News

Zumiez (NASDAQ:ZUMZ) Posts Q4 Sales In Line With Estimates, Next Quarter’s Sales Guidance is Optimistic

Clothing and footwear retailer Zumiez (NASDAQ:ZUMZ) met Wall Street’s revenue expectations in Q4 CY2024, but sales were flat year on year at $279.2 million. The company expects next quarter’s revenue to be around $181 million, coming in 2% above analysts’ estimates. Its GAAP profit of $0.78 per share was in line with analysts’ consensus estimates.

Is now the time to buy Zumiez? Find out in our full research report .

Zumiez (ZUMZ) Q4 CY2024 Highlights:

Rick Brooks, Chief Executive Officer of Zumiez Inc., stated, “We delivered a substantial improvement in fourth quarter operating profitability driven by significant gross margin expansion and a meaningful reduction in operating expenses. Comparable sales increased by 5.9% led by North America and while choppy, represents continued progress in growing the top-line and bottom line. This unexpected choppiness is indicative of the environment we have been operating in for some time, and we expect it will continue. Our plan for 2025 is to stay the course and focus on executing the product and customer engagement initiatives that have fueled our third consecutive quarter of positive comps while staying nimble and financially flexible to deliver enhanced profitability. We have demonstrated our ability to navigate challenging cycles and emerge stronger and I am confident that Zumiez is on right course to repeat this accomplishment once again.”

Company Overview

With store associates called “Zumiez Stash Members”, Zumiez (NASDAQ:ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $889.2 million in revenue over the past 12 months, Zumiez is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

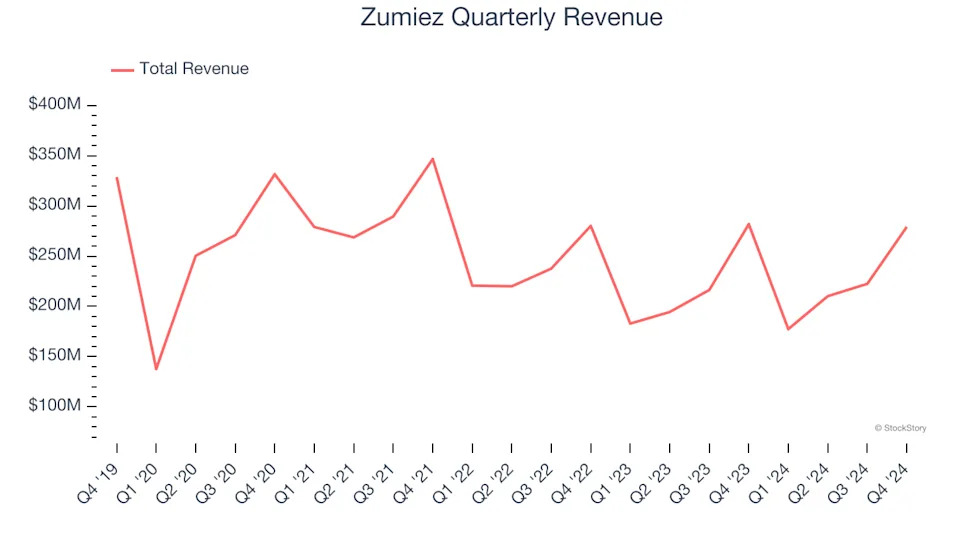

As you can see below, Zumiez’s revenue declined by 3% per year over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new stores and observed lower sales at existing, established locations.

This quarter, Zumiez’s $279.2 million of revenue was flat year on year and in line with Wall Street’s estimates. Company management is currently guiding for a 2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection implies its newer products will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

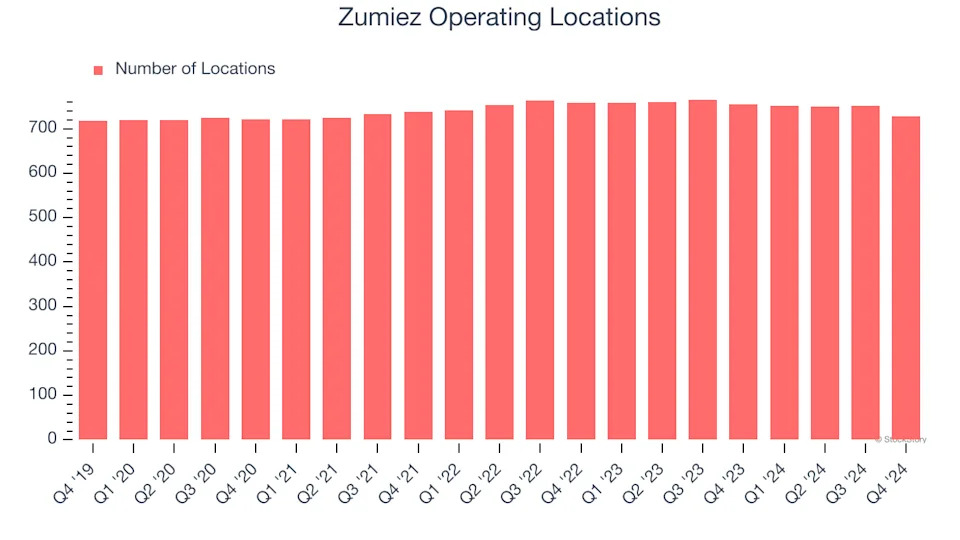

Zumiez listed 729 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

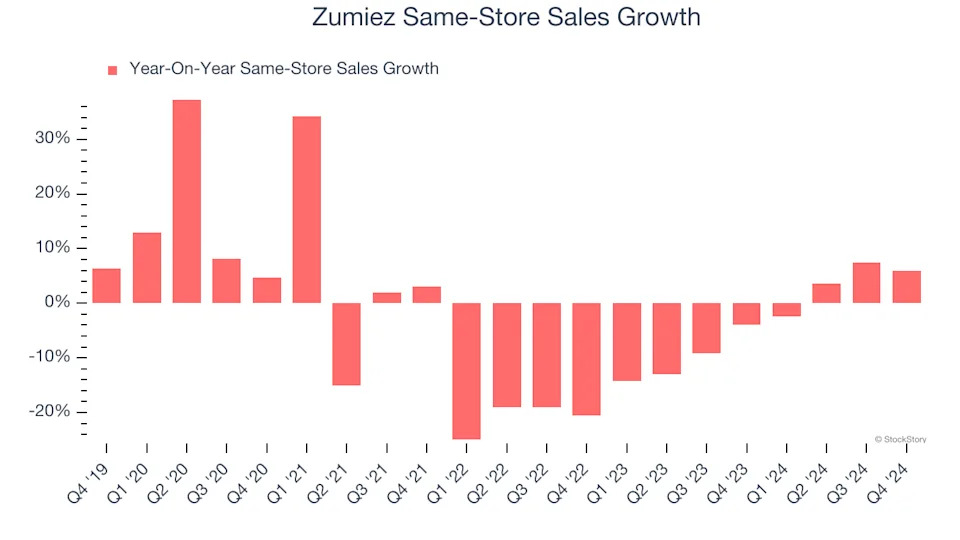

Zumiez’s demand has been shrinking over the last two years as its same-store sales have averaged 3.2% annual declines. This performance isn’t ideal, and we’d be concerned if Zumiez starts opening new stores to artificially boost revenue growth.

In the latest quarter, Zumiez’s same-store sales rose 5.9% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Zumiez’s Q4 Results

We enjoyed seeing Zumiez beat analysts’ EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed significantly and its gross margin fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded up 1.9% to $13 immediately after reporting.

So do we think Zumiez is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .