News

Happening Now: Market Extremes, Crypto Reserve, Tesla Top Pick

Market Extremes and March Bottoms

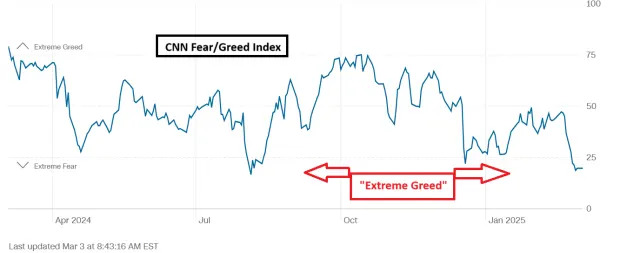

After the Nasdaq fell more than 5% in the span of just six sessions, various market indicators are exhibiting extremes, suggesting that a bounce is imminent. For instance, the AAII Investor Sentiment Survey shows bears outweigh bulls ~60% to 20%. Not only is it rare that bears outweigh bulls, but it is very rare that they outweigh them by this magnitude. Meanwhile, the “CNN Fear & Greed Index” is at its most fearful level since last summer. “Extreme Fear” readings have coincided with significant market bottoms over the past few years.

In addition to the extreme sentiment indicators, bulls can find solace in the fact that several bull market lows have occurred in the month of March in recent years.

Trump Announces Crypto Reserve

Over the weekend, President Donald Trump announced a crypto strategic reserve, sending prices soaring. In a “Truth Social” post, Trump named Bitcoin, Ethereum, XRP, Solana, and Cardano as the cryptocurrencies that would be added to the reserve. Investors will get more details when Trump hosts the first-ever White House crypto summit on Thursday, March 7 th . Crypto-related stocks such as Coinbase ( COIN ), MicroStrategy ( MSTR ), and the iShares Bitcoin ETF ( IBIT ) were very strong in early trading Monday.

Tesla “Top Pick” Status Reinstated at Morgan Stanley

Thus far, 2025 has not been kind to Tesla ( TSLA ) investors.The Zacks Rank #3 (Hold) stock has plunged more than 20% to start the year, is the worst-performing stock in the S&P 500 Index, and is the worst-performing “Magnificent 7” stock. However, the tide may finally be ready to turn for the bulls. Tesla shares are retesting the confluence zone, which intersects at the election day gap-up level, a previous breakout level, and the rising 200-day moving average.

This morning, Morgan Stanley’s ( MS ) Adam Jones, one of the top analysts who track Tesla, reiterated his bullish stance on the leading EV-maker, saying:

“As AI moves from the digital world (bits and bytes) to the physical world (atoms and photons), we expect to see TSLA’s TAM aperture further expand to broader domains, many of which are still not included in buy-side or sell-side financial models for the company.”

While the journey may be volatile and non-linear, we believe 2025 will be a year where investors will continue to appreciate and value these existing and nascent industries of embodied AI, where we believe Tesla has established a material competitive advantage.”

Like Jones, I believe bears are putting to much emphasis on the lagging legacy EV auto business, while failing to account for the company’s gigantic lead in real-world AI and other emerging businesses. Meanwhile, Tesla CEO Elon Musk tweeted about future Tesla EPS growth reaching 1,000% in 5 years, saying:

“It will require outstanding execution, but I think more like 1,000% gain for Tesla in 5 years is possible.”

Read here why Tesla is exhibiting parallels to its 2020 multi-bag move.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Morgan Stanley (MS) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research