News

Here are the market's biggest losers from Trump's fresh auto tariffs

President Donald Trump announced a 25% tariff rate on all imported vehicles on Wednesday, and investors are spooked.

Most auto stocks moved lower on Thursday in reaction to the tariffs, with various automakers expected to be negatively affected by the higher prices.

The tariffs don't take effect until April 3, and there's a chance negotiations result in changes to the final rate or a narrowing of the scope.

But investors are shooting first and asking questions later. That's because the tariffs if fully enacted, could cost automakers tens of billions of dollars.

Of the roughly 16 million cars sold in America each year, about half are manufactured outside in other countries, and nearly all of them rely on foreign-made auto parts, which are also subject to the new tariffs.

JPMorgan analyst Ryan Brinkman called the tariffs "draconian" in a note on Thursday and lowered his price targets for General Motors, Ford, and Ferrari as a result.

"We are lowering our price targets for shares of General Motors, Ford, and Ferrari given the increased potential for material earnings risk from draconian auto tariffs that now seem likelier than ever to be imposed as soon as April 3," Brinkman said.

Brinkman estimates that the new tariffs could cost the auto industry $82 billion, double his prior estimate of $41 billion.

Here are the biggest losers from the Trump auto tariffs, based on Thursday's price action.

General Motors

General Motors stock declined about 7% on Thursday, after dropping 3% on Wednesday. The company relies heavily on manufacturing its vehicles in Canada and Mexico.

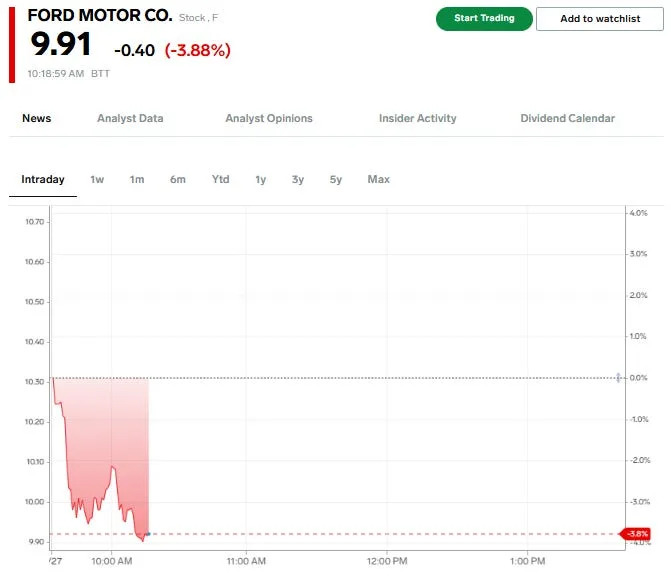

Ford

While Ford is better insulated from the tariffs than General Motors thanks to its domestic manufacturing plants, it still stands to take a sizable earnings hit, ranging from $2 billion to $4.5 billion, according to JPMorgan. The stock dropped 4% on Thursday.

European automakers

European automakers were slammed on Thursday, including luxury manufacturers like BMW, Mercedes-Benz, and Porsche. Shares of all three companies declined by about 3%.

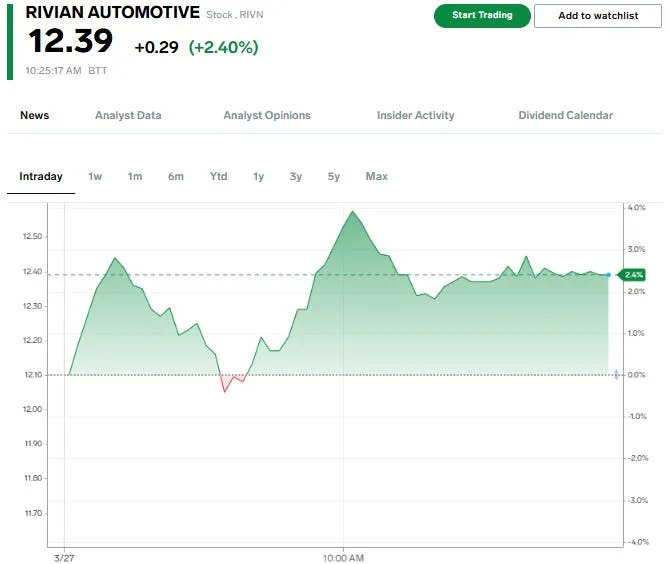

Relative winners

While the Trump tariffs are expected to raise the price of autos across the board, some manufacturers are better insulated, including Tesla and Rivian, which manufacture the bulk of their vehicles domestically.

Tesla and Rivian stock both jumped about 2% on Thursday.

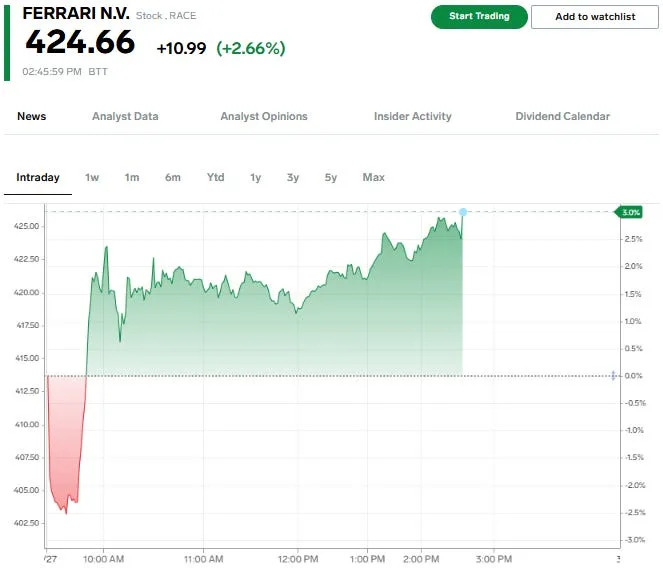

Ferarri

Shares of Ferarri initially dropped 3% in Thursday trades, as the company makes all of its vehicles in Italy.

But the stock quickly rebounded and rose as much as 3% after the company announced it would implement a 10% price increase on some of its vehicle models.

Analysts at Bernstein argued that Ferarri's high net-worth client base would most likely be unmoved by the higher prices.

Read the original article on Business Insider