News

Astrana Health’s (NASDAQ:ASTH) Q4 Sales Beat Estimates

Healthcare services company Astrana Health announced better-than-expected revenue in Q4 CY2024, with sales up 88.4% year on year to $665.2 million. The company expects the full year’s revenue to be around $2.6 billion, close to analysts’ estimates. Its GAAP loss of $0.15 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Astrana Health? Find out in our full research report .

Astrana Health (ASTH) Q4 CY2024 Highlights:

Company Overview

Founded in 2013, Astrana Health provides care management and coordination services designed to improve health outcomes for complex and chronically ill patients, focusing on personalized healthcare and value-based care delivery.

Healthcare Technology for Providers

The healthcare technology industry focuses on delivering software, data analytics, and workflow solutions to hospitals, clinics, and other care facilities. These companies enable providers to streamline operations, optimize patient outcomes, and transition to value-based care models. They boast subscription-based revenues or long-term contracts, providing financial stability and growth potential. However, they face challenges such as lengthy sales cycles, significant upfront investment in technology development, and reliance on providers’ adoption of new tools, which can be hindered by budget constraints or resistance to change. Over the next few years, the sector is poised for growth as providers increasingly prioritize digital transformation and efficiency in response to rising healthcare costs and patient demand for seamless care. Tailwinds include the growing adoption of AI-driven tools for patient engagement and operational improvements, government incentives for digitization, and the expansion of telehealth and remote patient monitoring. However, headwinds such as tightening hospital budgets, cybersecurity threats, and the fragmented nature of healthcare systems could slow adoption.

Sales Growth

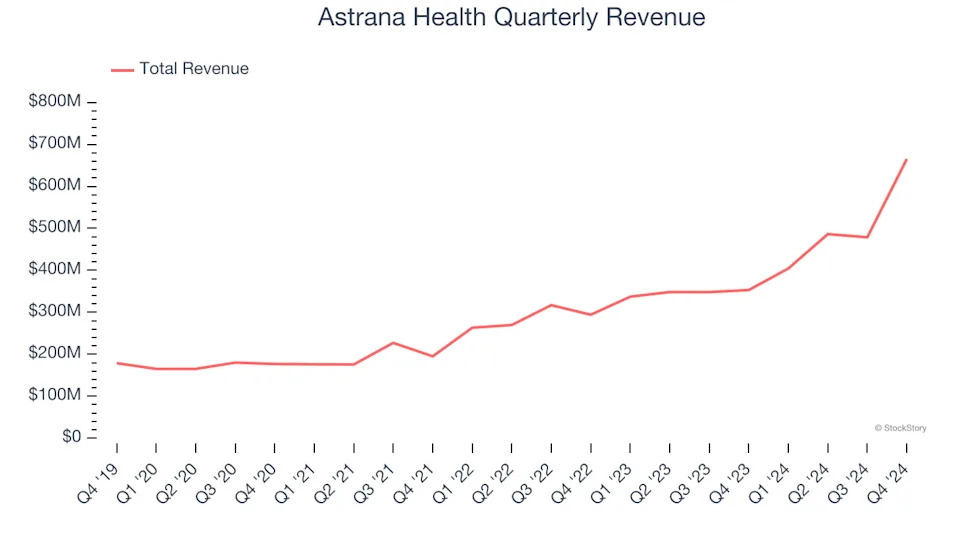

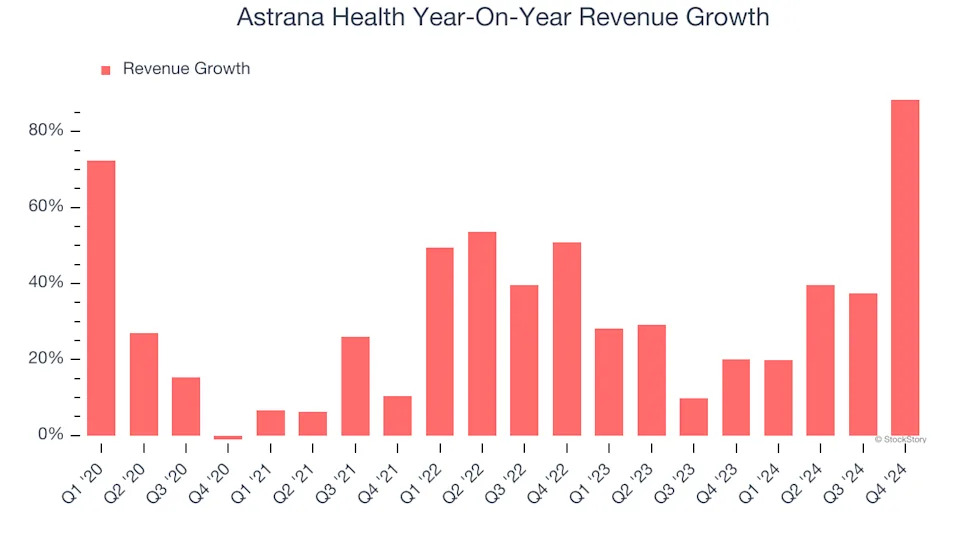

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Thankfully, Astrana Health’s 29.4% annualized revenue growth over the last five years was exceptional. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Astrana Health’s annualized revenue growth of 33.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Astrana Health reported magnificent year-on-year revenue growth of 88.4%, and its $665.2 million of revenue beat Wall Street’s estimates by 6.9%.

Looking ahead, sell-side analysts expect revenue to grow 27% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and implies the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Operating Margin

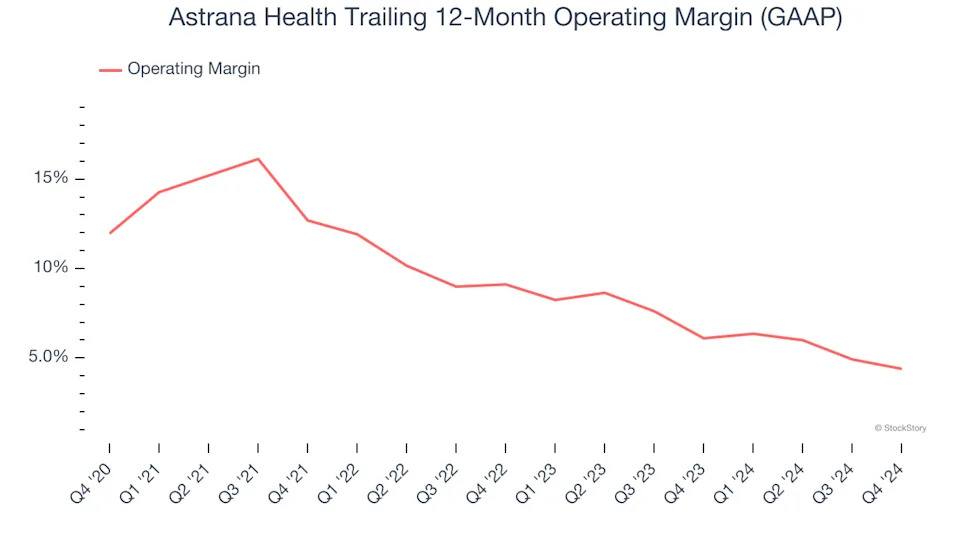

Astrana Health was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.6% was weak for a healthcare business.

Looking at the trend in its profitability, Astrana Health’s operating margin decreased by 7.6 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 4.7 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Astrana Health’s breakeven margin was up 1.2 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

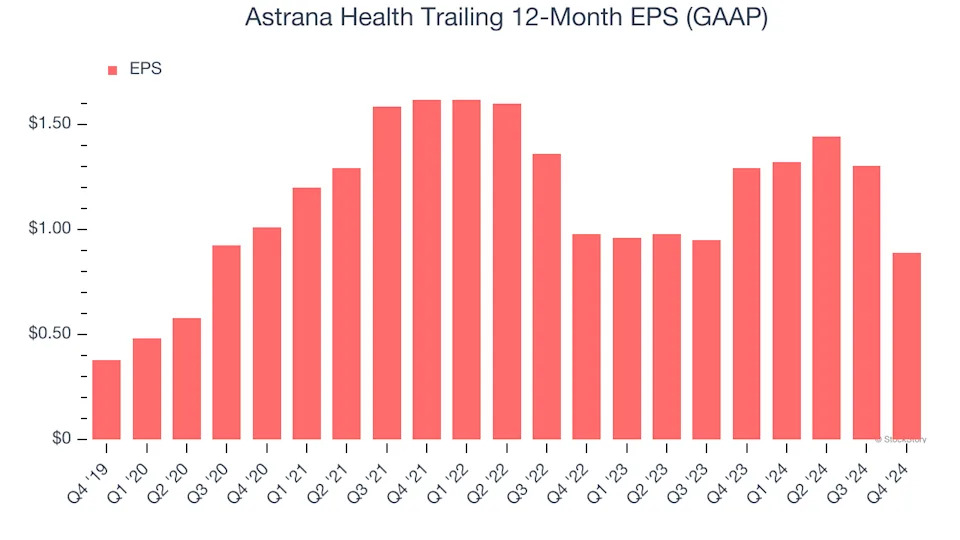

Astrana Health’s EPS grew at an astounding 18.7% compounded annual growth rate over the last five years. However, this performance was lower than its 29.4% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

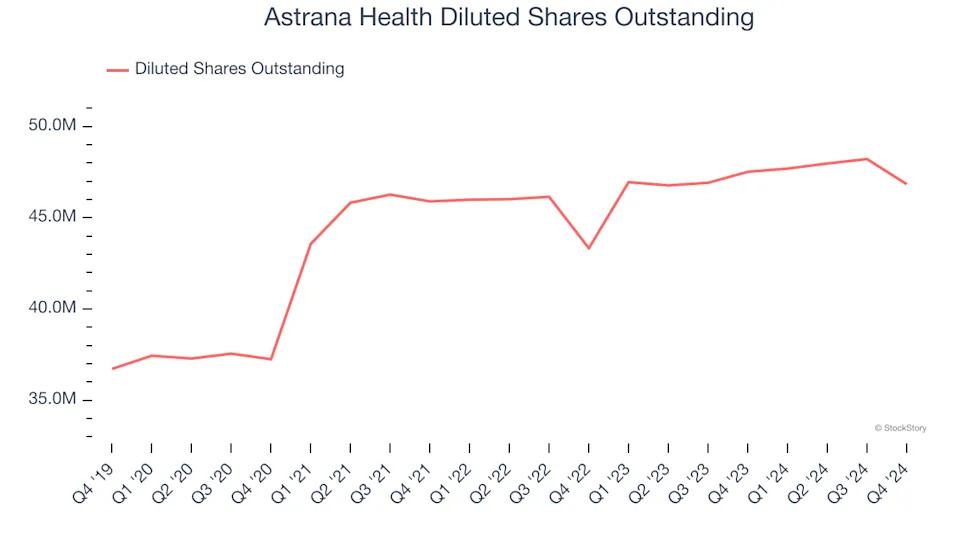

Diving into the nuances of Astrana Health’s earnings can give us a better understanding of its performance. As we mentioned earlier, Astrana Health’s operating margin improved this quarter but declined by 7.6 percentage points over the last five years. Its share count also grew by 27.6%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Astrana Health reported EPS at negative $0.15, down from $0.26 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Astrana Health’s full-year EPS of $0.89 to grow 49.9%.

Key Takeaways from Astrana Health’s Q4 Results

We were impressed by how significantly Astrana Health blew past analysts’ revenue expectations this quarter. On the other hand, its full-year EBITDA guidance missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.5% to $33.84 immediately after reporting.

Astrana Health didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is just one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .