News

WeightWatchers (NASDAQ:WW) Beats Q4 Sales Targets

Personal wellness company WeightWatchers (NASDAQ:WW) reported Q4 CY2024 results exceeding the market’s revenue expectations , but sales fell by 10.5% year on year to $184.4 million. Its non-GAAP profit of $0.32 per share was significantly above analysts’ consensus estimates.

Is now the time to buy WeightWatchers? Find out in our full research report .

WeightWatchers (WW) Q4 CY2024 Highlights:

"We are pleased with the momentum in our Clinical business in the Fourth Quarter, reflecting the increasing demand for comprehensive weight management solutions. As more people seek sustainable approaches—including those using or transitioning off medication—our unique combination of science-backed behavioral support, clinical care, and engaged global community allows us to deliver the right solutions at the right time. I am grateful for the Board’s trust in me to lead WeightWatchers through this next phase, and I look forward to building on our progress, working alongside our incredible team, and driving meaningful impact for our members," said Tara Comonte, President and CEO.

Company Overview

Known by many for its old cable television commercials, WeightWatchers (NASDAQ:WW) is a wellness company offering a range of products and services promoting weight loss and healthy habits.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

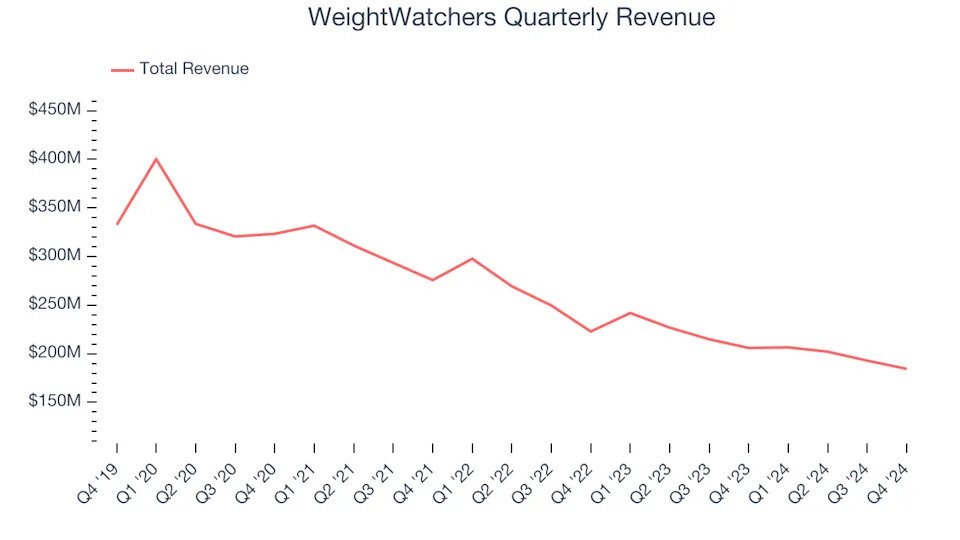

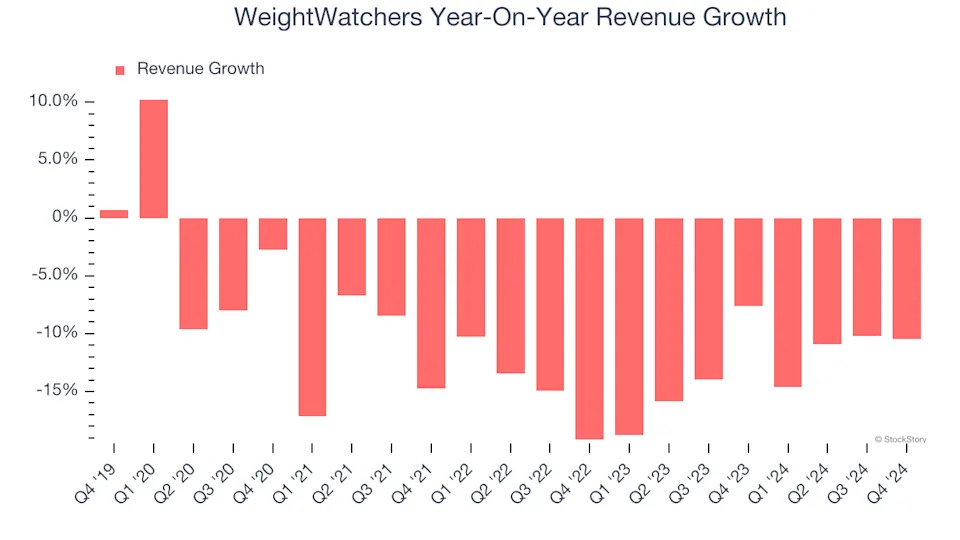

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, WeightWatchers’s demand was weak and its revenue declined by 11.1% per year. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. WeightWatchers’s recent history shows its demand has stayed suppressed as its revenue has declined by 13.1% annually over the last two years.

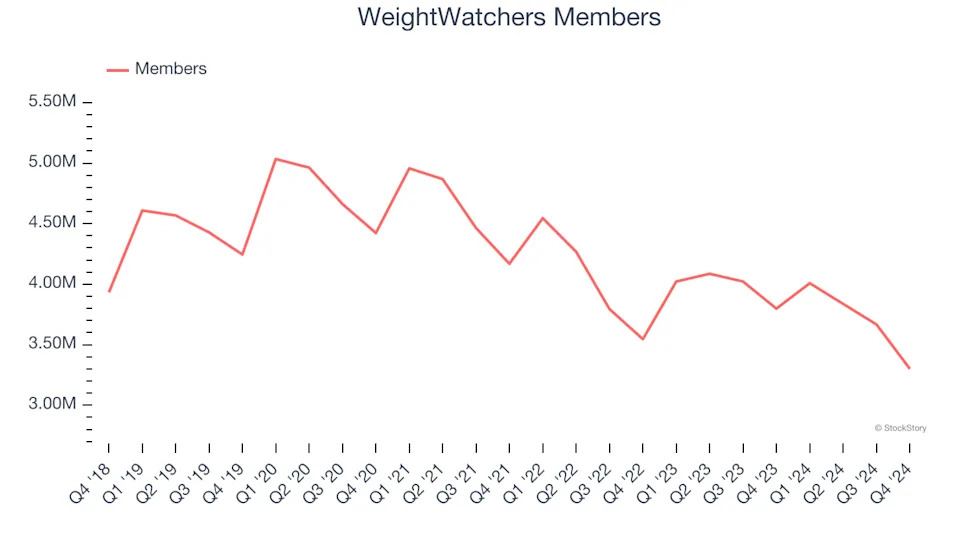

We can better understand the company’s revenue dynamics by analyzing its number of members, which reached 3.3 million in the latest quarter. Over the last two years, WeightWatchers’s members averaged 3.9% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, WeightWatchers’s revenue fell by 10.5% year on year to $184.4 million but beat Wall Street’s estimates by 5%.

Looking ahead, sell-side analysts expect revenue to decline by 8.9% over the next 12 months. Although this projection is better than its two-year trend, it's hard to get excited about a company that is struggling with demand.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Cash Is King

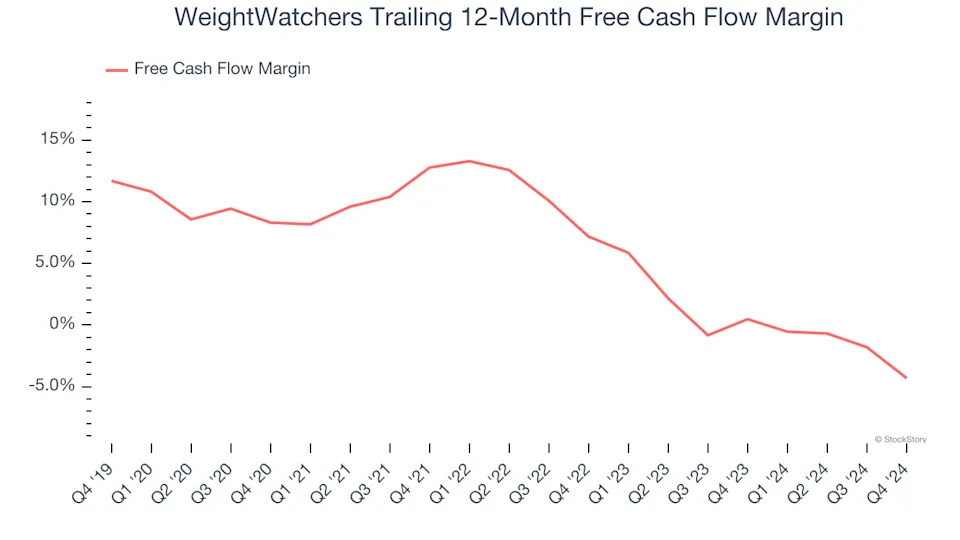

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the last two years, WeightWatchers’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.8%, meaning it lit $1.77 of cash on fire for every $100 in revenue.

WeightWatchers burned through $11.8 million of cash in Q4, equivalent to a negative 6.4% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict WeightWatchers will continue burning cash, albeit to a lesser extent. Their consensus estimates imply its free cash flow margin of negative 4.3% for the last 12 months will increase to negative 1.7%.

Key Takeaways from WeightWatchers’s Q4 Results

We liked that WeightWatchers beat analysts’ revenue and EPS expectations this quarter. The company is not providing 2025 guidance at this time. Overall, this quarter was solid. The stock traded up 4.2% to $0.83 immediately following the results.

Indeed, WeightWatchers had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .