News

Ross Stores (NASDAQ:ROST) Reports Q4 In Line With Expectations But Quarterly Revenue Guidance Significantly Misses Expectations

Off-price retail company Ross Stores (NASDAQ:ROST) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 1.8% year on year to $5.91 billion. On the other hand, next quarter’s revenue guidance of $4.79 billion was less impressive, coming in 6.9% below analysts’ estimates. Its GAAP profit of $1.79 per share was 7.9% above analysts’ consensus estimates.

Is now the time to buy Ross Stores? Find out in our full research report .

Ross Stores (ROST) Q4 CY2024 Highlights:

Company Overview

Selling excess inventory or overstocked items from other retailers, Ross Stores (NASDAQ:ROST) is an off-price concept that sells apparel and other goods at prices much lower than department stores.

Discount Retailer

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $21.13 billion in revenue over the past 12 months, Ross Stores is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there is only so much real estate to build new stores, placing a ceiling on its growth. To accelerate sales, Ross Stores likely needs to lean into pricing or international expansion.

As you can see below, Ross Stores grew its sales at a tepid 5.7% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Ross Stores reported a rather uninspiring 1.8% year-on-year revenue decline to $5.91 billion of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 1.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, similar to its five-year rate. This projection is particularly noteworthy for a company of its scale and implies the market is baking in success for its products.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Store Performance

Number of Stores

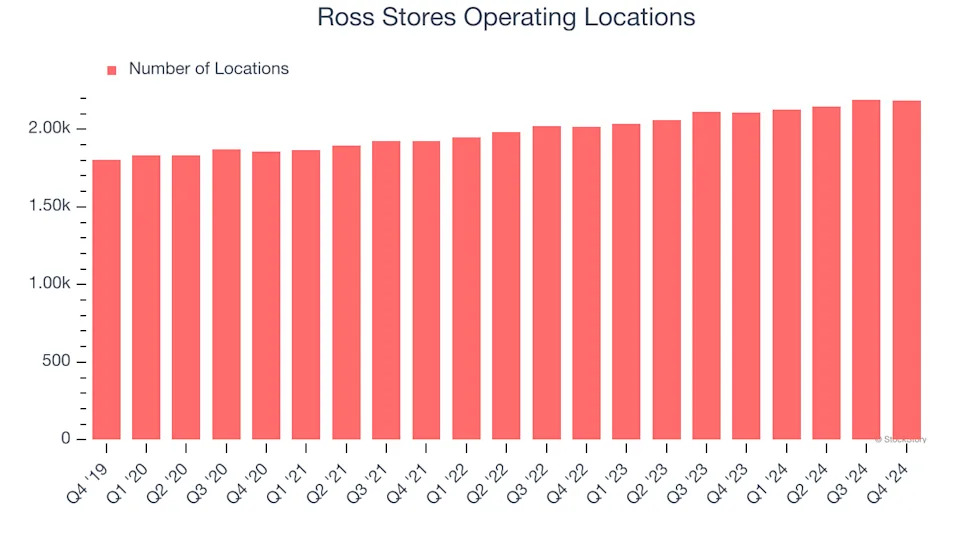

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Ross Stores sported 2,186 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 4.2% annual growth, among the fastest in the consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

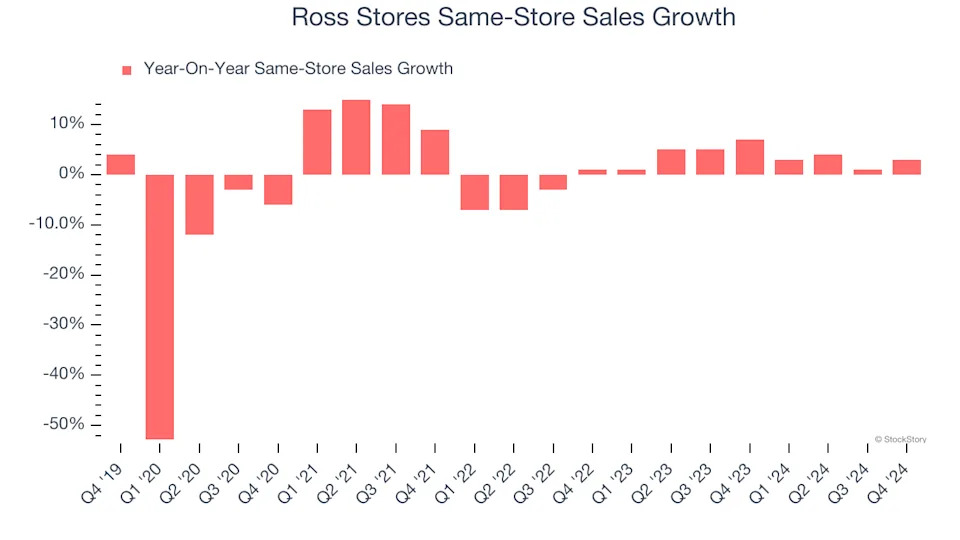

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Ross Stores’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.6% per year. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Ross Stores multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Ross Stores’s same-store sales rose 3% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Ross Stores’s Q4 Results

It was encouraging to see Ross Stores beat analysts’ EPS expectations this quarter. On the other hand, its full-year revenue and EPS guidance missed significantly. Overall, this was a weaker quarter. The stock traded down 1.2% to $134.48 immediately following the results.

Ross Stores may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .