News

Energy Recovery’s (NASDAQ:ERII) Q4 Earnings Results: Revenue In Line With Expectations

Energy recovery device manufacturer Energy Recovery (NASDAQ:ERII) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 17.3% year on year to $67.08 million. Its non-GAAP profit of $0.50 per share was 24% above analysts’ consensus estimates.

Is now the time to buy Energy Recovery? Find out in our full research report .

Energy Recovery (ERII) Q4 CY2024 Highlights:

Company Overview

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ:ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

Water Infrastructure

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

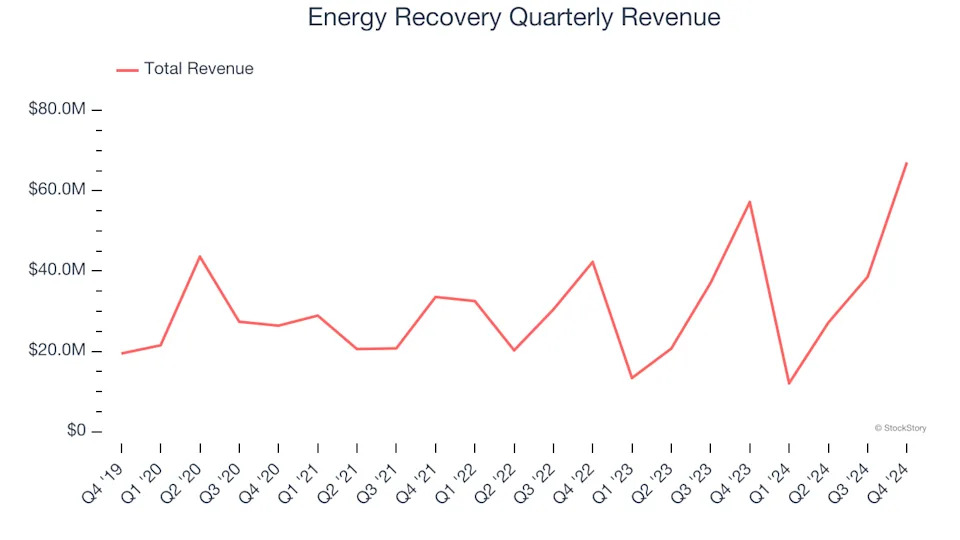

Sales Growth

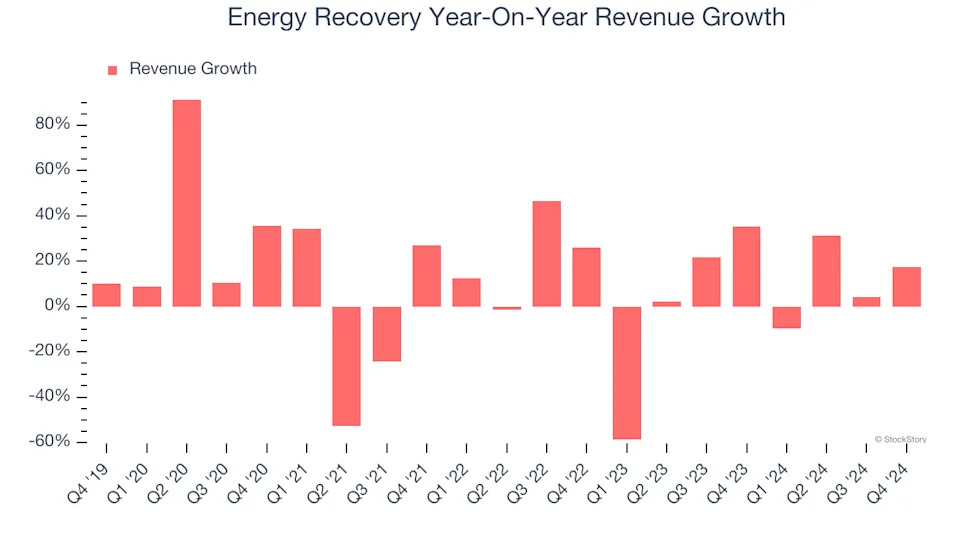

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Energy Recovery’s 10.8% annualized revenue growth over the last five years was impressive. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Energy Recovery’s recent history shows its demand slowed significantly as its annualized revenue growth of 7.4% over the last two years is well below its five-year trend.

This quarter, Energy Recovery’s year-on-year revenue growth was 17.3%, and its $67.08 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.2% over the next 12 months, an improvement versus the last two years. This projection is healthy and implies its newer products and services will catalyze better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

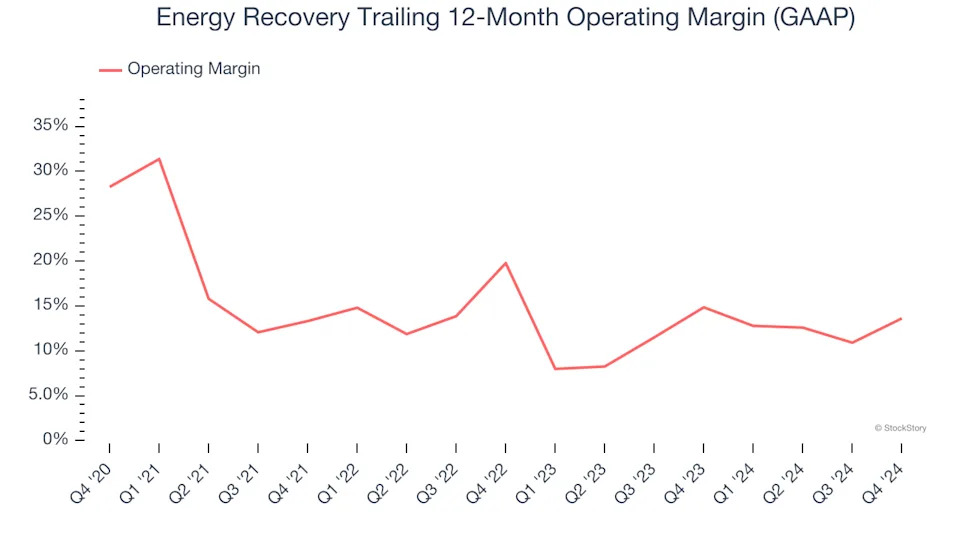

Operating Margin

Energy Recovery has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Energy Recovery’s operating margin decreased by 14.7 percentage points over the last five years. This raises an eyebrow about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Energy Recovery generated an operating profit margin of 38.2%, up 2.1 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

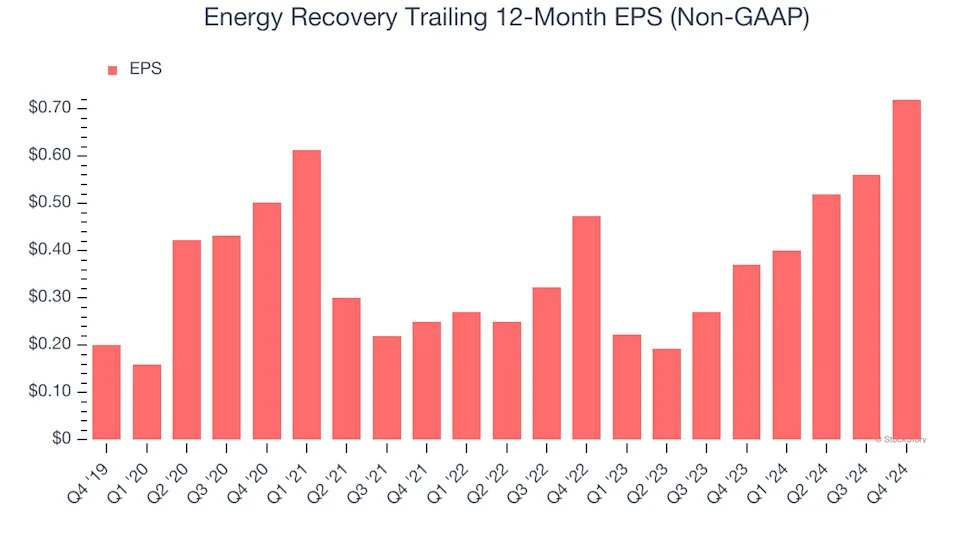

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Energy Recovery’s EPS grew at an astounding 29.2% compounded annual growth rate over the last five years, higher than its 10.8% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Energy Recovery’s two-year annual EPS growth of 23.4% was fantastic and topped its 7.4% two-year revenue growth.

In Q4, Energy Recovery reported EPS at $0.50, up from $0.34 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Energy Recovery’s full-year EPS of $0.72 to shrink by 4.2%.

Key Takeaways from Energy Recovery’s Q4 Results

We were impressed by how significantly Energy Recovery blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid quarter. The stock traded up 1.2% to $14.85 immediately after reporting.

Energy Recovery put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .