News

The Trump 2.0 Stock Market in 4 Charts

Key Takeaways

Investors cheered Donald Trump's election victory in November, bidding up stocks to record highs in anticipation of tax cuts, deregulation, and a business-friendly Washington. Trump's on-again, off-again approach to tariffs has thrown cold water on that optimism in recent weeks.

A Rough Start to Trump 2.0

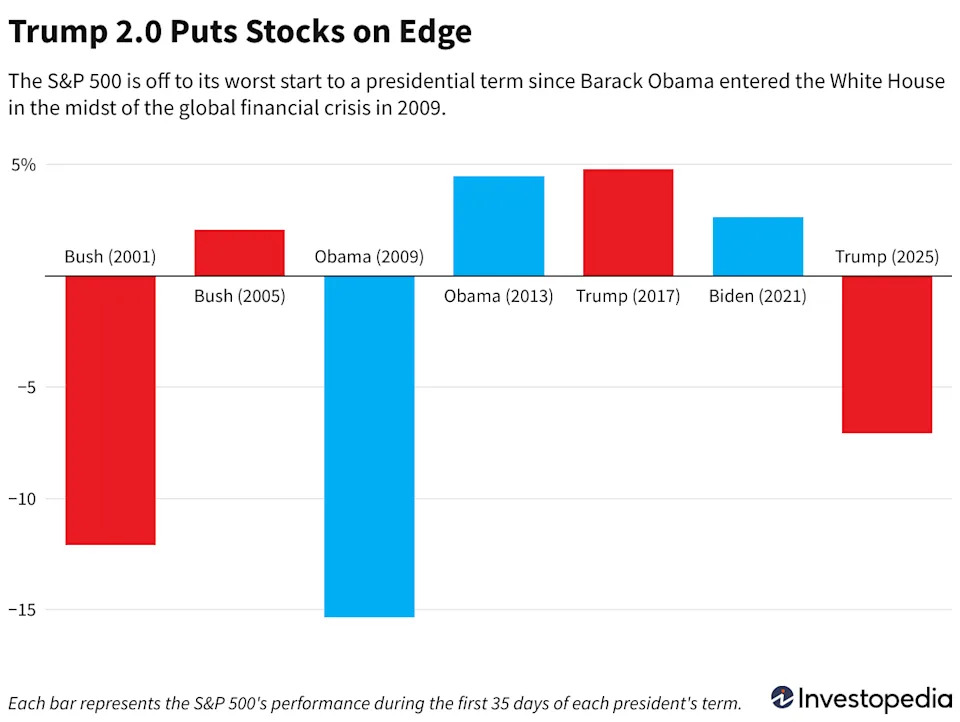

The S&P 500 is off to its worst start for a presidential term since 2009, when Barack Obama entered the White House in the midst of the global financial crisis . The benchmark index had, as of Tuesday's close, fallen more than 7% since Trump was inaugurated for a second term on Jan. 20. The tech-heavy Nasdaq Composite has had it even worse; it was down more than 11% before rebounding slightly on Wednesday.

The stock market has been shaken in recent weeks by Trump's tariffs, which many economists have warned could reaccelerate inflation . The levies, and the unpredictable way they've been rolled out, have also upended business leaders' expectations for the U.S. economy, threatening to slow hiring and investment. Finally, Trump's tariffs have eroded many everyday Americans' confidence in the U.S. economy .

Ultimately, the risk that tariffs usher in a period of stagflation , in which growth is slow and inflation high, has offset most of the optimism on Wall Street about Trump's regulatory and tax agendas.

Trump Cites 'Some Disturbance' to Economy, Markets

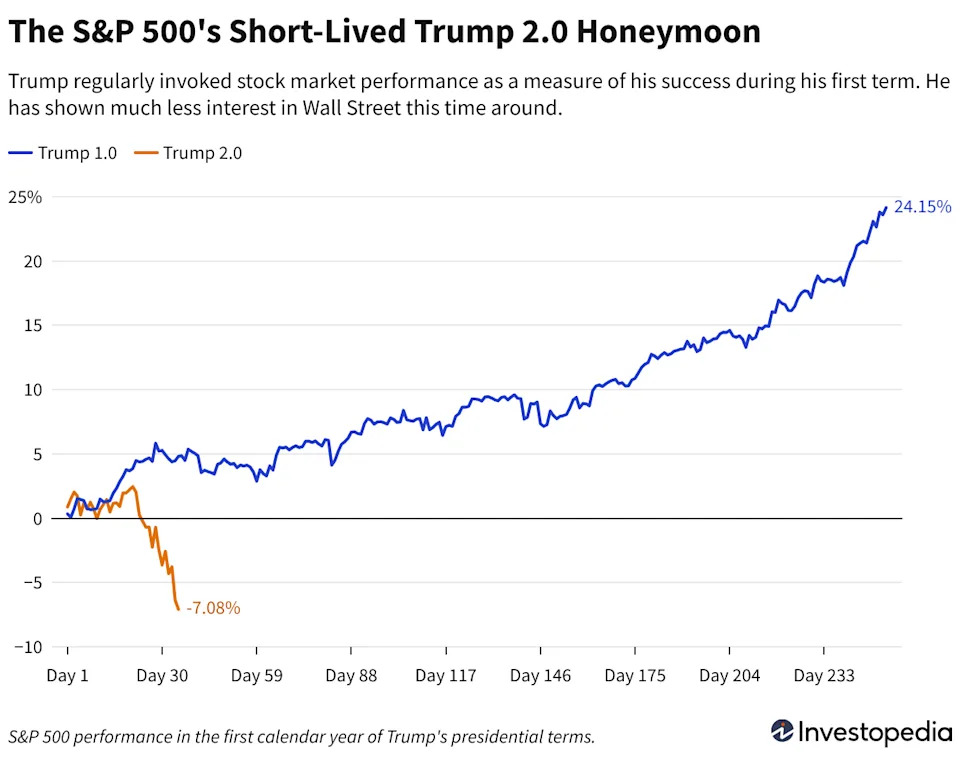

Trump hasn't done much to stabilize markets in the last week, a notable departure from his first term, in which he regularly invoked a strong stock market as a sign of his success. Over the weekend, Trump declined to say whether he thought the U.S. could enter a recession this year and, when asked about the market's reaction to his policies, said, "You can't really watch the stock market."

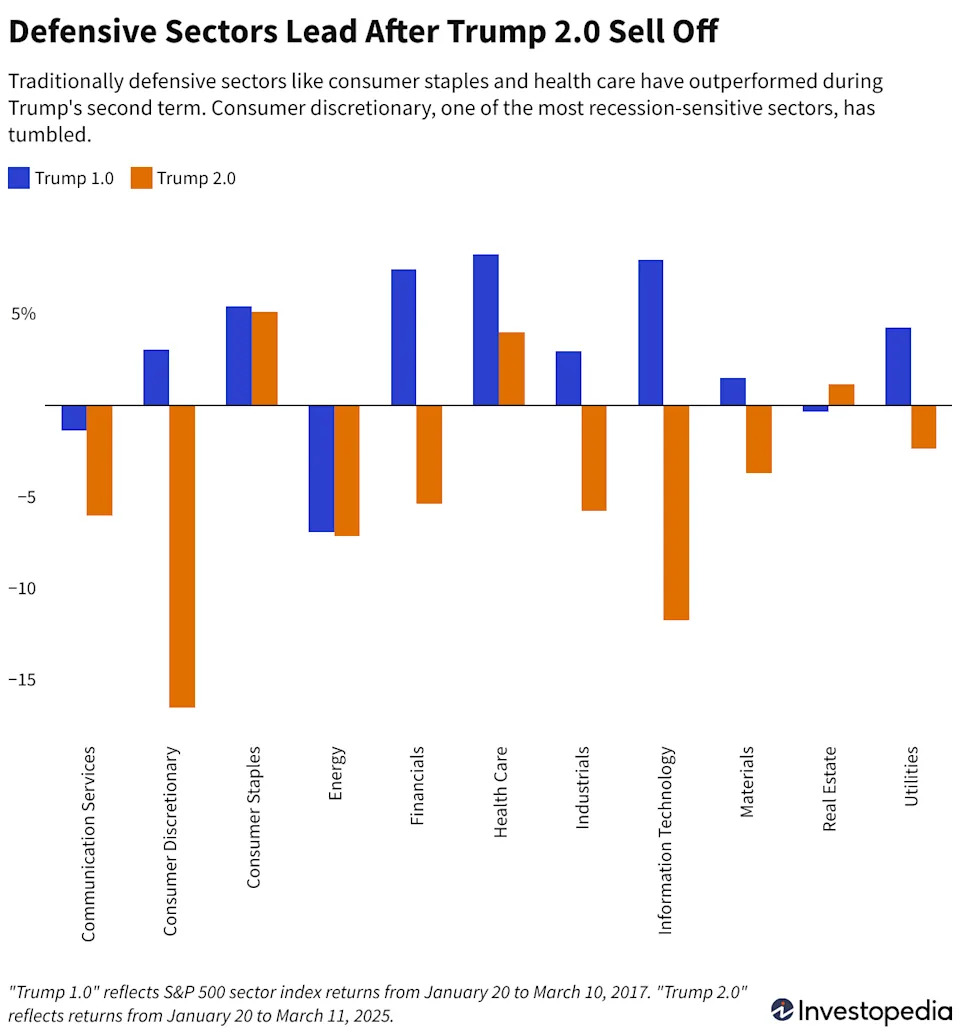

Trump and his Cabinet members have characterized the economic turmoil some forecasters see on the horizon as "a detox period," "a period of transition," and "some disturbance." But what looks like "some disturbance" in Washington looks like a recession to many on Wall Street. Since Trump's inauguration, stocks in traditionally defensive sectors like consumer staples and healthcare have risen, while recession-sensitive sectors like consumer discretionary and financials have slumped.

Real-estate stocks have gotten a bittersweet reprieve. Interest rates tumbled recently in large part because fearful investors fled risk assets for safe havens like Treasurys, causing their yields and consumer interest rates to fall.

Post-Election Optimism Has Waned

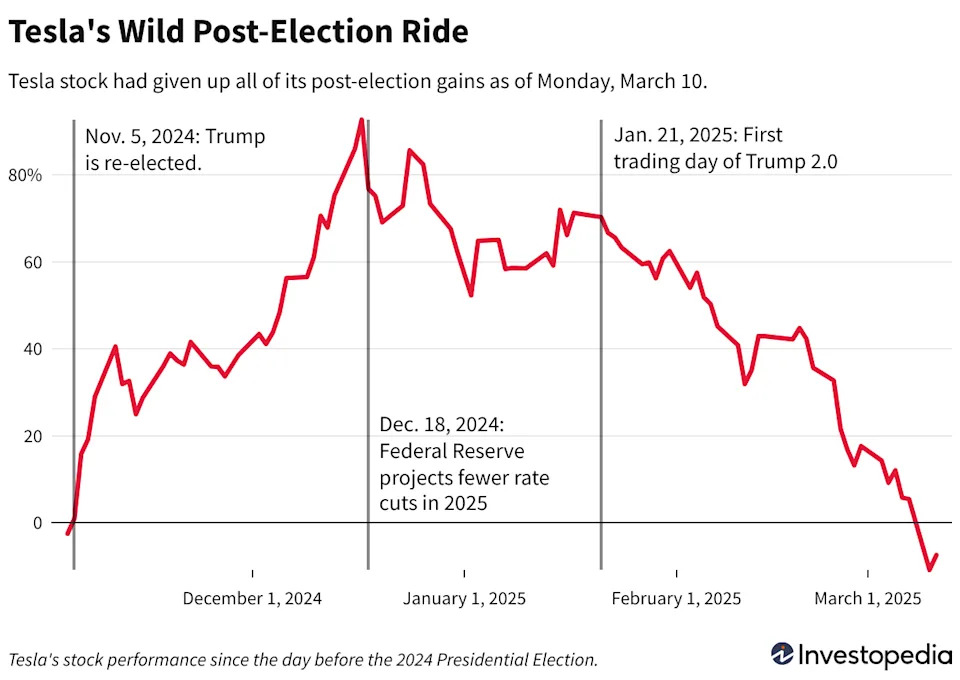

Trump's re-election unleashed animal spirits on Wall Street, fueling a sharp rise in growth stocks , especially of companies expected to benefit from artificial intelligence (AI) . Those stocks, lifted by post-election optimism, have been some of the hardest hit by Wall Street's newfound pessimism.

Tesla ( TSLA ) stock stands out as a prime example. Shares shot up in the wake of Trump's election as investors bet the electric vehicle maker would benefit from CEO Elon Musk's proximity to the president. Trump promised to end government support for electric vehicles and promote their gas-powered competitors, yet the stock continued to climb. That was in part because Musk said he would launch a robotaxi service and turn Tesla into an AI powerhouse, all of which Trump was expected to assist with.

Since Trump's inauguration, Tesla's stock has been battered by his aggressive tariff policies , concern Musk is stretched too thin with corporate and government work, and a consumer backlash against Musk's political influence. The stock, as of Monday, had given up all of its post-election gains .

Trump says he's not paying attention to the stock market, but he may have noticed Tesla's stock swoon. The South Lawn of the White House resembled a Tesla showroom on Tuesday when Trump inspected several models and said he was buying one as a show of support for Musk.

"This man has devoted his energy and his life to doing this," Trump said of Musk’s work with the Department of Government Efficiency (DOGE), "and I think he's been treated very unfairly by a very small group of people."

Tesla was the best-performing stock in the S&P 500 on Wednesday.

Read the original article on Investopedia