News

Hewlett Packard Enterprise (NYSE:HPE) Posts Better-Than-Expected Sales In Q4 But Stock Drops 14.6%

Enterprise technology company Hewlett Packard Enterprise (NYSE:HPE) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 16.3% year on year to $7.85 billion. On the other hand, next quarter’s revenue guidance of $7.4 billion was less impressive, coming in 6.4% below analysts’ estimates. Its non-GAAP profit of $0.49 per share was in line with analysts’ consensus estimates.

Is now the time to buy Hewlett Packard Enterprise? Find out in our full research report .

Hewlett Packard Enterprise (HPE) Q4 CY2024 Highlights:

Company Overview

Born from the 2015 split of the iconic Silicon Valley pioneer Hewlett-Packard, Hewlett Packard Enterprise (NYSE:HPE) provides edge-to-cloud technology solutions that help businesses capture, analyze, and act upon their data across hybrid environments.

Hardware & Infrastructure

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $31.23 billion in revenue over the past 12 months, Hewlett Packard Enterprise is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. For Hewlett Packard Enterprise to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

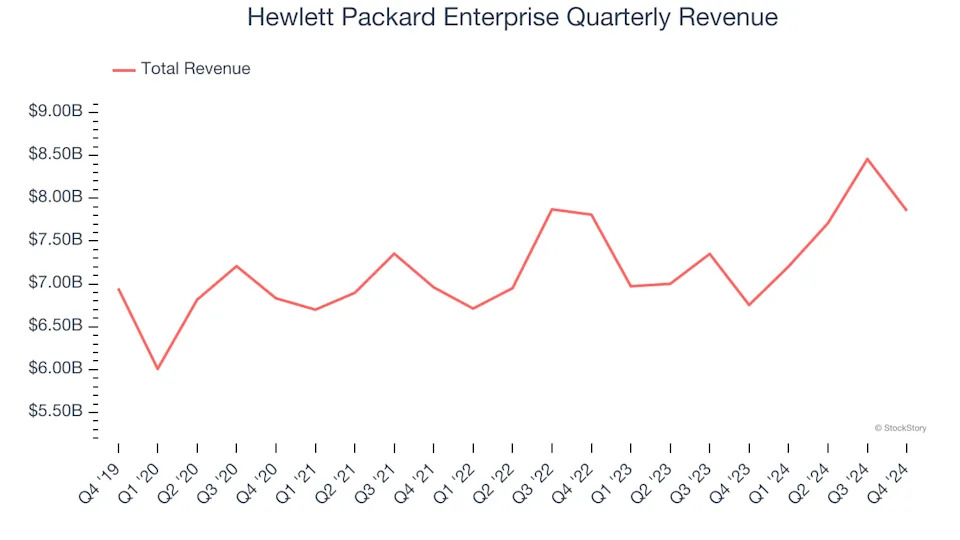

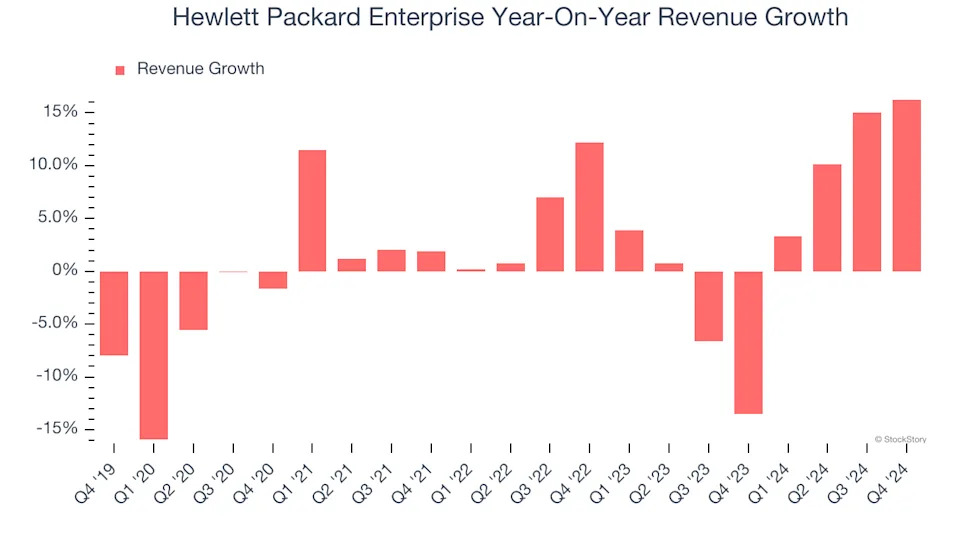

As you can see below, Hewlett Packard Enterprise’s sales grew at a sluggish 1.8% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Hewlett Packard Enterprise’s annualized revenue growth of 3.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Hewlett Packard Enterprise reported year-on-year revenue growth of 16.3%, and its $7.85 billion of revenue exceeded Wall Street’s estimates by 0.5%. Company management is currently guiding for a 2.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Operating Margin

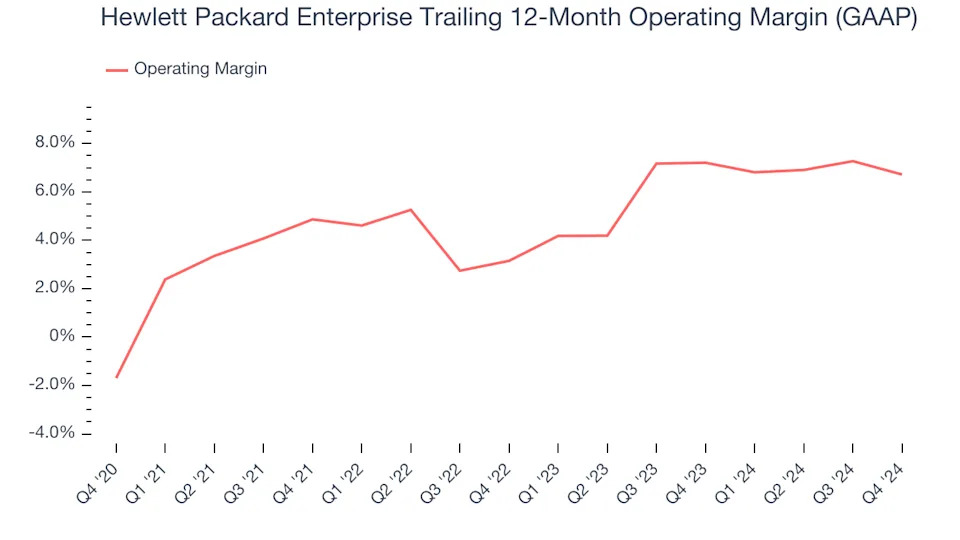

Hewlett Packard Enterprise was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.1% was weak for a business services business.

On the plus side, Hewlett Packard Enterprise’s operating margin rose by 8.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Hewlett Packard Enterprise generated an operating profit margin of 5.5%, down 2.3 percentage points year on year. This contraction shows it was recently less efficient because its expenses grew faster than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

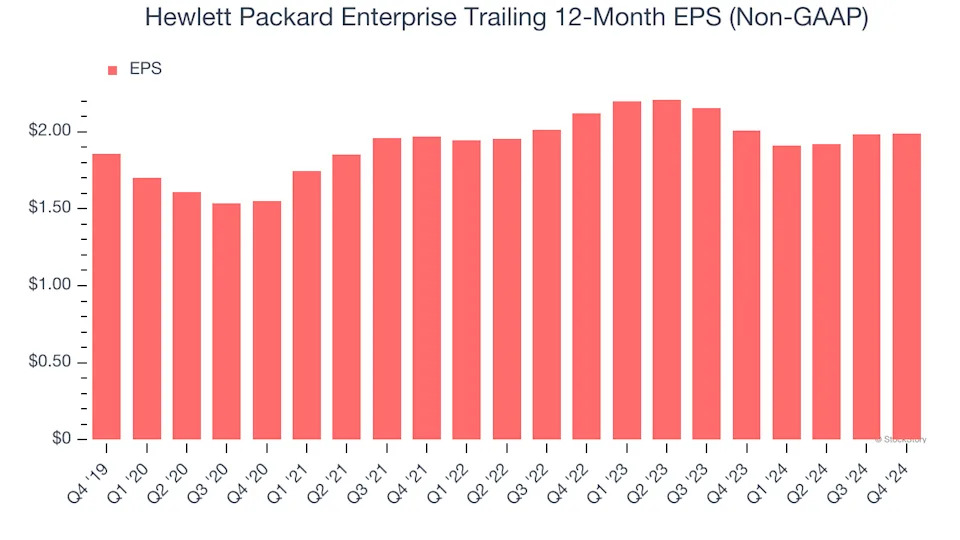

Hewlett Packard Enterprise’s weak 1.4% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

In Q4, Hewlett Packard Enterprise reported EPS at $0.49, in line with the same quarter last year. This print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects Hewlett Packard Enterprise’s full-year EPS of $1.99 to grow 8.3%.

Key Takeaways from Hewlett Packard Enterprise’s Q4 Results

It was good to see Hewlett Packard Enterprise narrowly top analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed significantly and its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 14.6% to $15.32 immediately following the results.

Hewlett Packard Enterprise’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .