News

Myriad Genetics (NASDAQ:MYGN) Misses Q4 Sales Targets, Stock Drops

Genetic testing company Myriad Genetics (NASDAQ:MYGN) fell short of the market’s revenue expectations in Q4 CY2024, but sales rose 7.1% year on year to $210.6 million. The company’s full-year revenue guidance of $850 million at the midpoint came in 1.5% below analysts’ estimates. Its non-GAAP profit of $0.03 per share was in line with analysts’ consensus estimates.

Is now the time to buy Myriad Genetics? Find out in our full research report .

Myriad Genetics (MYGN) Q4 CY2024 Highlights:

“There is a lot for Myriad Genetics to be proud of in 2024. We generated 11% revenue growth over 2023, making this our second consecutive year of double-digit growth, and $40 million in adjusted EBITDA. This achievement is the result of the company's multi-year investment strategy along with our team’s hard work and focus on the needs of our patients and the healthcare providers who serve them,” said Paul J. Diaz, President and CEO, Myriad Genetics.

Company Overview

Founded in 1991, Myriad Genetics (NASDAQ:MYGN) provides genetic testing and precision medicine solutions, with a focus on identifying hereditary risks for cancer, guiding treatment decisions, and supporting mental health diagnosis.

Therapeutics

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

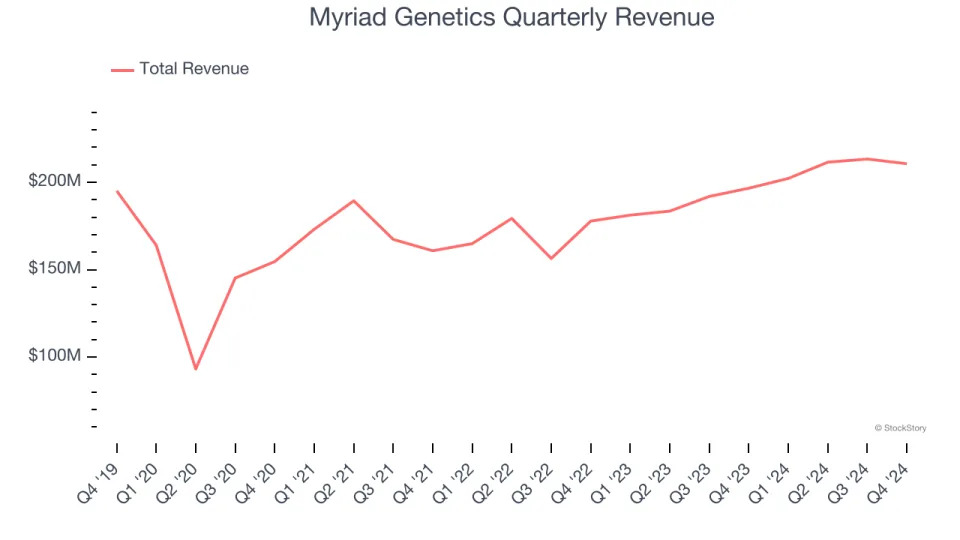

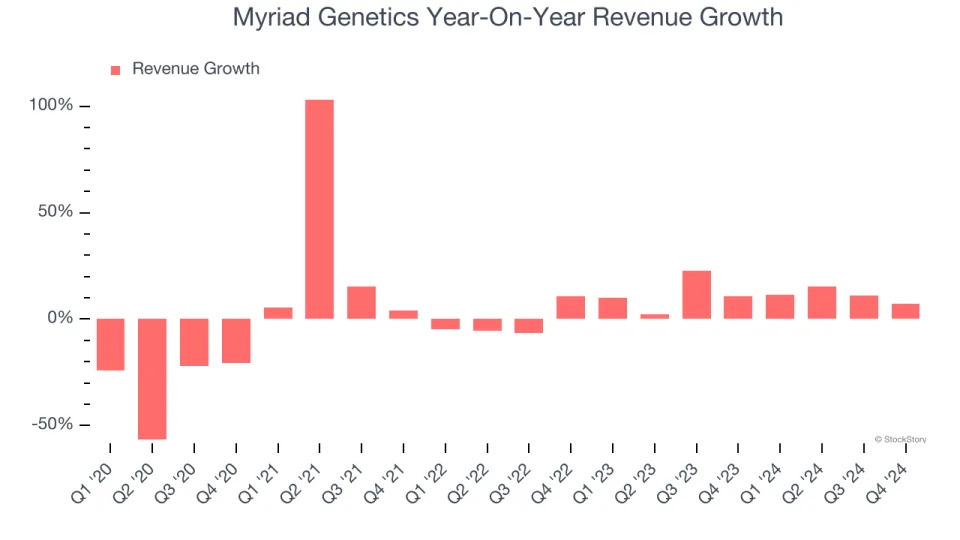

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Myriad Genetics struggled to consistently increase demand as its $837.6 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Myriad Genetics’s annualized revenue growth of 11.1% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Myriad Genetics’s revenue grew by 7.1% year on year to $210.6 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

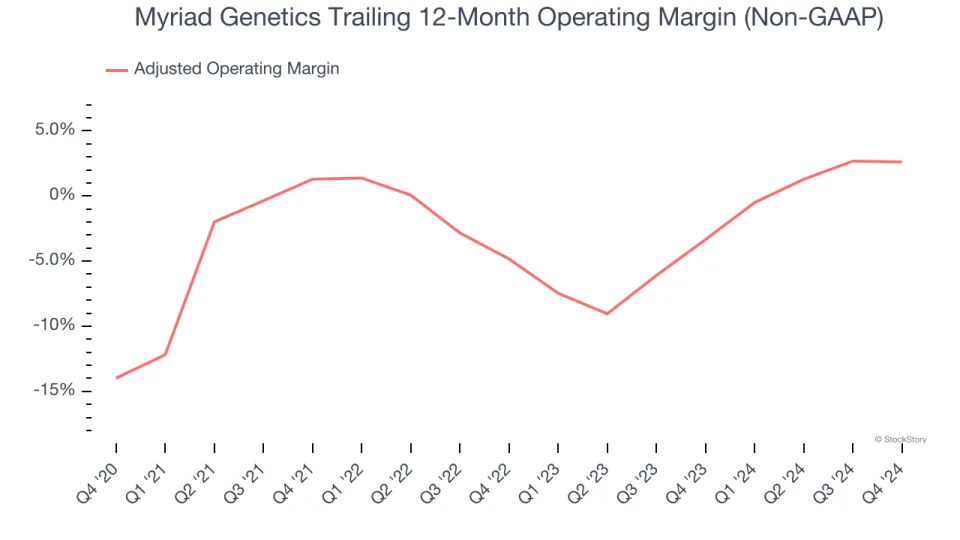

Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Although Myriad Genetics was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average adjusted operating margin of negative 3% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Myriad Genetics’s adjusted operating margin rose by 16.6 percentage points over the last five years. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 7.4 percentage points on a two-year basis.

In Q4, Myriad Genetics generated an adjusted operating profit margin of 2.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

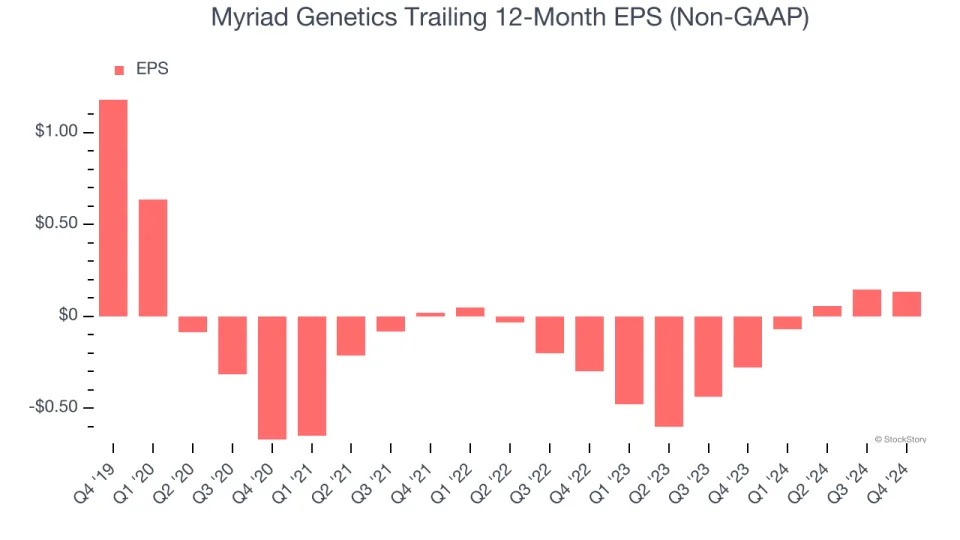

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Myriad Genetics, its EPS declined by 35.3% annually over the last five years while its revenue was flat. However, its adjusted operating margin actually expanded during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

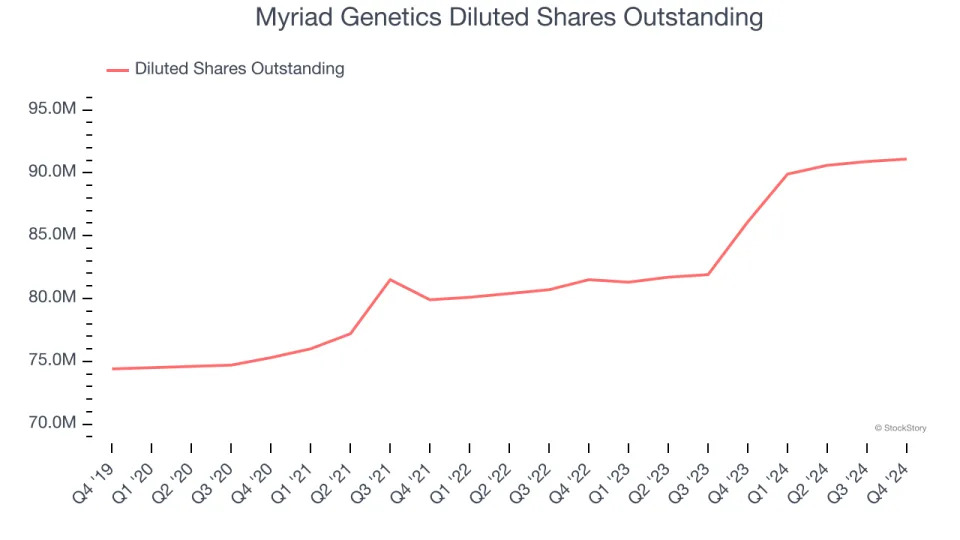

We can take a deeper look into Myriad Genetics’s earnings to better understand the drivers of its performance. A five-year view shows Myriad Genetics has diluted its shareholders, growing its share count by 22.4%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Myriad Genetics reported EPS at $0.03, down from $0.04 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Myriad Genetics to perform poorly. Analysts forecast its full-year EPS of $0.13 will hit $0.05.

Key Takeaways from Myriad Genetics’s Q4 Results

We were impressed by how significantly Myriad Genetics blew past analysts’ EBITDA expectations this quarter. On the other hand, its revenue missed Wall Street's estimates along with its full-year revenue and EBITDA guidance, making this a weaker quarter. The stock traded down 7.4% to $12.72 immediately after reporting.

Big picture, is Myriad Genetics a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .