News

RadNet’s (NASDAQ:RDNT) Q4 Sales Top Estimates But Stock Drops

Diagnostic imaging company RadNet (NASDAQ:RDNT) reported Q4 CY2024 results beating Wall Street’s revenue expectations , with sales up 13.5% year on year to $477.1 million. On the other hand, the company’s full-year revenue guidance of $1.94 billion at the midpoint came in 1.2% below analysts’ estimates. Its GAAP profit of $0.07 per share was 40.7% below analysts’ consensus estimates.

Is now the time to buy RadNet? Find out in our full research report .

RadNet (RDNT) Q4 CY2024 Highlights:

Dr. Howard Berger, President and Chief Executive Officer of RadNet, commented, “I am very pleased with our performance in the fourth quarter and for full-year 2024. Relative to last year’s fourth quarter, Revenue increased 13.5% and Adjusted EBITDA(1) increased 14.0%. This performance was driven by strong aggregate procedural volume growth of 8.0% and same center procedural growth of 4.0%. This performance enabled us to meet or exceed guidance levels we set at the beginning of 2024 and revised upward throughout the year.”

Company Overview

Founded in 1981, RadNet (NASDAQ: RDNT) provides outpatient diagnostic imaging services and advanced AI solutions to enhance radiology practices.

Testing & Diagnostics Services

The testing and diagnostics services industry plays a crucial role in disease detection, monitoring, and prevention, serving hospitals, clinics, and individual consumers. This sector benefits from stable demand, driven by an aging population, increased prevalence of chronic diseases, and growing awareness of preventive healthcare. Recurring revenue streams come from routine screenings, lab tests, and diagnostic imaging, with reimbursement from Medicare, Medicaid, private insurance, and out-of-pocket payments. However, the industry faces challenges such as pricing pressures, regulatory compliance, and the need for continuous investment in new testing technologies. Looking ahead, industry tailwinds include the expansion of personalized medicine, increased adoption of at-home and rapid diagnostic tests, and advancements in AI-driven diagnostics that enhance accuracy and efficiency. However, headwinds such as reimbursement uncertainties, competition from decentralized testing solutions, and regulatory scrutiny over test validity and cost-effectiveness may impact profitability. Adapting to evolving healthcare models and integrating automation will be key for sustaining growth and maintaining operational efficiency.

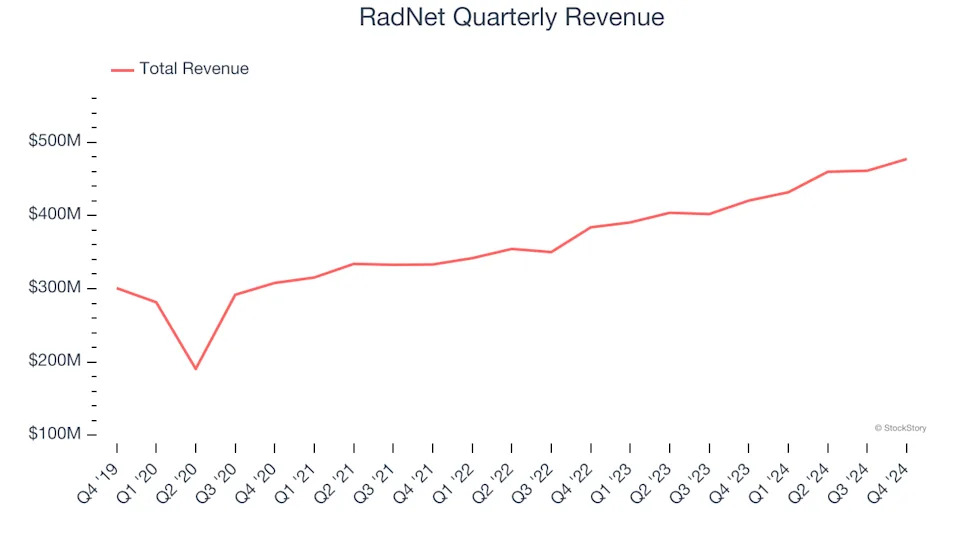

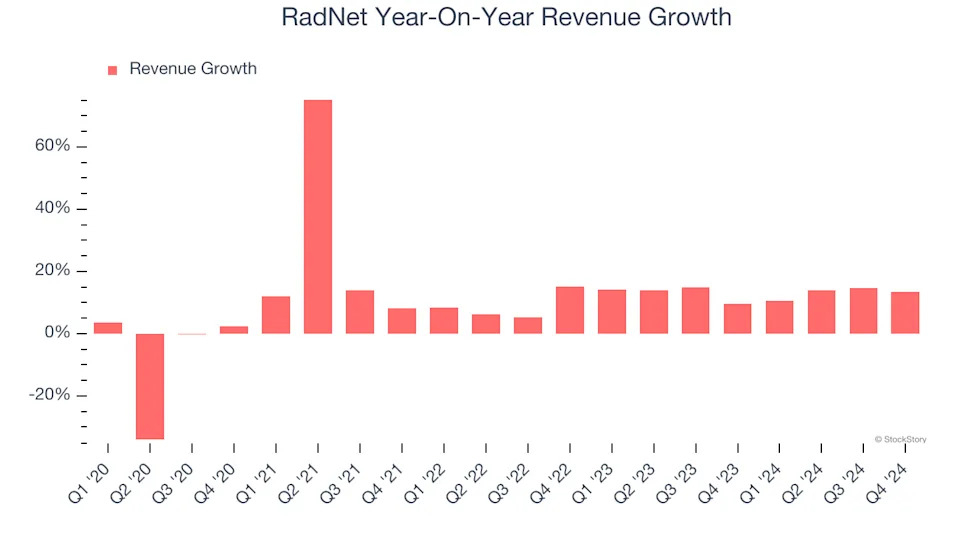

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Luckily, RadNet’s sales grew at a decent 9.7% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. RadNet’s annualized revenue growth of 13.1% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, RadNet reported year-on-year revenue growth of 13.5%, and its $477.1 million of revenue exceeded Wall Street’s estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and indicates the market sees some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

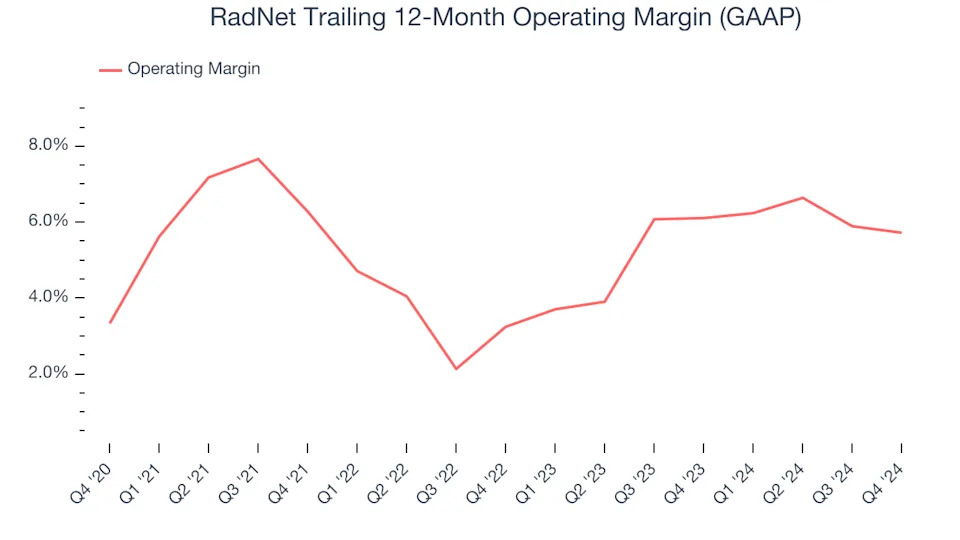

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

RadNet was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.1% was weak for a healthcare business.

On the plus side, RadNet’s operating margin rose by 2.4 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

This quarter, RadNet generated an operating profit margin of 5.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

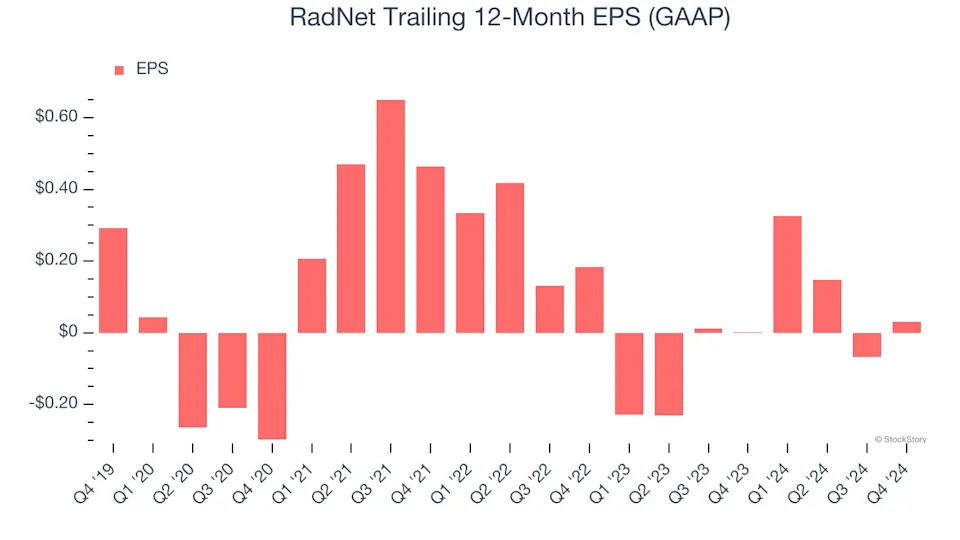

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for RadNet, its EPS declined by 36.6% annually over the last five years while its revenue grew by 9.7%. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

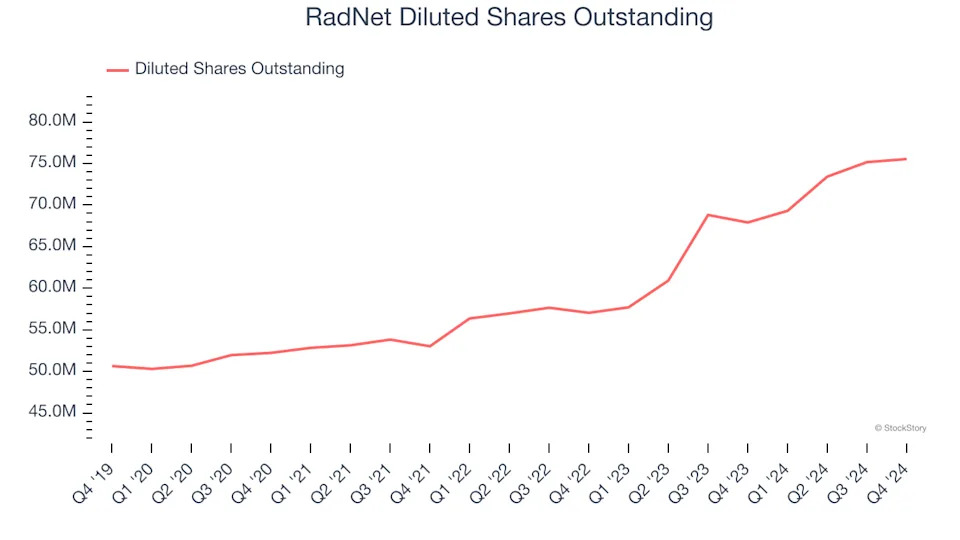

We can take a deeper look into RadNet’s earnings to better understand the drivers of its performance. A five-year view shows RadNet has diluted its shareholders, growing its share count by 49.2%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, RadNet reported EPS at $0.07, up from negative $0.03 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects RadNet to perform poorly. Analysts forecast its full-year EPS of $0.03 will hit $0.45.

Key Takeaways from RadNet’s Q4 Results

We enjoyed seeing RadNet beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed significantly and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 6.3% to $53.94 immediately after reporting.

The latest quarter from RadNet’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .