News

4 charts show why Wall Street's most bullish strategist expects the stock market to triple by 2030

Fundstrat's Tom Lee raised eyebrows last month when he made an extremely bullish prediction: the S&P 500 will nearly triple by 2030.

In an interview with Bloomberg's Odd Lots, Lee said he expects the S&P 500 to top 15,000 by the end of the decade. The index closed last week around 5,555.

"If this is a normal S&P cycle following demographics…S&P should be potentially 15,000 by the end of the decade. To me, as you move into a longer timeframe that's probably where I think we're moving towards," Lee said.

In the interview, Lee said he was looking at a handful of charts that back up his bullish long-term prediction.

Here are the four charts Lee shared with Business Insider that show why the already upbeat forecaster is so bullish on the stock market.

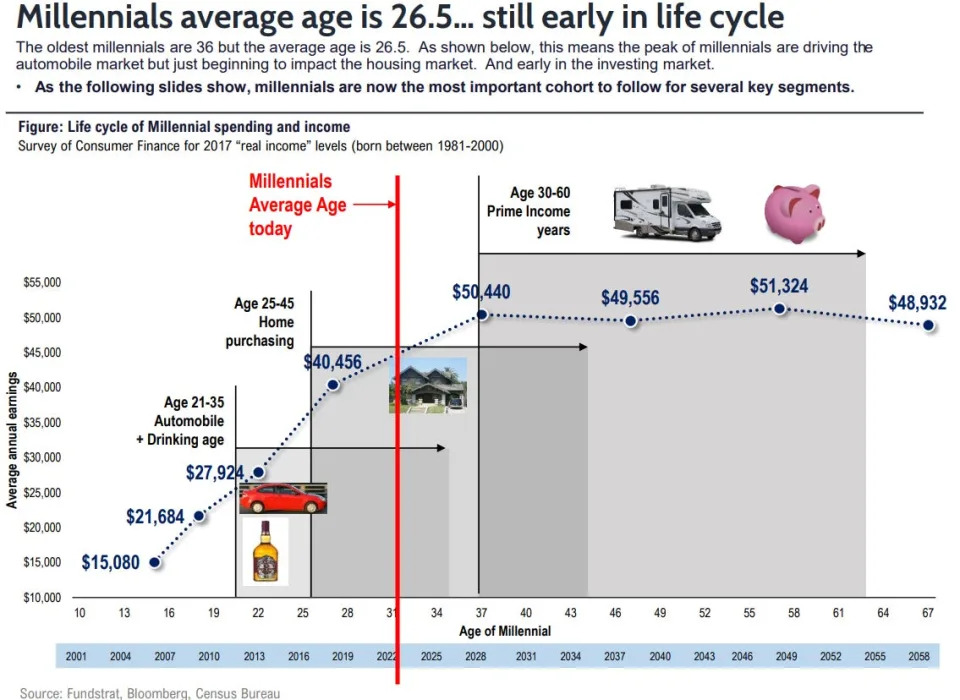

1. Thank you, millennials

Lee put the chart above together several years ago, but his thesis remains the same. The average age of millennials is now around 31 years old, and the global cohort of 2.5 billion people is starting to enter its prime age years of 30-50 years old.

"This would be the third time that stocks entered a cycle where annual returns compound at high teens. You had the roaring 20's, and then you had the 50's through the late 60's, and this is a third cycle," Lee told CNBC last month.

"They all coincided with a surge in the number of people aged 30-50, so in other words the number of prime age adults, and this time it's powered by millennials and Gen Z."

"It's a demand story. When you get to your prime years, 30-50, Urban Institute shows you start to borrow more money, you're making big life decisions, this is what powers the economy."

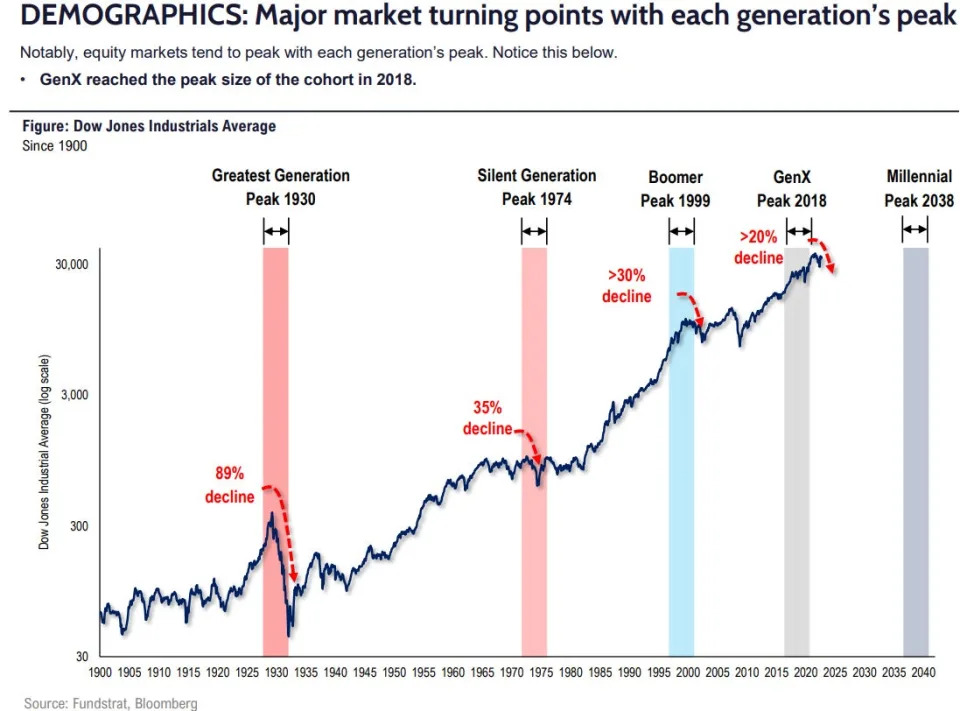

2. Stock market peaks and demographics

The stock market has a history of peaking right around the same time a population hits its peak prime age of around 50 years old, as they are closer to retirement and often spend less money.

For example, when the greatest generation peaked in 1930, that coincided with a multi-year bear market in stocks.

Fast-forward to 1974, when the silent generation saw its prime age peak. This occurred around the same time as a painful stock market correction of about 35% that lasted years.

And the peak in the baby boomer population's prime age was in 1999, just a year before a multi-year bear market hit stocks.

The average millennial is not set to hit their peak prime age until 2038, suggesting plenty of upside ahead for the stock market between now and then, according to Lee.

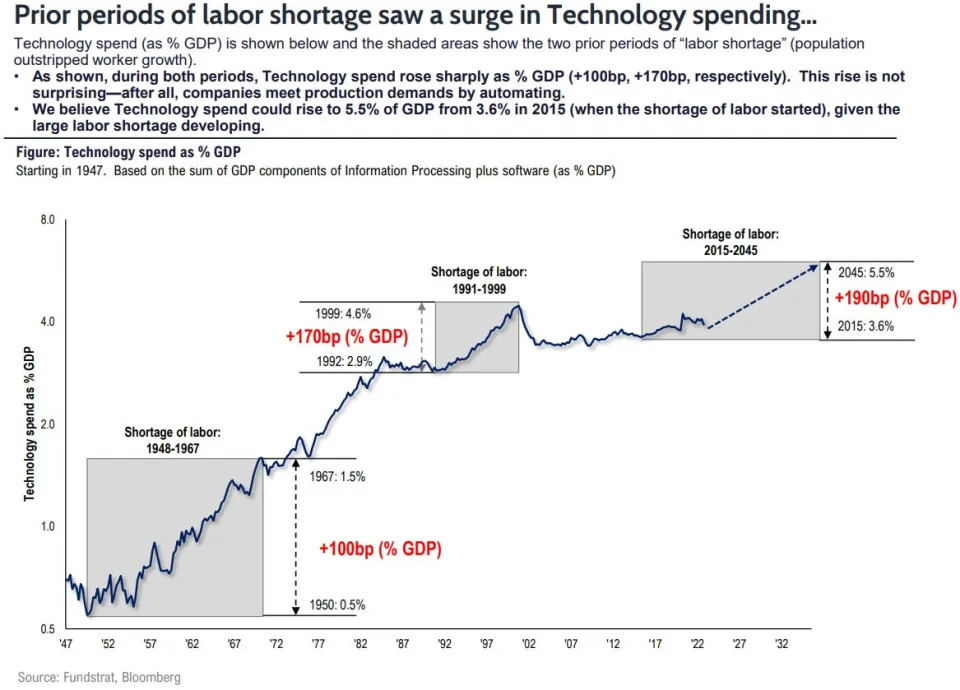

3. Tech will address a global labor shortage

According to Lee, spending on technology will boom in the coming years as the world grapples with a growing labor shortage.

"We have a really big opportunity for US technology companies because of AI, which is supplying the global digital labor, because there's a global labor shortage. So these two forces are combining to I think power almost a decade of extraordinarily good stock returns," Lee said.

"I think that there's going to be a lot of dollars spent on US technology product because the world is short 80 million workers by the end of this decade, that's roughly $3 trillion of labor salary that's turning into silicon, so that means US suppliers of silicon and AI are going to have a $3 trillion revenue run rate."

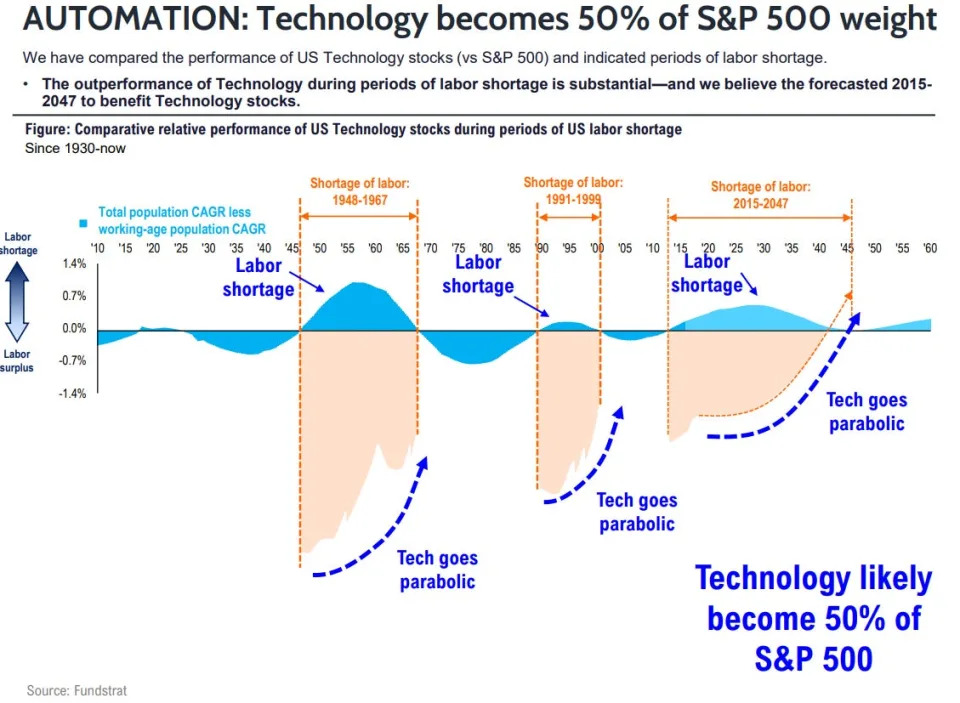

4. Money will flow into US tech stocks

As more companies spend trillions of dollars on technology to address a global labor shortage, that will catapult the technology sector to make up 50% of the S&P 500.

The information technology sector currently makes up about 30% of the index.

"If US companies are growing earnings at this speed, the P/E multiple of the US should go up. There's going to be capital flows into the US. Where else in the world do you find the best and most important technology companies, they're all basically in America," Lee said.

This story was originally published in July 2024.

Read the original article on Business Insider