News

FedEx, UPS lose parcel market share to big retailers, smaller couriers

Americans are shipping more parcels than ever, but traditional parcel carriers FedEx and UPS are losing market share to private fleets operated by online retailers and regional couriers, many of which have sprouted in recent years to meet e-commerce demand for last-mile delivery.

That’s the conclusion of a report on Thursday from ShipMatrix Inc., a parcel management, consulting and analytics firm with a strong history assessing industry trends.

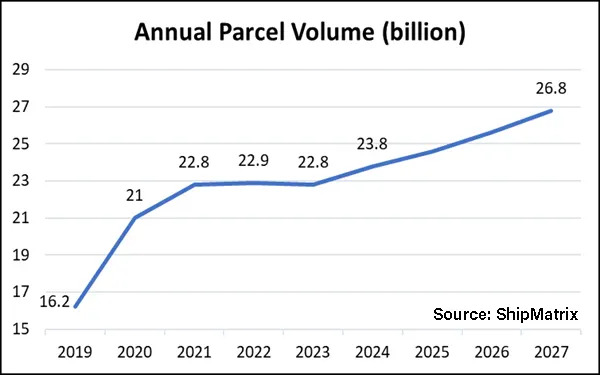

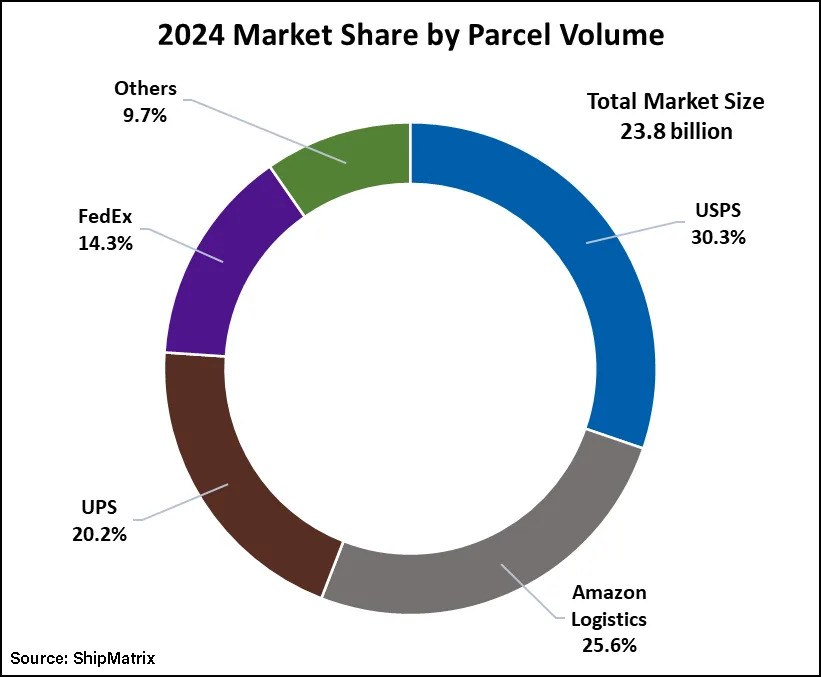

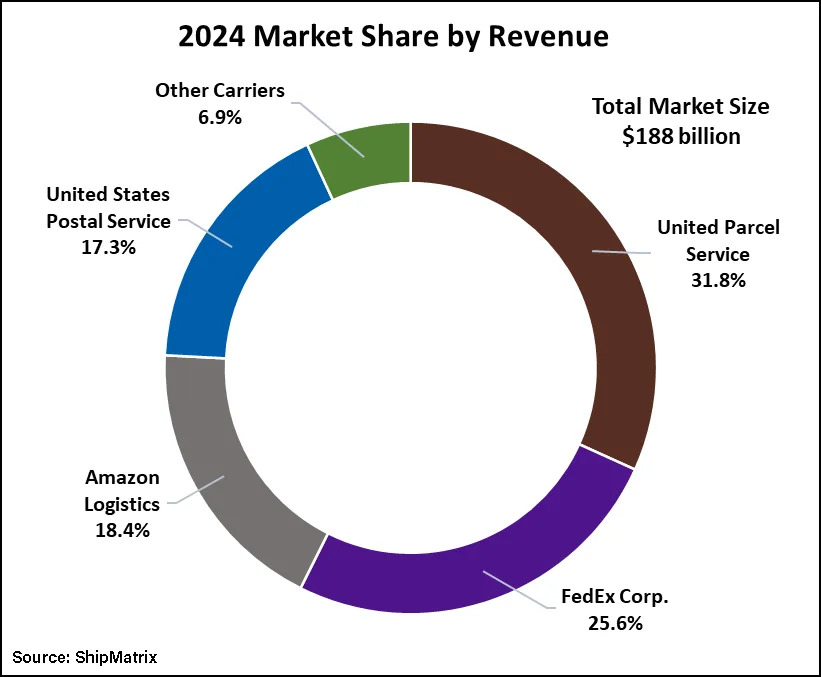

In 2024, parcel volumes reached an all-time high of 23.8 billion, up 4% from the prior year and 50% since 2019. Parcel delivery revenues grew 4.1% to $188 billion, with an average revenue of $8 per parcel.

ShipMatrix estimates U.S. parcel volume will grow at a compound annual rate of 4% over the next three years to 26.8 billion in 2027. “However, most of that growth will be handled by private networks of Amazon, Walmart and other retailers, resulting in a flat to negative growth for UPS, FedEx and USPS,” the report said.

FedEx ( NYSE: FDX ) and UPS ( NYSE: UPS ) face keen competition in parcel shipping from Amazon Logistics ( NASDAQ: AMZN ), Walmart ( NYSE: WMT ) and Target, as well as smaller, independent carriers such as OnTrac, Better Trucks, Jitsu, Veho, SpeedX and UniUni.

The growth of volume among companies that are, or were, the largest customers of FedEx, UPS and the U.S. Postal Service is the most dramatic market development in recent years and poses an ongoing risk to the legacy carriers, ShipMatrix said. Amazon dropped FedEx as a carrier five years ago. UPS said in January it will slash volumes it handles for Amazon by 50% over the next 18 months as it focuses on higher-yield freight.

Amazon delivered 6.1 billion packages in 2024 compared to 1.7 billion in 2019. Other carriers, led by Walmart, saw growth jump 44% year over year to 2.3 billion packages. The number of shipments for this cohort has nearly quadrupled from 600 million in 2019. UPS parcel volume of 4.8 billion was flat year over year, while FedEx recorded a marginal decrease to 3.4 billion packages.

Parcel industry revenue growth has normalized after spiking in 2021 and 2022 when consumers were reluctant to shop in person because of COVID and heavily relied on ordering goods from their computers or mobile devices. UPS led the way in revenue last year at $59.8 billion. Other carriers, excluding Amazon, FedEx and the Postal Service, experienced 48% revenue growth to $13 billion.

Walmart’s ability to fulfill orders from its stores and clubs has been a key driver of its e-commerce growth, CEO Doug McMillon said during an investor town hall on Wednesday. The retailer’s coverage of U.S. households with same-day delivery has grown by 22% during the past two years. The company can now provide same-day delivery to 93% of U.S. residences, up from 76% of households two years ago, he said.

Management said e-commerce represents 17% of the retailer’s total net sales and expects it to contribute 50% of topline growth over the next five years. The U.S. e-commerce business has turned a corner this quarter and the company now forecasts it to achieve profitability for the full year after, McMillon said.

In related news, Shipium, a shipping platform for e-commerce brands, has added UniUni to its carrier network, the last-mile logistics company announced on Tuesday.

ShipMatrix said it relied on company reports, regulatory filings and other data sources for its findings.

Fun facts from the ShipMatrix report:

l isch.

RELATED READING:

New UPS tool helps online shoppers calculate import fees before buying

FedEx offers lower cost no-box, no-label returns

FedEx says economic uncertainty slowing parcel and freight demand

The post FedEx, UPS lose parcel market share to big retailers, smaller couriers appeared first on FreightWaves .