News

3 Reasons to Avoid MTRX and 1 Stock to Buy Instead

Matrix Service’s 25.9% return over the past six months has outpaced the S&P 500 by 20.3%, and its stock price has climbed to $11.86 per share. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Matrix Service, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

Despite the momentum, we don't have much confidence in Matrix Service. Here are three reasons why there are better opportunities than MTRX and a stock we'd rather own.

Why Do We Think Matrix Service Will Underperform?

Founded in Oklahoma, Matrix Service (NASDAQ:MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

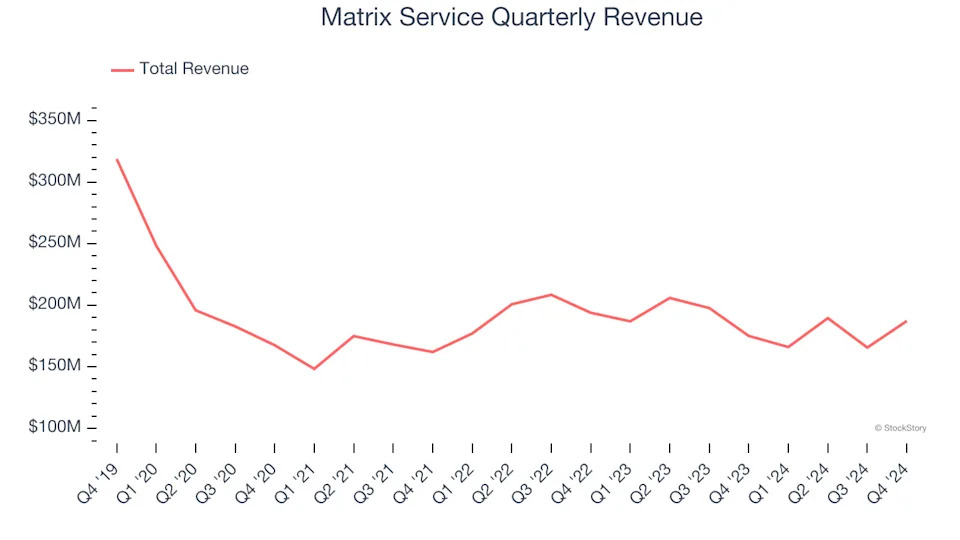

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Matrix Service’s demand was weak and its revenue declined by 12.9% per year. This was below our standards and is a sign of poor business quality.

2. Low Gross Margin Reveals Weak Structural Profitability

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Matrix Service has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 4.4% gross margin over the last five years. Said differently, Matrix Service had to pay a chunky $95.64 to its suppliers for every $100 in revenue.

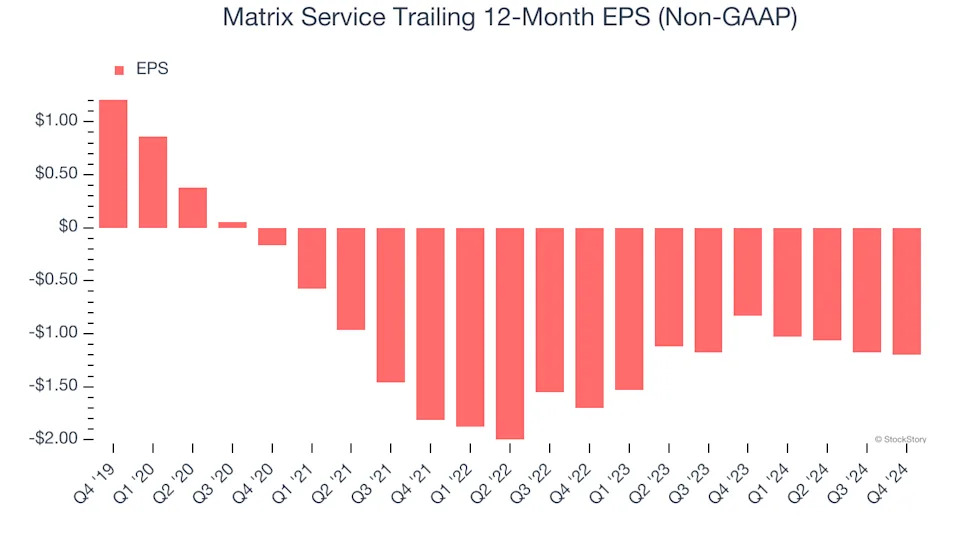

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Matrix Service, its EPS declined by more than its revenue over the last five years, dropping 24.5% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Matrix Service doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 17.3× forward price-to-earnings (or $11.86 per share). This valuation tells us a lot of optimism is priced in - we think there are better investment opportunities out there. We’d suggest looking at our favorite semiconductor picks and shovels play .

Stocks We Would Buy Instead of Matrix Service

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free .