News

Paychex (NASDAQ:PAYX) Reports Q1 In Line With Expectations

Payroll and human resources software provider, Paychex (NASDAQ:PAYX) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 4.8% year on year to $1.51 billion. Its non-GAAP profit of $1.49 per share was 0.7% above analysts’ consensus estimates.

Is now the time to buy Paychex? Find out in our full research report .

Paychex (PAYX) Q1 CY2025 Highlights:

Company Overview

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

Sales Growth

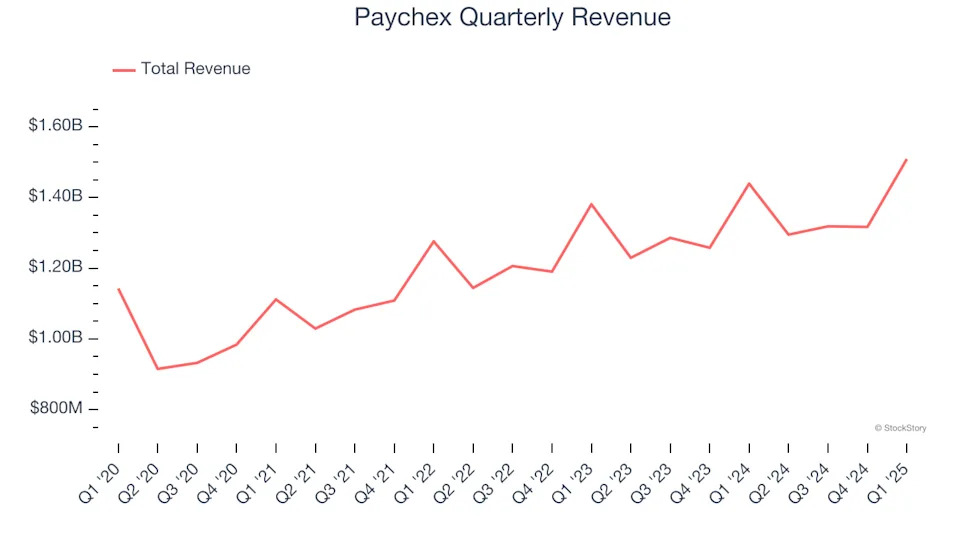

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Paychex’s 6.6% annualized revenue growth over the last three years was weak. This was below our standard for the software sector and is a tough starting point for our analysis.

This quarter, Paychex grew its revenue by 4.8% year on year, and its $1.51 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and indicates its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

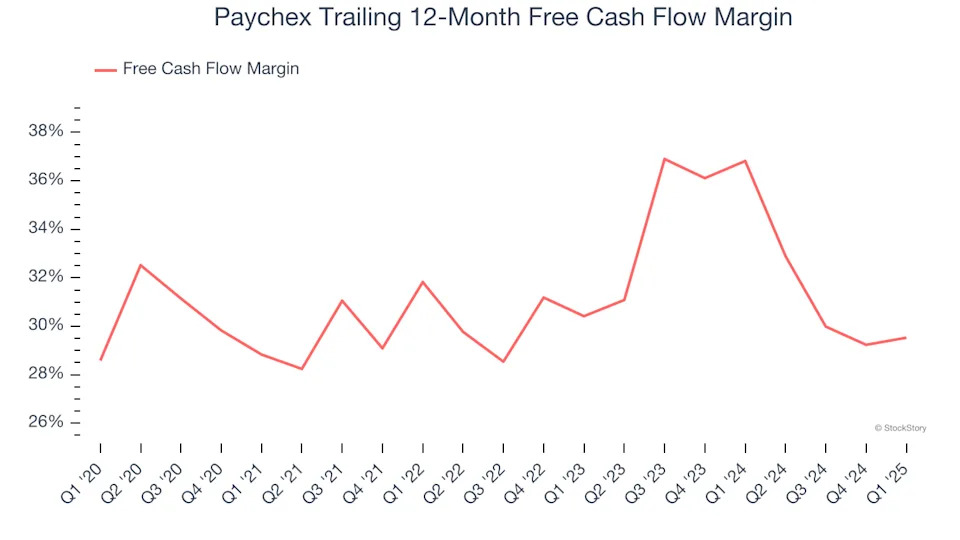

Paychex has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging 29.5% over the last year.

Paychex’s free cash flow clocked in at $667.3 million in Q1, equivalent to a 44.2% margin. This cash profitability was in line with the comparable period last year and above its one-year average.

Over the next year, analysts predict Paychex’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 29.5% for the last 12 months will increase to 37.3%, it options for capital deployment (investments, share buybacks, etc.).

Key Takeaways from Paychex’s Q1 Results

There weren't many resounding positives in these results. Both revenue and EBITDA were roughly in line with expectations. The stock traded down 1.1% to $142.52 immediately following the results.

So should you invest in Paychex right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .