News

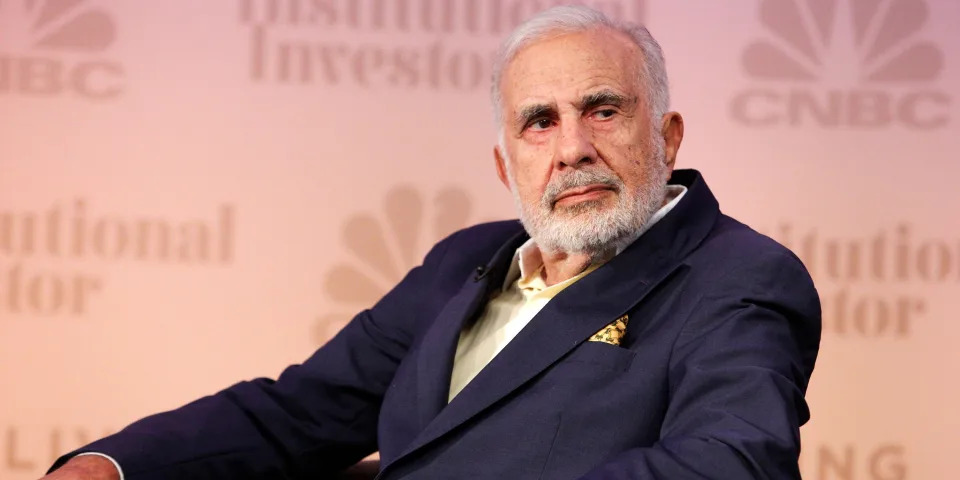

SEC charges activist Carl Icahn with failing to disclose billions in stock pledges

The billionaire investor Carl Icahn has been accused by the Securities and Exchange Commission of failing to disclose pledges made against his shares of Icahn Enterprises .

According to an SEC press release , Icahn and his firm settled the charges by agreeing to pay $500,000 and $1.5 million, respectively.

The SEC said that since the start of 2019, Icahn pledged between 51% and 82% of his outstanding shares in the company as collateral to secure billions worth of personal margin loans. Icahn Enterprises failed to make the required disclosure in its Form 10-K, the release said.

The SEC added that Icahn also failed to file Schedule 13D amendments to describe his personal-margin-loan agreements, which the agency said dated back to at least 2005.

A related SEC consent order said Icahn first disclosed margin borrowing in July 2023. Between 2018 and 2022, his total outstanding principal amount of loans reached as much as $5.1 billion, according to the document.

"The federal securities laws imposed independent disclosure obligations on both Icahn and IEP. These disclosures would have revealed that Icahn pledged over half of IEP's outstanding shares at any given time," Osman Nawaz, the chief of the SEC Enforcement Division's Complex Financial Instruments Unit, said in the press release.

The SEC said that without admitting or denying the charges, both parties agreed to cease and desist from violations.

The inquiry was sparked by a report from the activist investment firm Hindenburg Research, which sent IEP's stock spiraling when it announced a short on the company in May 2023.

Hindenburg's report highlighted Icahn's use of margin loans. It also accused Icahn and his firm of inflating the value of its assets, as well as creating a "Ponzi-like" investing structure to pay back older investors.

The outside counsel for Icahn Enterprises issued the following statement:

"More than a year ago Hindenburg published a self-serving report that made false and totally irresponsible allegations IEP inflated its net asset value and had 'Ponzi-like' dividends. The government investigated these claims and IEP and Carl Icahn fully cooperated. The result is this settlement. In short, the government found absolutely no fraud and did not find any inflation of IEP's NAV or impropriety in its dividends."

Icahn added the following in his own statement:

"After Hindenburg issued a false report to make money on its short position at the expense of ordinary investors, the government investigation that followed has resulted in this settlement which makes no claim IEP or I inflated NAV or engaged in a 'Ponzi-like' structure. Hindenburg's modus operandi, which is to publish scurrilous and unsupported allegations, did damage to IEP and its investors."

Read the original article on Business Insider