News

Clarus’s (NASDAQ:CLAR) Q4: Beats On Revenue But Full-Year Sales Guidance Misses Expectations Significantly

Outdoor lifestyle and equipment company Clarus (NASDAQ:CLAR) beat Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 6.7% year on year to $71.41 million. On the other hand, the company’s full-year revenue guidance of $255 million at the midpoint came in 10.8% below analysts’ estimates. Its non-GAAP loss of $0.08 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Clarus? Find out in our full research report .

Clarus (CLAR) Q4 CY2024 Highlights:

Management Commentary“During 2024 we remained focused on executing against our strategic roadmap and positioning Clarus for profitable growth over the long term,” said Warren Kanders, Clarus’ Executive Chairman.

Company Overview

Initially a financial services business, Clarus (NASDAQ:CLAR) designs, manufactures, and distributes outdoor equipment and lifestyle products.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

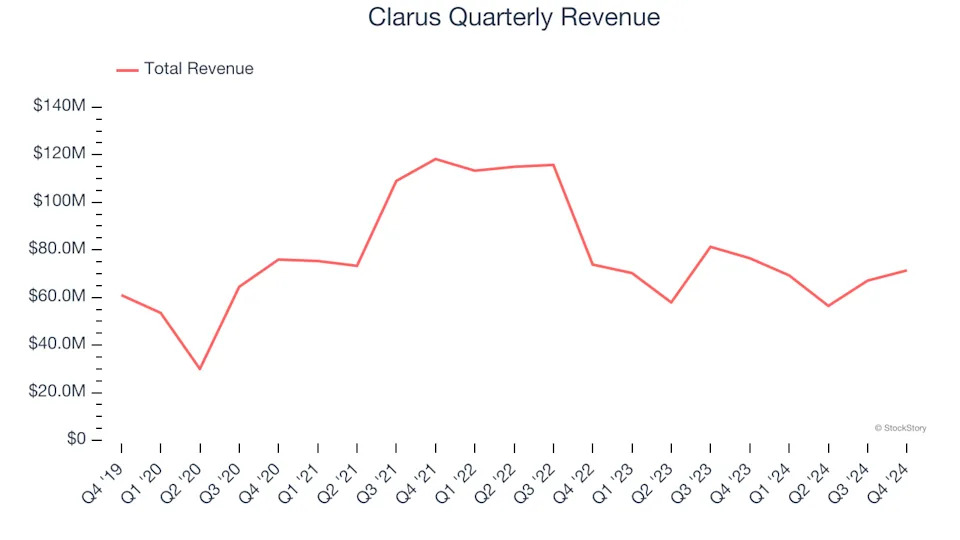

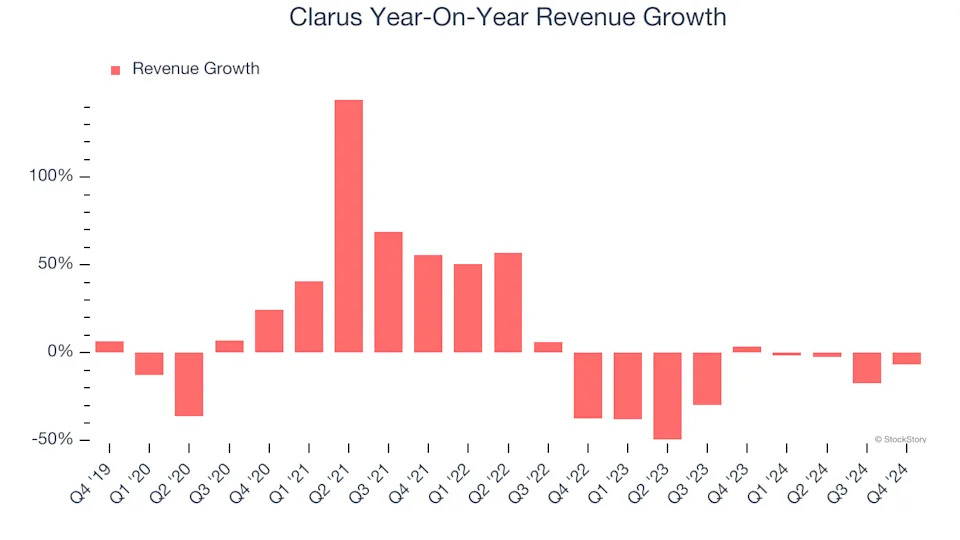

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Clarus’s 2.9% annualized revenue growth over the last five years was weak. This was below our standards and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Clarus’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 20.5% annually.

This quarter, Clarus’s revenue fell by 6.7% year on year to $71.41 million but beat Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

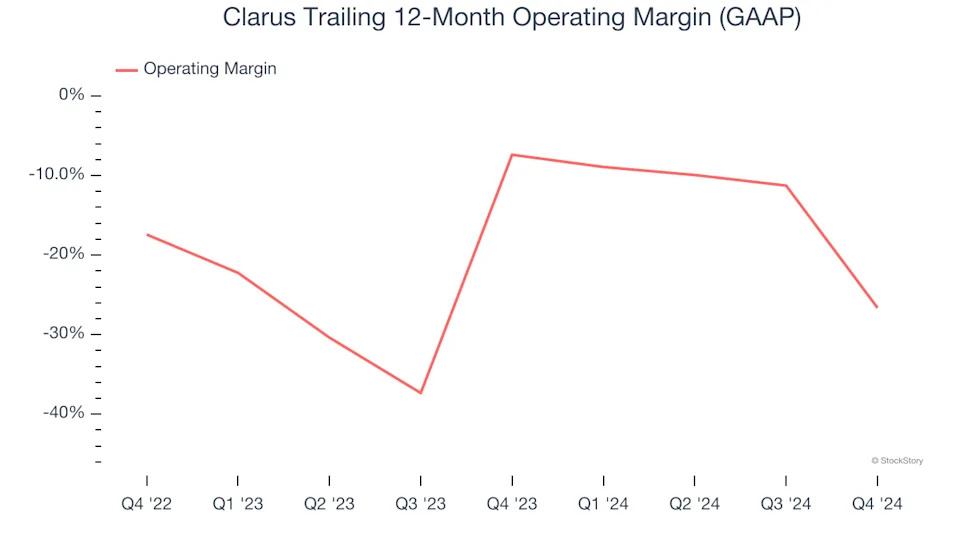

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Clarus’s operating margin has shrunk over the last 12 months and averaged negative 16.6% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q4, Clarus generated a negative 70.2% operating margin. The company's consistent lack of profits raise a flag.

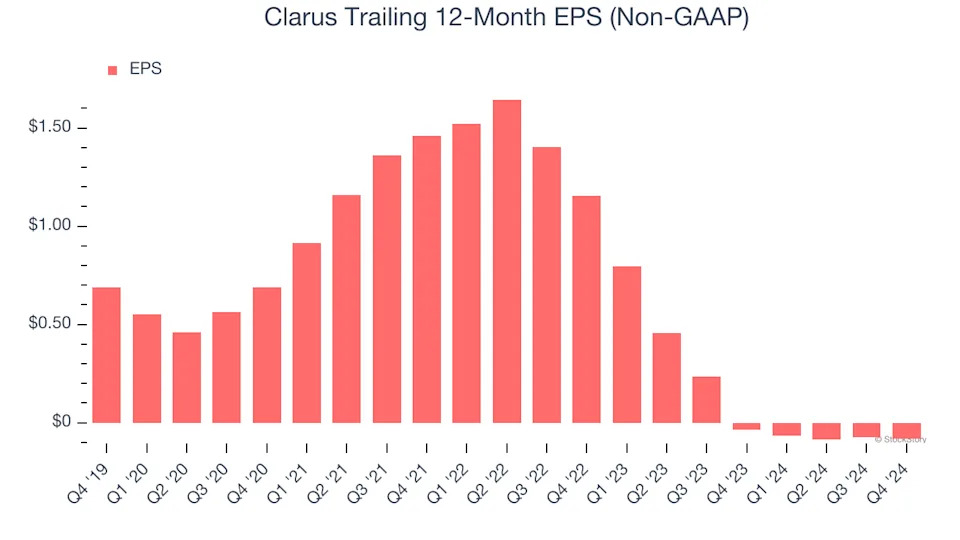

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Clarus, its EPS declined by 16.2% annually over the last five years while its revenue grew by 2.9%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q4, Clarus reported EPS at negative $0.08, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Clarus’s full-year EPS of negative $0.08 will reach break even.

Key Takeaways from Clarus’s Q4 Results

It was encouraging to see Clarus beat analysts’ revenue expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its full-year revenue guidance and EPS fell short. Overall, this was a weaker quarter. The stock traded up 4.1% to $4.45 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .