News

Is a noticeable market shift around the corner?

The freight market has been all over the place for small carriers, and right now, there’s a feeling that something’s about to give. The big question is whether this shift is going to work in your favor or just keep the squeeze on spot market rates a little longer.

Truckload demand (the need for your services as a small carrier) is still 16% lower than it was last September, but we’re also seeing some carriers tap out . That means fewer trucks on the road but not enough freight demand to make shippers and brokers start bidding up rates. At least, not yet.

If you’re running off the load board, you have to be locked in on two things:

The carriers winning right now aren’t just “grinding it out.” They’re making deliberate, data-backed decisions on where they run and what they haul.

Key Market Indicators – What’s Happening Right Now?

More carriers are moving away from the spot market and locking in contract freight because the rates are holding up better. If you’re still running off the load board, you’ve probably noticed that brokers aren’t moving on rates, and negotiating a decent payout is getting tougher by the day.

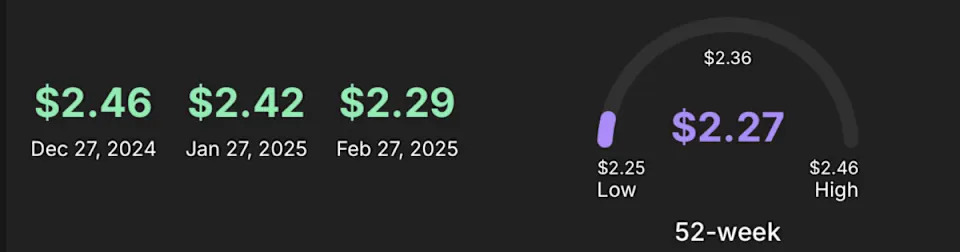

The numbers back it up. The national spot rate has dropped from $2.42 last month to $2.29 today , a 5.4% decline in just four weeks . That’s happening even as some smaller carriers exit the market. But don’t expect this to force rates up yet – there are still enough trucks out there to cover demand, so shippers aren’t feeling the heat to pay more.

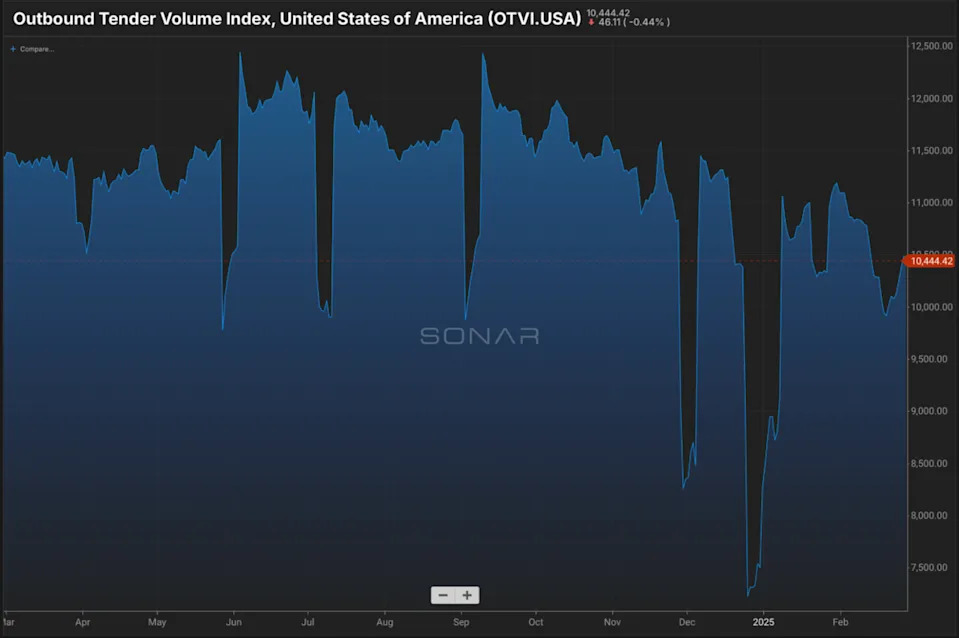

Freight Volume Is Up, but Don’t Expect More Money

On paper, freight volumes are rising, but here’s the catch – contract carriers aren’t rejecting loads like they used to. Instead, they’re taking whatever is available just to keep rolling. That means higher load volume isn’t translating to better rates .

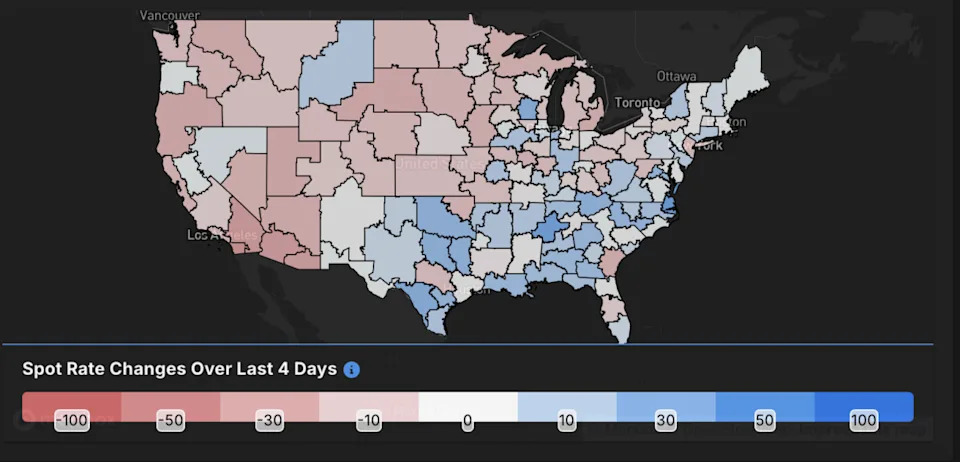

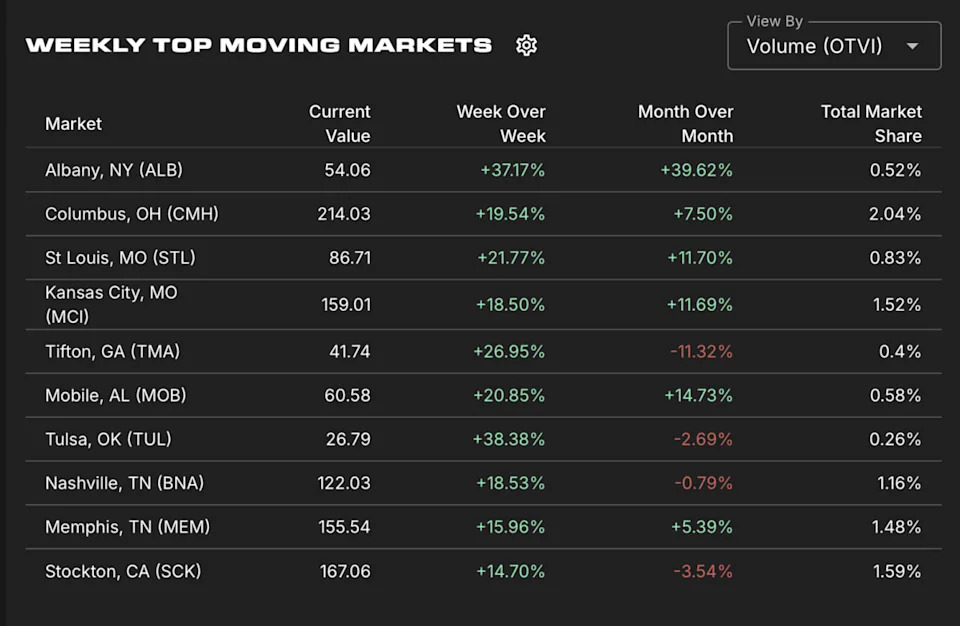

Here’s where the best outbound demand growth is happening:

If you’re looking for better load board opportunities, these are the markets to watch. But if you’re running into these cities, be smart – have a reload lined up before you roll in .

Meanwhile, Stockton, Tifton and Nashville, Tennessee, are slowing down. If you’re running into those markets, expect fewer options and weaker rates.

What’s the Bigger Picture?

The big question: Is this the start of a rate rebound, or will brokers and shippers keep control of the market?

If you’re still running the spot market, you can’t afford to just hope rates will bounce back. You have to play this market smart.

Major Regulatory Change – CVSA 2025 Out-of-Service Criteria Updates

Before we even see a real rate shift, another big deadline is on the horizon that could put some trucks out of service.

Starting April 1, the CVSA’s new Out-of-Service (OOS) criteria go into effect, bringing stricter rules on brakes, tires, suspension and driver qualifications ( FreightWaves ).

Brake systems:

If your electrical cable or service gladhand is unplugged,

that’s an automatic violation

. (Example, hotshotters with breakaway cables unattached.)

Tires:

Sidewall leaks?

That’s an immediate OOS violation.

Suspension:

Cracked U-bolt bottom plates?

You’re sidelined until it’s fixed.

Driver restrictions: Failed a drug test? You can’t even be in the truck if the driver has a commercial learner’s permit (CLP).

What Small Carriers Need to Do Right Now

If the market is changing, standing still isn’t an option. The carriers that make the right moves first will be the ones keeping their profits intact. Here’s what you need to act on right now.

1. Be Smart About Where You Run

2. Get Ahead of CVSA Enforcement Before April 1

3. Stop Letting Costs Eat Into Your Margins

This isn’t the time to hope the market turns in your favor. Make the right moves now, or you’ll be playing catch-up later.

Subscribe to The Playbook newsletter here.

The post Is a noticeable market shift around the corner? appeared first on FreightWaves .