News

Bitcoin rout amplified by record ETF outflows, traders say — what investors need to know about ‘faster money’

Bitcoin bulls have celebrated the introduction of exchange traded funds investing directly in the crypto, which pushed up institutional participation. But sudden outflows can also accelerate selloffs when the crypto drops, analysts said.

As bitcoin BTCUSD recorded in February its worst monthly performance since June 2022 with a 17.2% decline, bitcoin ETFs also saw their biggest monthly outflow since they debuted, with $3.3 billion pulled out from the funds, according to the Dow Jones Market Data.

The crypto weakness is part of a selloff across risky assets blamed in part on uncertainty around President Trump’s trade policies.

“The broader risk-off environment, coupled with significant outflows from bitcoin-backed ETFs, has intensified selling pressure,” said Naeem Aslam, chief investment officer at Zaye Capital Markets, in a Friday note.

Since a number of major assets managers such as BlackRock BLK and Fidelity launched bitcoin ETFs in January last year, such products have attracted mainstream institutional investors including Michigan and Wisconsin state pension funds, hedge funds such as Millennium Management, and banks such as Barclays and Bank of America.

However, institutions “are faster money,” said John Glover, chief investment officer at crypto lending platform Ledn and a Wall Street veteran. “When they’ve made a profit, or when they’re rebalancing their portfolio on a monthly basis and bitcoins have gone up significantly and the bitcoin holdings may be larger than their allocation targets, they’re going to sell some of the bitcoin at month end or a quarter end,” Glover said.

“Likewise, on the downside, if the bitcoin holding as a percent of their portfolio is lower than target, they’ll buy some bitcoin back,” noted Glover.

Bitcoin, which surged to a record high at $109,225 on Jan. 20 — Donald Trump’s presidential inauguration day, amid expectations that the president would usher a new, friendlier era for crypto regulation, fell briefly below $80,000 on Friday, the lowest level since Nov. 10, 2024.

Read: The ‘bro bubble’ is bursting, says Bank of America strategist.

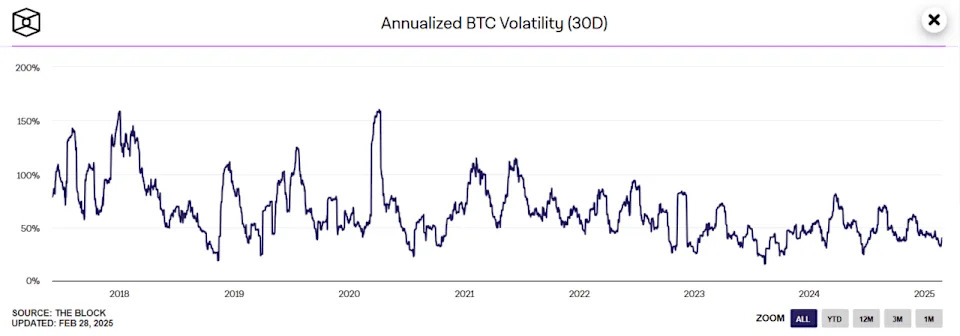

On the bright side, ETFs likely have contributed to an increase in liquidity and a drop in the volatility of bitcoin trading, Glover said.

While bitcoin 30-day annualized bitcoin volatility often topped 100% before 2022, it has mostly sit in the range of 30% to 60% over the past year, according to data from crypto news and data site the Block.

However, bitcoin ETFs might have also brought even more speculators into the market, Glover said.

The introduction of the bitcoin ETFs have lowered the barrier for retail participants to trade the crypto, as it saved investors the trouble of going to crypto exchanges and setting up wallets themselves. Instead, they can now easily trade them via their regular brokerage accounts. It also opened a pathway for many institutions who previously were restricted by rules about investing directly in crypto.

Since the ETFs were introduced, “because a large part of these products are being held in tax-efficient portfolios, people can get in and out very quickly now and not worry about the tax consequences. If they’ve got a profit, they’re going to get out,” Glover said. Investment accounts such as individual retirement accounts or 401(k)s offer tax deferral or tax exemptions on capital gains.

Since the ETFs were launched, bitcoin rose over 70%, offering some investors incentives to lock in profits.

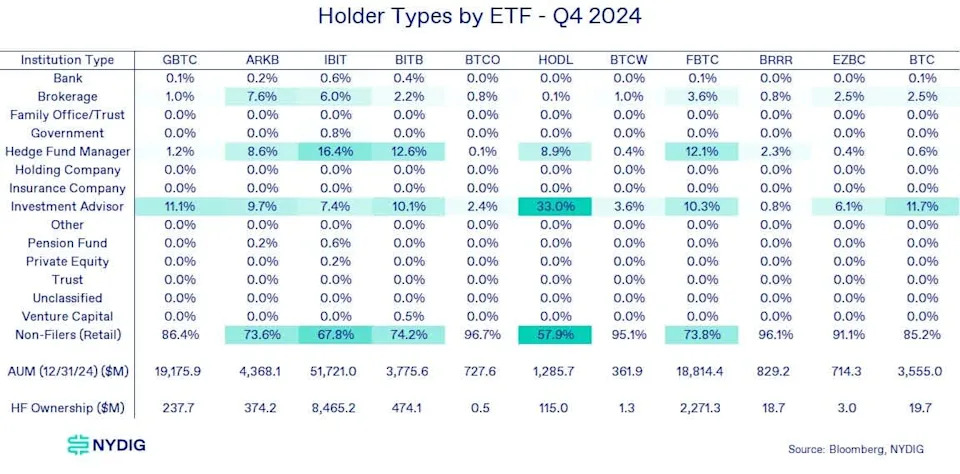

It’s hard to trace who exactly has been selling the bitcoin ETFs. However, the 13F quarterly securities holder filings can shed some light on the holders of bitcoin ETFs as of Dec. 31 last year, the latest data available. Institutional investment managers with at least $100 million in assets are required to file a quarterly Form 13F with the Securities and Exchange Commission, which shows their holdings as of the end of a calendar quarter.

Who owns the bitcoin ETFs

Retail investors were the largest owners of bitcoin ETFs, accounting for $77.9 billion, or 74% of the asset under management by such products as of Dec. 31, 2024, according to Greg Cipolaro, global head of research at NYDIG. Retail investors do not report their holdings.

Hedge funds were the second largest owner group in bitcoin ETFs, while the third largest investors were investment advisors, wrote Cipolaro, who ran an analysis of the 13F filings for the fourth quarter last year and data on ETF assets under management

The recent selling may partially result from some hedge funds unwinding their basis trades that invovled bitcoin ETFs and bitcoin futures, noted Shubh Varma, co-founder and chief executive at crypto derivatives analytics firm Hyblock Capital.

The so-called basis trade, sometimes known as the cash-and-carry trade, is a market-neutral strategy aimed at exploiting the price discrepancy between an asset and its corresponding derivatives. In the case of bitcoin, traders buy bitcoin, or bitcoin ETFs, and short bitcoin futures as they wait for the cash and futures prices to converge. They hold the bitcoin or bitcoin ETFs through the futures delivery date and use it to cover their short obligations.

Some hedge funds may be unwinding their basis trades as they don’t want to take any additional risk as volatility rose recently, with their goal being purely securing the basis yield, Varma said in an interview.

“They may be completely fine making 5% in a year or 7% in a year on this trade. So when there’s volatility, they usually want to just sit out,” Varma said.

“Either they’re selling because of some threshold or standards or limitations they have, or they’re selling because they feel like this trade is no longer secure anymore,” noted Varma.

However, Eric Rose, head of digital asset execution at StoneX Group, said if done on an orderly basis, the unwinding of basis trade does not necessarily lead to price decline.

The hedge funds may be “selling their ETF position that they have, but they’re going to be correspondingly buying back the futures. So that unwind doesn’t have a directional impact on bitcoin price,” Rose said in a phone interview.

Bitcoin’s decline may be partially driven by the selling of long-term holders, Rose added.

Based on blockchain data, the total amount of circulating bitcoin supply that is held by long term holders, or addresses that have held the bitcoin for 155 days or longer, have declined over 1,420,000 from around 15,790,000 on Nov. 5, when Trump won the presidential election, to around 14,370,000 on Friday, according to data from the bitcoin magazine.