News

We mistimed the market – but it doesn’t matter for this stock

Questor is The Telegraph’s stockpicking column, helping you decode the markets and offering insights on where to invest.

Antofagasta has provided significant highs and substantial lows since this column first tipped it in August 2021.

The Chilean copper miner’s share price slumped by 35pc within a year of our initial “buy” recommendation, but subsequently surged so that we briefly enjoyed a 55pc paper profit last year.

Following a recent decline, however, the company’s shares are now up by just 14pc versus their price at the time of our original tip. This is roughly in line with the FTSE 100’s gain over the same time period, which is hugely disappointing. The stock’s total return, meanwhile, amounts to a somewhat more respectable 27pc.

Clearly, we should have waited a little longer before tipping the company’s shares so as to benefit from a lower price. We should then have exited at the peak of their aforementioned surge to lock in a considerable profit prior to their recent decline.

The problem with attempting to time the stock market in such a manner, though, is that it is impossible to accurately forecast the mood of overwhelmingly irrational investors who continually overreact to good and bad news alike.

Questor will therefore persist with its longstanding strategy of seeking to unearth high quality companies that trade at attractive prices on a long-term view.

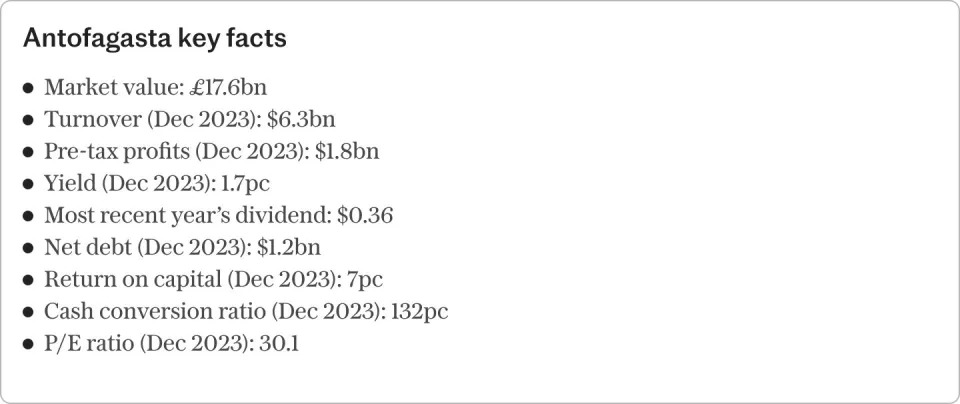

On this front, Antofagasta continues to have significant merit. Although its shares trade on a forward price-to-earnings ratio of 32.4 using 2024’s forecast earnings even after their recent slide, the firm’s bottom line is expected to rise by 30pc in the current financial year. This suggests that it offers good value for money.

The company has further growth potential over the coming years. Due to its wide variety of industrial applications, copper is likely to experience rising demand as the world economy’s performance gradually benefits from an increasingly accommodative monetary policy in the US.

Indeed, the full impact of the Federal Reserve’s recent interest rate cuts is yet to be felt. Once time lags have passed, they and any future monetary policy easing are set to catalyse the world economy’s growth rate.

In addition, the world’s continued push towards net zero is likely to prompt higher demand for copper that should support the metal’s price and Antofagasta’s profits.

Electric vehicles and renewable energy infrastructure use relatively large amounts of copper, for example, and are central to the global energy transition. Meanwhile, a lack of major discoveries over recent years means there could prove to be a supply and demand imbalance for the metal over the long run.

Separately, the company’s recently released fourth-quarter production update showed that it continues to make encouraging overall progress.

Although full-year copper production of 664,000 tonnes was only marginally higher than in 2023 – and is expected to be between 660,000 and 700,000 tonnes in the current year – the company’s development projects are advancing on time and on budget.

They have the potential to catalyse its financial performance, while the firm’s forecast of a fall in net cash costs this year could help to further bolster its bottom line.

Antofagasta’s financial position, meanwhile, remains sound. At the time of its half-year results in June, for example, its net gearing ratio amounted to just 12pc. And with net interest cover in the first half of its latest financial year being in excess of 25, it is well placed to invest for long-term growth.

Indeed, it forecasts that capital expenditure will reach $3.9bn (£3.2bn) in the current year. This is up from an expected $2.7bn in 2024.

With the company set to release full-year results next month, it would be unsurprising for its shares to exhibit elevated volatility in the short run. However, they have fluctuated significantly on a fairly regular basis since our original tip, with the financial performance and outlook of mining companies inherently uncertain.

While this may cause concern for some investors, the firm’s sound financial position means that it is highly likely to successfully emerge from industry downturns to capitalise on an upbeat long-term global economic outlook.

Clearly, the world economy could experience a period of elevated uncertainty in the short run as US interest rate cuts take time to have their desired impact on GDP growth. Meanwhile, ongoing uncertainty regarding China’s economy may dampen sentiment towards copper miners due to the country being the world’s largest importer of the metal.

However, in Questor’s view, Antofagasta continues to offer significant long-term capital return potential. The company’s upbeat earnings outlook, solid fundamentals and improving operating conditions equate to a favourable risk/reward opportunity.

Questor says: £17.63

Ticker: ANTO

Share price at close: TBC

Read the latest Questor column on telegraph.co.uk every weekday at 5am. Read Questor’s rules of investment before you follow our tips.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month with unlimited access to our award-winning website, exclusive app, money-saving offers and more.