News

Bitcoin Drops Below $79K. It Will Get Uglier Before It Gets Better

Despite all the noise being made by President Trump’s historic White House Crypto Summit — Bitcoin and the rest of crypto continue to sell off thanks to macro weakness sparked by Trump’s other fascination: Tariffs.

Bitcoin dropped below $79,000 Monday as Ethereum broke below $2,000 for the first time since November 2023. Which begs the question — how bad can things get before they get better?

Unfortunately, the answer might be way worse. Let’s dig in.

Bitcoin Vs. Everything Else

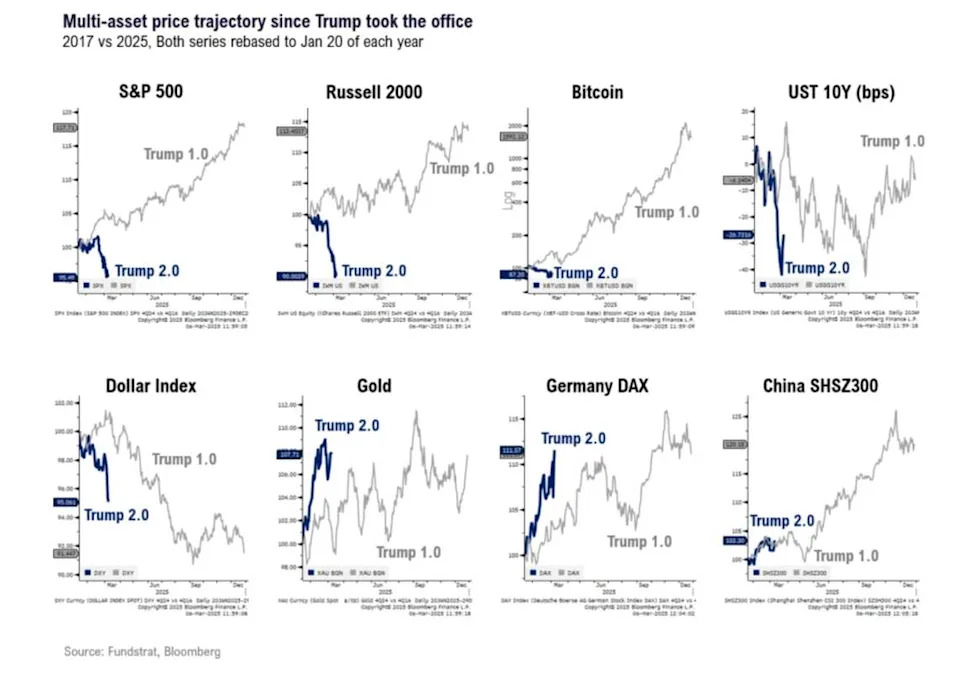

As Fundstrat brutally highlighted in a new note today — America is not off to a hot start under Trump 2.0. In fact, as they put it:

"At least for now, the short-term winner has been anything but America."

The 8-piece chart, I guess, is both as hopeful as it is brutal. Germany’s stock market is ripping while America’s stock market (and Bitcoin) get spanked. But as Fundstrat’s Sean Farrell told us last week — they still have a $175,000 year-end price target. How can that be, if in the short-term they see Bitcoin falling further to $62,000 during the rest of March?

Fundstrat's Tom Lee commented, "So, Bitcoin is down." But it's, "actually not a surprise to our clients because Mark Newton our head of technical strategy really pointed out the cycles into January. He was targeting 62,000 for Bitcoin by the end of March. So we're actually on our way to 62,000, but that's not a bearish development, it's just a retracement."

The answer is both technical and fundamental — but in general most people are still optimistic that when the market digests what Trump is attempting to do with tariffs, the 10-year will be meaningfully lower — and crypto, as a result, will take the fastest elevator to the top as stocks recover.

The answer is both technical and fundamental — but in general most people are still optimistic that when the market digests what Trump is attempting to do with tariffs, the 10-year will be meaningfully lower — and crypto, as a result, will take the fastest elevator to the top as stocks recover.

That may be — but at least for now there aren’t much backstops left, so it is hard to refute more weakness ahead, even despite the fact that Trump’s constant attention on crypto might push other global leaders to step up and beat America to the punch on establishing a Bitcoin reserve (something more and more states might also beat the Federal government to.)