News

3 Reasons to Sell GPC and 1 Stock to Buy Instead

Genuine Parts has gotten torched over the last six months - since October 2024, its stock price has dropped 22.6% to a new 52-week low of $103.50 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Genuine Parts, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even though the stock has become cheaper, we're swiping left on Genuine Parts for now. Here are three reasons why we avoid GPC and a stock we'd rather own.

Why Is Genuine Parts Not Exciting?

Largely targeting the professional customer, Genuine Parts (NYSE:GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

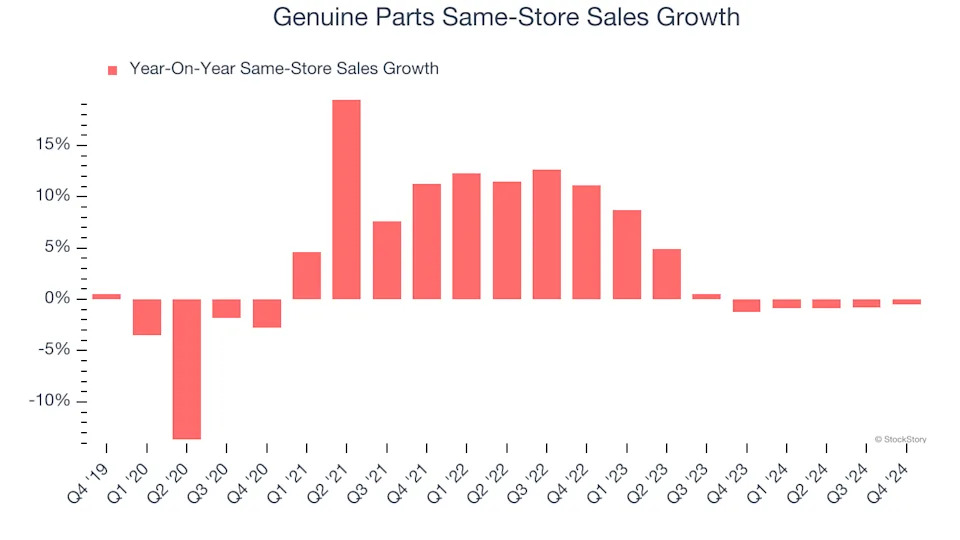

1. Same-Store Sales Falling Behind Peers

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Genuine Parts’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.2% per year.

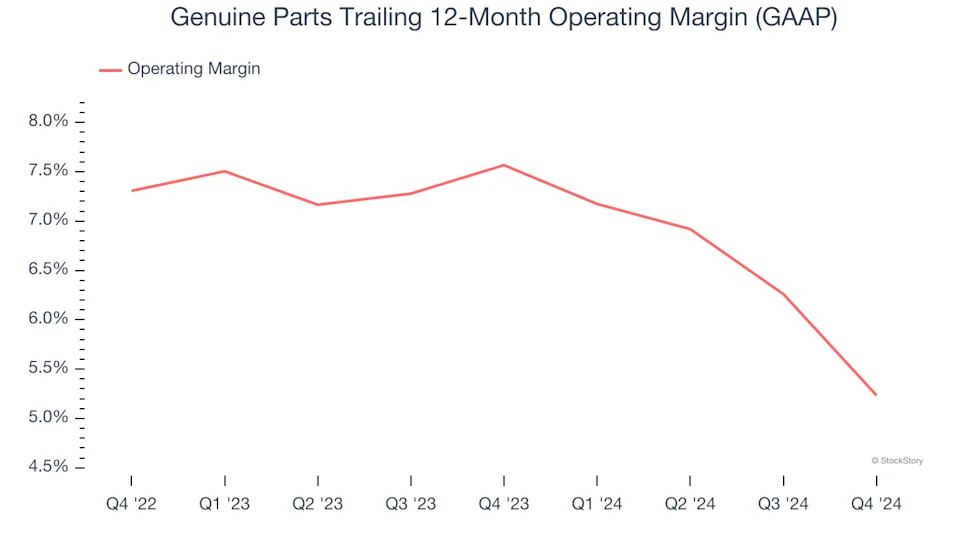

2. Shrinking Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Genuine Parts’s operating margin decreased by 2.3 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Genuine Parts’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers. Its operating margin for the trailing 12 months was 5.2%.

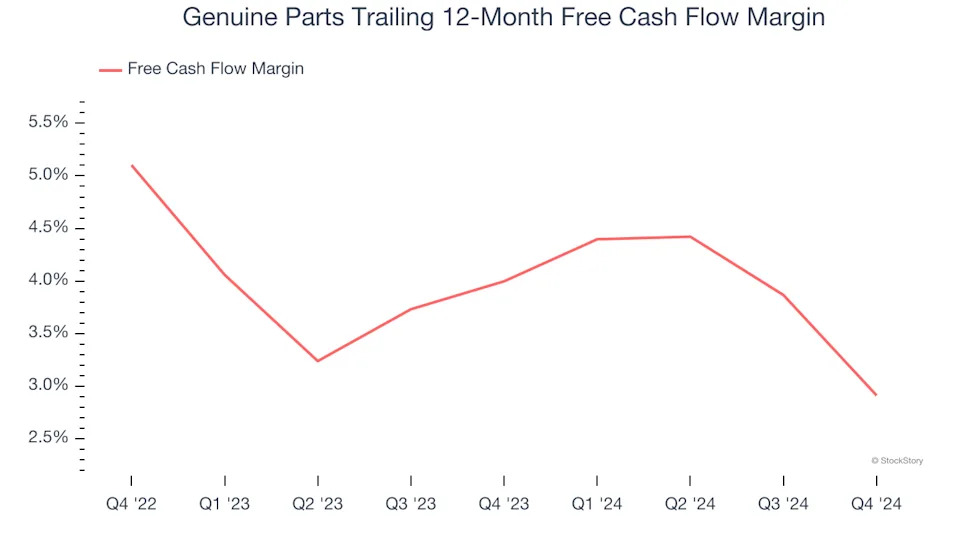

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Genuine Parts’s margin dropped by 1.1 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Final Judgment

Genuine Parts isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 12.9× forward price-to-earnings (or $103.50 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses .

Stocks We Like More Than Genuine Parts

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week . This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free .