News

If I Could Only Invest In 1 "Magnificent Seven" Stock Over the Next Decade, This Would Be It

Over the last year, investors have turned to the " Magnificent Seven " stocks in search of outsized gains, and for good reason.

Mega-cap tech companies such as Nvidia , Microsoft , Alphabet , and Meta Platforms have all outperformed the S&P 500 and Nasdaq Composite over the last 12 months. Much of these gains can be attributed to a rising interest in artificial intelligence (AI), a market dominated by the Magnificent Seven.

Yet despite the impressive performances of the companies above, I see another member of the Magnificent Seven as a superior choice for long-term investors.

E-commerce and cloud computing giant Amazon (NASDAQ: AMZN) has underperformed the Nasdaq over the last year and has basically generated returns in line with those of the S&P 500.

With shares down roughly 14% over the last month, I think now is a prime opportunity to buy the dip in Amazon.

Let's dig into how Amazon is quietly disrupting the AI landscape and assess why now looks like a lucrative opportunity to scoop up shares at a dirt-cheap valuation.

Don't call it a comeback

One of the biggest opportunities surrounding AI is cloud computing. Amazon faces fierce competition in the cloud infrastructure market from Microsoft Azure and Alphabet's Google Cloud Platform (GCP).

Over the last 18 months or so, Microsoft has swiftly augmented the Azure platform thanks to the company's $10 billion investment in OpenAI -- the developer of ChatGPT. Moreover, Alphabet has done a respectable job of breaking into the cloud realm thanks to a series of acquisitions, including MobiledgeX, Forseeti, Siemplify, and Mandiant .

These moves by Microsoft and Alphabet initially appeared to be taking a toll on Amazon's cloud revenue growth and its profitability. However, the table below illustrates some newfound encouraging trends from Amazon's cloud segment, Amazon Web Services (AWS).

|

Category |

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|---|---|---|---|---|---|---|

|

AWS Revenue Year over Year % Growth |

16% |

12% |

12% |

13% |

17% |

19% |

|

AWS Operating Income Year over Year % Growth |

(26%) |

(8%) |

30% |

39% |

83% |

72% |

Data source: Investor Relations

The figures above showcase a really positive narrative for Amazon. Over the last year, AWS has transitioned from a business experiencing consistent deceleration to one that has now grown in three consecutive quarters, all while significantly increasing operating income.

Amazon is a money-printing machine

Seeing a return to revenue and profit growth is nice to see, but it's only one part of the greater story for Amazon.

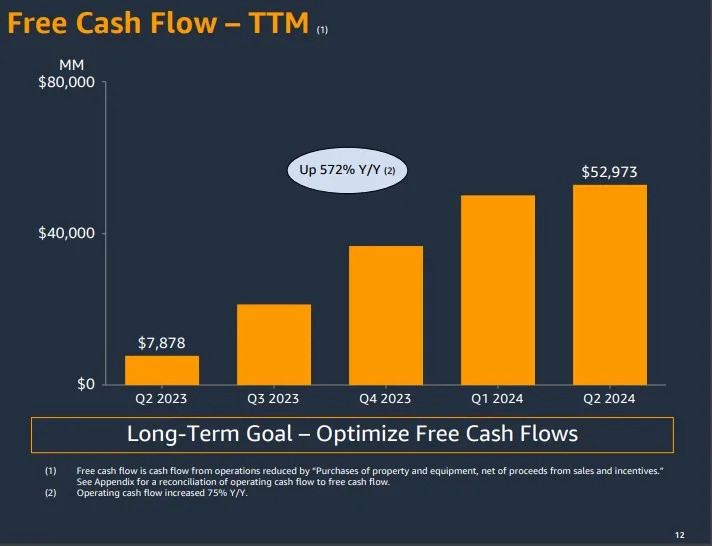

The majority of Amazon's operating profits stem from AWS. For this reason, the reacceleration of the cloud business has directly impacted Amazon's overall cash flow profile. For the quarter ended June 30, Amazon generated $53 billion of free cash flow on a trailing-12-month basis. Furthermore, with a balance sheet boasting $86 billion of cash and equivalents, Amazon has virtually no shortage to invest aggressively and give its rivals a run for their money.

One of the catalysts sparking renewed growth in AWS is Amazon's $4 billion investment in generative AI start-up Anthropic.

This relationship is particularly important because Anthropic is training its AI models on Amazon's in-house semiconductor chips -- Trainium and Inferentia. This provides Amazon with a direct line to compete against Nvidia as demand for semiconductor chips continues to boom.

Moreover, the company is also investing $11 billion into a data center project in Indiana. To me, these investments solidify Amazon's ambitions to compete all across the AI landscape as AWS enters a new phase of its evolution.

For those reasons, I think the revenue growth and renewed profits from AWS, as shown above, are only the beginning.

A prime valuation for investors

Amazon currently trades at a price-to-free-cash-flow (P/FCF) multiple of 37.1, which is less than half its 10-year average. I find this peculiar, considering that Amazon is a much larger and far more sophisticated business today than it was a decade ago.

To me, investors are either overlooking or unappreciative of Amazon's dive into the AI realm. I think AI's future potential may be baked into some of Amazon's Magnificent Seven compatriots, given that many of them have handily outperformed the markets over the last year.

By contrast, Amazon is already reaping the rewards from these AI-driven initiatives, and the company has a boatload of cash to keep funding the growth for quite some time. For these reasons, I think Amazon is the most lucrative opportunity among mega-cap tech stocks right now. In my eyes, this is an excellent opportunity to buy Amazon stock hand over fist.

Before you buy stock in Amazon, consider this: