News

Auto Stocks Fall After Trump Pledge to Impose 25% Tariffs on Imported Vehicles

Shares of major carmakers and auto-parts manufacturers fell after President Trump said he would impose 25% tariffs on global automotive imports to the U.S., rekindling concerns about trade frictions between the U.S. and its trading partners.

The tariffs–set to cover finished automobiles and automotive parts–will be levied on top of existing duties, including a 2.5% tariff imposed by the U.S., as well as 25% tariffs on light trucks. Trump said the U.S. would start collecting the auto tariffs on April 3.

The president has been turning to tariffs to address what he sees as unfair trade imbalances between the U.S. and other world economies. Trump ordered federal agencies to explore how to adjust U.S. tariffs to match those of other countries.

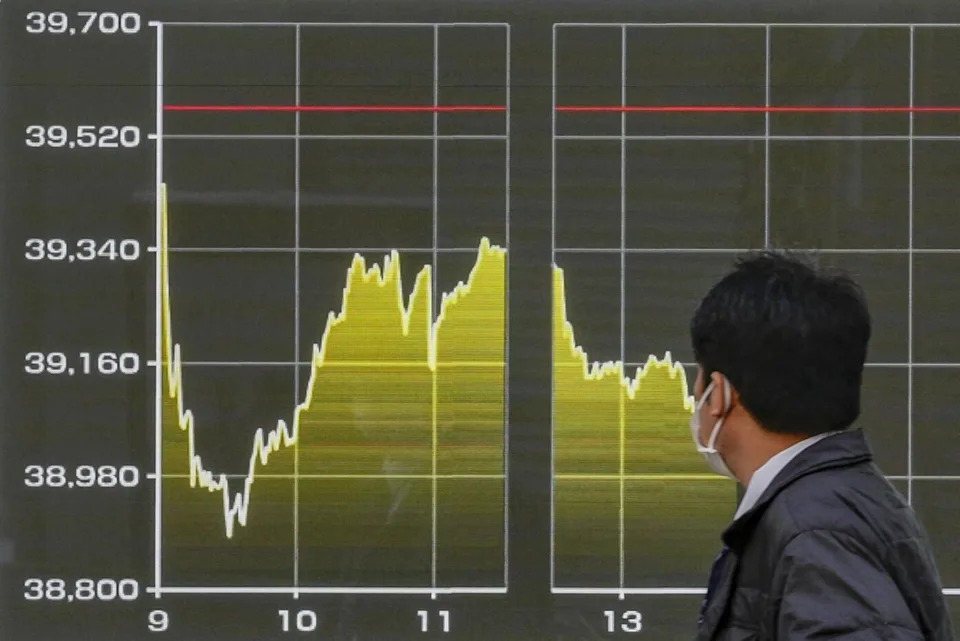

The latest announcement weighed on Asian and European automotive stocks Thursday. In Japan, Toyota Motor shares closed 2% lower, Nissan Motor closed down 1.7% and Honda Motor was down 2.5%. In South Korea, Hyundai Motor shares fell 4.3% and Kia was down 3.5%.

In Europe, Mercedes-Benz Group shares slumped more than 3%, while BMW and Volkswagen lost more than 2%. Shares of premium carmaker Porsche AG were down more than 4%. German automotive supplier Continental lost 3%.

Stellantis, the owner of the Jeep and Dodge brands, shed more than 4% in Milan. Ferrari shares lost 2%, while tiremaker Pirelli was down 1.2%. Meanwhile, Volvo Car shares were down nearly 8%, while Aston Martin in the U.K. was down 5%.

Trump’s latest move underscores his willingness to make good on pledges to penalize foreign carmakers even at the cost of ratting relations with U.S. trading partners.

In a post on Truth Social early Thursday, the president threatened to impose “large-scale tariffs, far larger than currently planned” on Canada and the European Union if they worked together to “do economic harm” to the U.S.

The auto tariffs in their current form “would be a hurricane-like headwind to foreign and many U.S. automakers,” ultimately pushing up the average price of a car by as much as $10,000, Wedbush Securities analysts wrote in a note to clients. General Motors and Ford Motor stock fell 6.3% and 1.2% premarket, respectively.

Nearly half of new passenger vehicles sold in the U.S. in 2024 were assembled outside the country, according to data from S&P Global Mobility. Mexico is the biggest auto exporter to the U.S.

The tariffs will weigh significantly on German car manufacturers, CMC Markets’ chief market analyst Jochen Stanzl wrote in a research note, pointing out that the U.S. is a crucial trading partner. “One can only hope that Trump will use these tariffs as leverage to negotiate a better deal,” Stanzl said.

Tariffs are unlikely to have a major impact on the Chinese auto industry, said BOCOM International analyst Angus Chan. “U.S. tariffs have been existing for many years so many Chinese automakers, auto parts companies and battery makers wouldn’t touch the U.S. market.”

However, the measures could hurt sales of Japanese and South Korean cars or their profitability in the U.S. market. Toyota, for instance, sold 2.3 million cars in the U.S. last year. Of that, about 23% were exported from Japan.

Given the interconnectedness of the automotive supply chain, the proposed tariffs could harm economic growth in Asia, with South Korea and Japan particularly exposed. Citigroup analysts estimate the tariffs will weigh on South Korea’s gross domestic product.

“The new 25% levy from Washington will undermine confidence, hit production, and reduce orders,” said Stefan Angrick and Dave Chia at Moody’s Analytics. They expect the “impact will ripple through the region, causing noticeable damage.”

A key question for investors will be whether any company or country will get a reprieve from the tariffs. Moody’s Analytics economists expect carmakers to step up investment in the U.S. as they seek to negotiate exemptions or reduced tariffs.

Hyundai Motor announced at the White House on Monday that it would invest an additional $21 billion in U.S.-based car manufacturing and supply chains for critical materials, including a $5.8 billion steel mill to be built in Louisiana.

President Trump credited the South Korean company’s investment to his aggressive use of tariffs to discourage companies from relying on imports to supply operations in the U.S.

Write to Kosaku Narioka at kosaku.narioka@wsj.com and Mauro Orru at mauro.orru@wsj.com