fell by 6% MoM. Mahindra's PV volumes contracted by 10% MoM, and Toyota's sales (mostly PVs) dipped by a nominal 1% MoM.

Despite the downturn in December, the Indian market is likely to have concluded 2024 with record-high sales.

Our LV sales forecast remains largely unchanged, with only minor adjustments for 2024. Volumes are projected to have reached an unprecedented 4.9 mn units during the year, representing a 4% YoY increase.

Looking ahead, we maintain a cautious stance regarding the 2025 sales outlook due to growing global uncertainty and geopolitical tensions. While India may not become a direct target of US President-elect Donald Trump's protectionist trade policies, it could be indirectly affected by the ripple effects of US policies, such as heightened inflation in the global economy. Therefore, we forecast LV wholesales to show a modest gain of 2% YoY to 5 mn units in 2025.

"Downturn in the Indian market expected in December 2024" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.