News

Sales And Marketing Software Stocks Q4 Recap: Benchmarking Sprout Social (NASDAQ:SPT)

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the sales and marketing software stocks, including Sprout Social (NASDAQ:SPT) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 29.6% since the latest earnings results.

Sprout Social (NASDAQ:SPT)

Founded by Justyn Howard and Aaron Rankin in 2010, Sprout Social (NASDAQ:SPT) provides a software as a service platform that companies can use to schedule and respond to posts on major social media networks like Twitter, Facebook, Instagram, Youtube and LinkedIn.

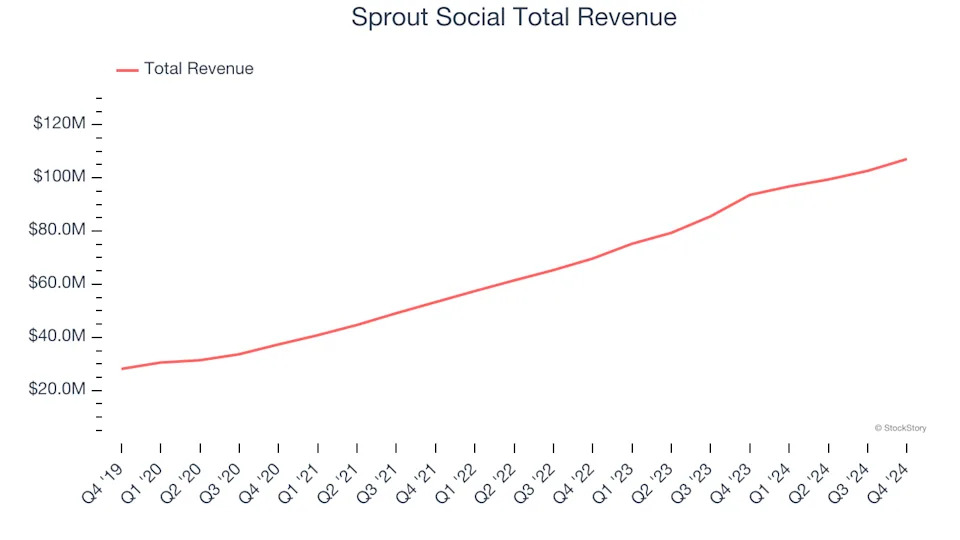

Sprout Social reported revenues of $107.1 million, up 14.4% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ billings estimates.

“The Sprout team delivered a solid fourth quarter, driving 14% revenue growth and 26% growth in cRPO, laying the foundation for future growth in 2025 and beyond. As we work to define the future of social media management, we remain focused on execution—winning the enterprise, driving customer health, expanding our partnership ecosystem, and driving deeper engagement in our customer base,” said Ryan Barretto, CEO.

The stock is down 38.6% since reporting and currently trades at $16.76.

Is now the time to buy Sprout Social? Access our full analysis of the earnings results here, it’s free .

Best Q4: Yext (NYSE:YEXT)

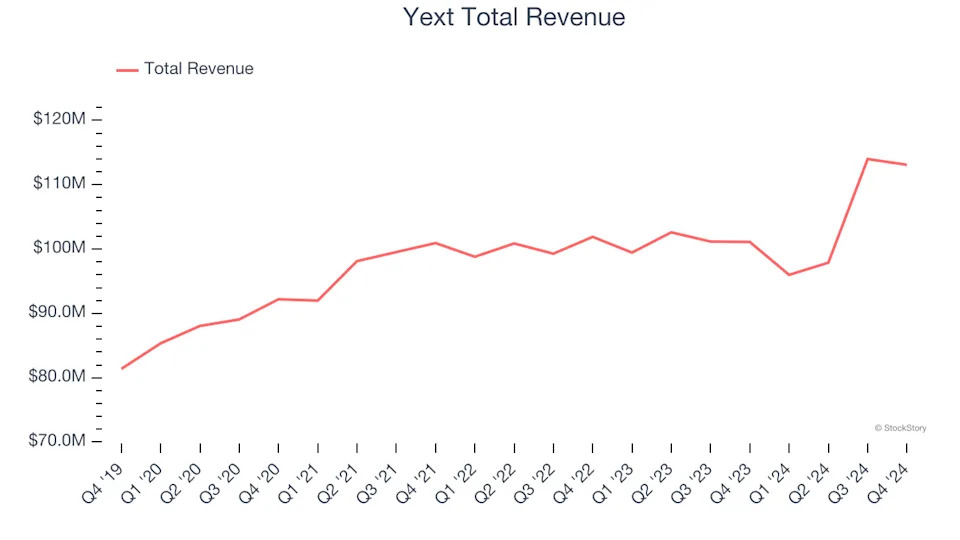

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Yext reported revenues of $113.1 million, up 11.9% year on year, in line with analysts’ expectations. The business had an exceptional quarter with an impressive beat of analysts’ annual recurring revenue estimates and a solid beat of analysts’ billings estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 14.5% since reporting. It currently trades at $5.61.

Is now the time to buy Yext? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: The Trade Desk (NASDAQ:TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ:TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

The Trade Desk reported revenues of $741 million, up 22.3% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted EBITDA guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 62.6% since the results and currently trades at $45.74.

Read our full analysis of The Trade Desk’s results here.

HubSpot (NYSE:HUBS)

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software-as-a-service platform that helps small and medium-sized businesses market themselves, sell, and get found on the internet.

HubSpot reported revenues of $703.2 million, up 20.8% year on year. This result beat analysts’ expectations by 4.4%. More broadly, it was a mixed quarter as it also produced an impressive beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations.

The company added 9,811 customers to reach a total of 247,939. The stock is down 38.1% since reporting and currently trades at $486.07.

Read our full, actionable report on HubSpot here, it’s free.

PubMatic (NASDAQ:PUBM)

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

PubMatic reported revenues of $85.5 million, up 1.1% year on year. This number came in 3.1% below analysts' expectations. It was a slower quarter as it also recorded EBITDA guidance for next quarter missing analysts’ expectations significantly and a poor net revenue retention rate.

PubMatic had the weakest performance against analyst estimates among its peers. The stock is down 41.7% since reporting and currently trades at $8.15.

Read our full, actionable report on PubMatic here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here .