News

Kura Sushi (NASDAQ:KRUS) Posts Q1 Sales In Line With Estimates But Full-Year Sales Guidance Slightly Misses Expectations

Sushi restaurant chain Kura Sushi (NASDAQ:KRUS) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 13.3% year on year to $64.89 million. On the other hand, the company’s full-year revenue guidance of $277 million at the midpoint came in 1.3% below analysts’ estimates. Its non-GAAP loss of $0.14 per share was in line with analysts’ consensus estimates.

Is now the time to buy Kura Sushi? Find out in our full research report .

Kura Sushi (KRUS) Q1 CY2025 Highlights:

Hajime Uba, President and Chief Executive Officer of Kura Sushi, stated, “We had a very productive second quarter, making headway on the new market opportunities represented by our success in Bakersfield, building out our IP pipeline, and beginning testing or rollout of several systems projects that have long been in development. New restaurant openings are going exceptionally smoothly, with 11 units opened to-date and another six under construction. While the inclement weather was an unexpected sales pressure, we’re pleased overall with the quarter due to the great progress we’ve made across our initiatives.”

Company Overview

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $258.4 million in revenue over the past 12 months, Kura Sushi is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

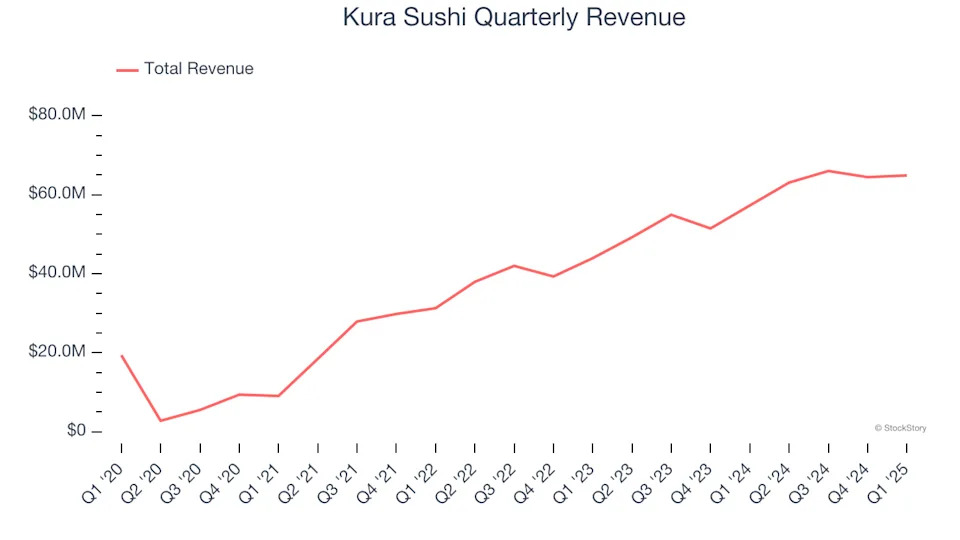

As you can see below, Kura Sushi’s 28.7% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Kura Sushi’s year-on-year revenue growth was 13.3%, and its $64.89 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 17.9% over the next 12 months, a deceleration versus the last six years. Still, this projection is healthy and implies the market is forecasting success for its menu offerings.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

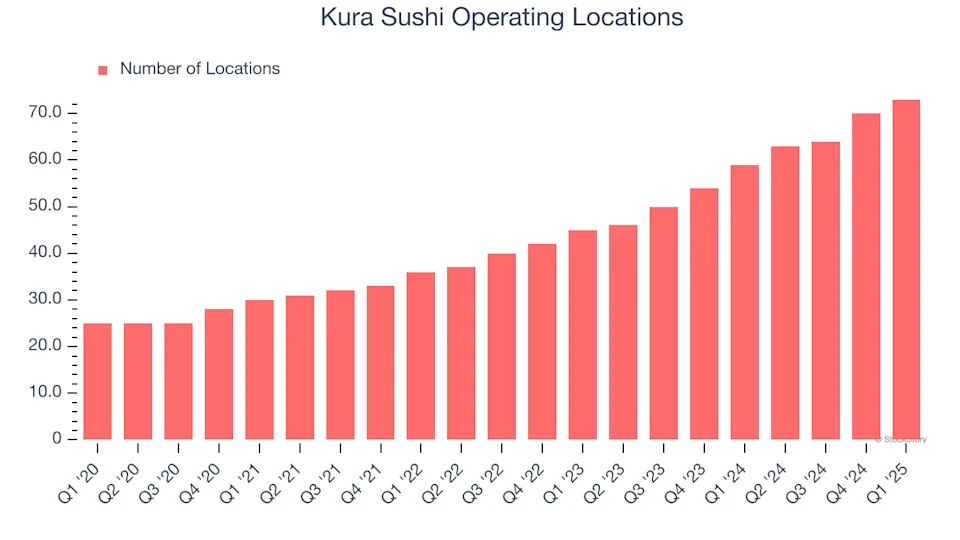

Kura Sushi operated 73 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 28.4% annual growth, much faster than the broader restaurant sector. This gives it a chance to scale into a mid-sized business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

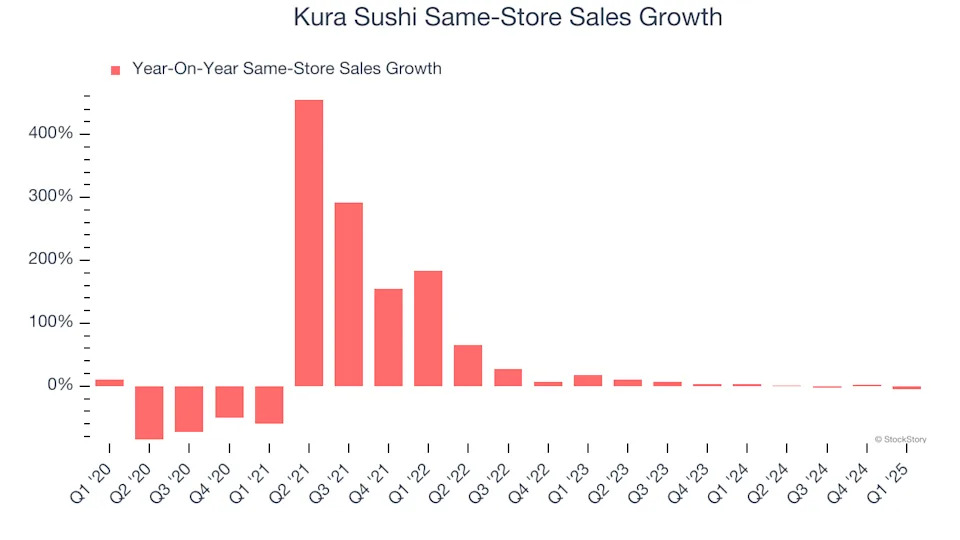

Kura Sushi’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2.2% per year. This performance gives it the confidence to meaningfully expand its restaurant base.

In the latest quarter, Kura Sushi’s same-store sales fell by 5.3% year on year. This decline was a reversal from its historical levels.

Key Takeaways from Kura Sushi’s Q1 Results

We struggled to find many positives in these results. Its EBITDA missed significantly and its same-store sales fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.3% to $40 immediately following the results.

Kura Sushi’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .