News

Zscaler’s (NASDAQ:ZS) Q4 Sales Beat Estimates, Stock Soars

Cloud security platform Zscaler (NASDAQ:ZS) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 23.4% year on year to $647.9 million. The company expects next quarter’s revenue to be around $666 million, close to analysts’ estimates. Its non-GAAP profit of $0.78 per share was 12.7% above analysts’ consensus estimates.

Is now the time to buy Zscaler? Find out in our full research report .

Zscaler (ZS) Q4 CY2024 Highlights:

“Growing adoption of Zero Trust and AI is driving strong demand for our platform, resulting in yet another strong quarter that exceeded our guidance on both top and bottom line. We are leading the industry towards Zero Trust Everywhere by transforming security from legacy appliance-based to a Zero Trust architecture,” said Jay Chaudhry, Chairman and CEO of Zscaler.

Company Overview

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ:ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Network Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments is increasing demand modern cloud-based network security software, which offers better performance at lower cost than maintaining the traditional on-premise solutions, such as expensive specialized firewall hardware.

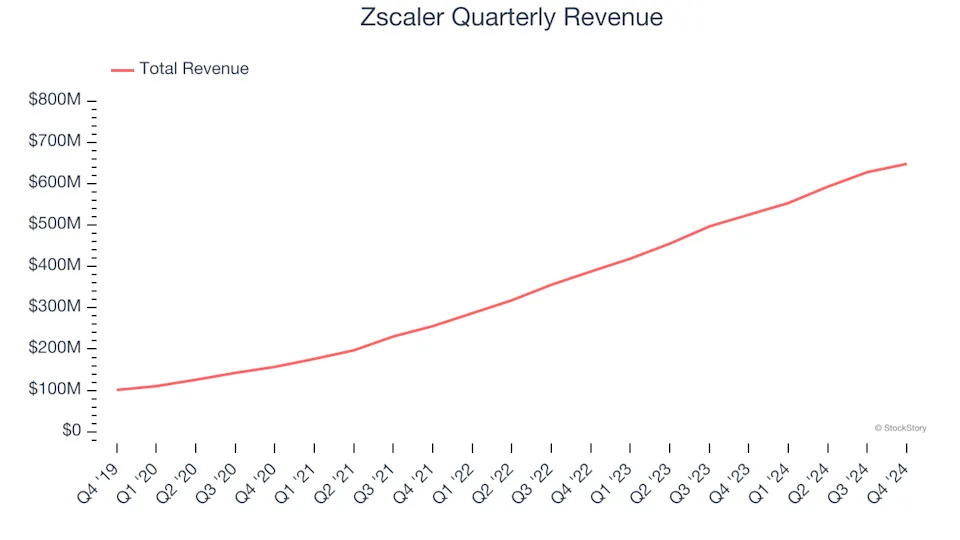

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Zscaler’s sales grew at an incredible 41.2% compounded annual growth rate over the last three years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Zscaler reported robust year-on-year revenue growth of 23.4%, and its $647.9 million of revenue topped Wall Street estimates by 2.1%. Company management is currently guiding for a 20.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.3% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is admirable and indicates the market sees success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

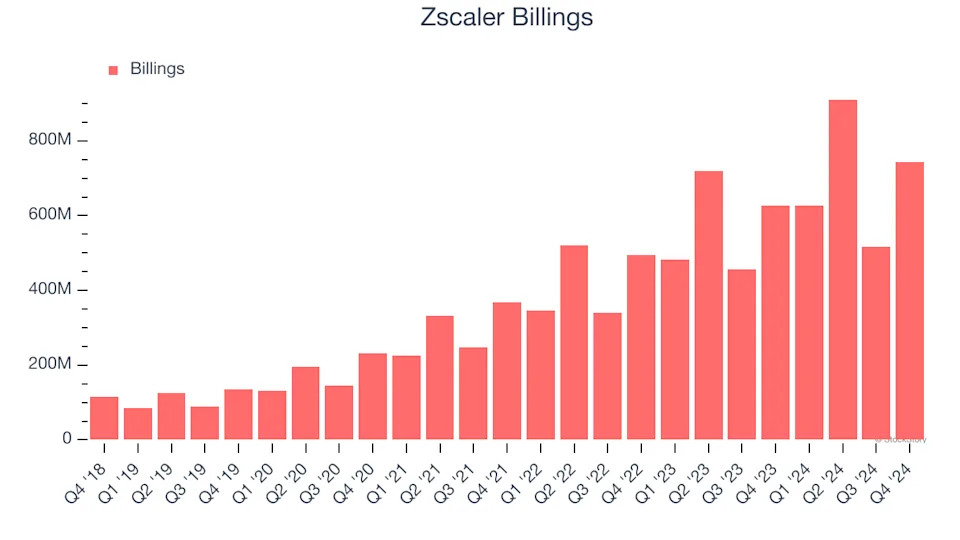

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Zscaler’s billings punched in at $742.7 million in Q4, and over the last four quarters, its growth was impressive as it averaged 22.1% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

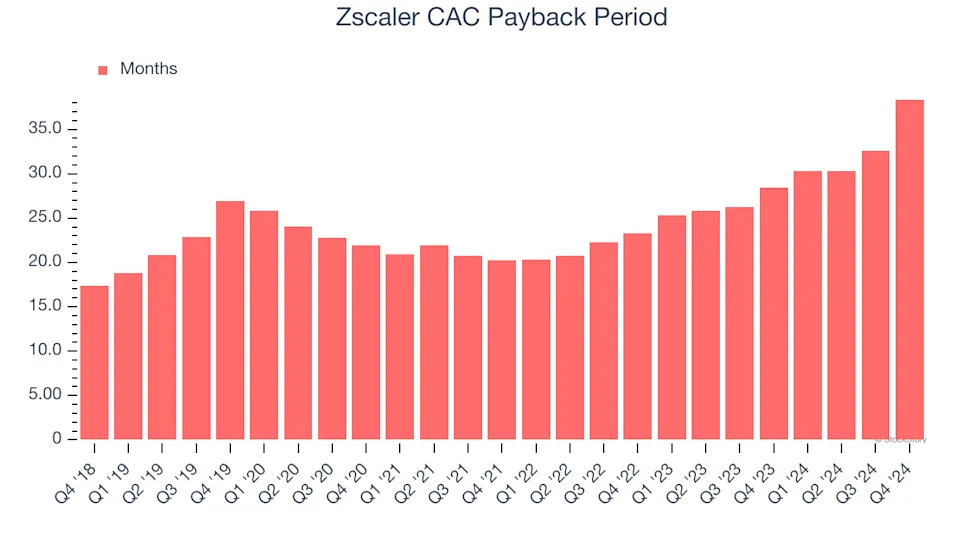

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Zscaler is efficient at acquiring new customers, and its CAC payback period checked in at 38.4 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

Key Takeaways from Zscaler’s Q4 Results

This was a beat and raise quarter. We enjoyed seeing Zscaler beat analysts’ billings expectations this quarter. We were also happy its revenue and operating profit outperformed Wall Street’s estimates. Looking ahead, the company raised full-year revenue and operating profit guidance, both of which are above Consensus expectations. Overall, this quarter was very solid with very little to pick on. The stock traded up 6.2% to $208.90 immediately following the results.

Zscaler put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .