News

How One of the Wildest Weeks in Market History Unfolded

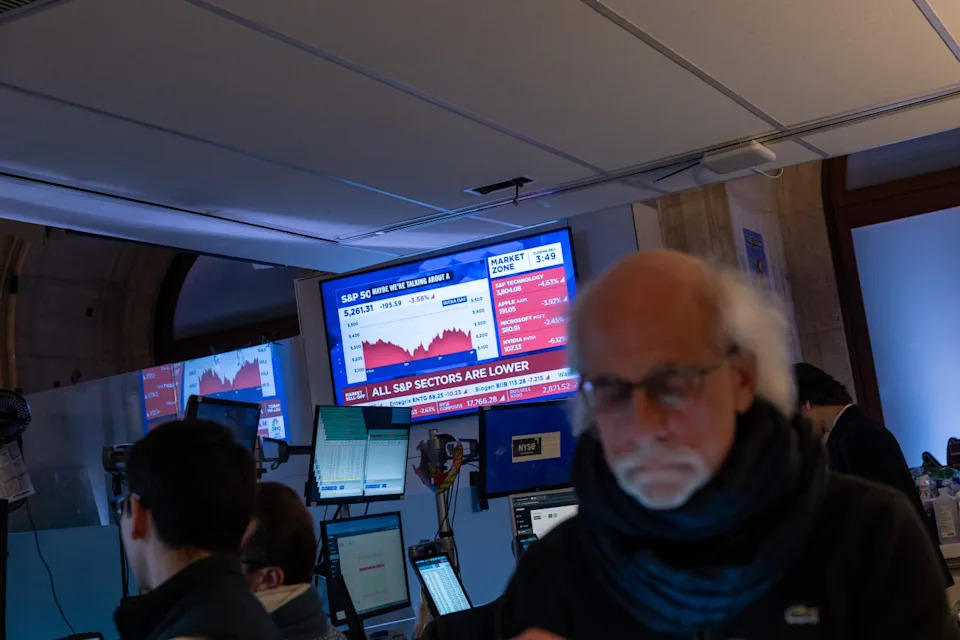

The biggest one-day rally since the financial crisis. The most volatile stretch since the Covid meltdown. A bond selloff that sent yields surging. A steep slide in the dollar. And rattled investors driving gold to new records.

Yet one of the most tumultuous weeks in years for financial markets ended with all three major U.S. indexes up 5% or more.

For Wall Street, it was a bruising run. Traders described scenes of tension, where the rapid surges and dives made it difficult to determine the prices of various investments. And the sheer violence of the moves left many exhausted and bracing for more trouble ahead.

With the Dow Jones Industrial Average ending Friday on a 600-plus point gain, Jed Ellerbroek, portfolio manager at Argent Capital Management in St. Louis, said the declines earlier this week and last had clients calling to ask whether or not to buy more shares. Meanwhile, he grew concerned watching individual investors pumping more money than usual into big stock funds.

Such investors might be expecting a scenario like the 2020 Covid crash, which was short-lived and led to an epic rally. They might have forgotten how stocks fell more than 50% in the 2008 crash and took years to recoup the losses, Ellerbroek said.

“That leaves me feeling like this downturn probably has more to go,” he said.

The S&P 500 rose 1.8% on Friday to end the week up 5.7%. The tech heavy Nasdaq Composite increased 2.1%, for a weekly gain of 7.3%. The blue-chip Dow added 1.6% Friday to lift its weekly rise to 5%.

All three indexes remain below where they were trading when President Trump launched his tariff blitz last week from the White House Rose Garden. All three are down on the year.

The volatility began last week after Trump shocked investors, economists, business leaders and trade partners with a barrage of tariffs that were far steeper than anyone expected. A four-day selloff ensued, but it was Wednesday when the wild ride peaked.

A sharp climb in Treasury yields was alarming investors ahead of the opening bell Wednesday when Trump took to social media to say that it was “ a great time to buy .” By the day’s end, U.S. stocks had staged a historic rally after another online post from the president announced a 90-day pause on some tariffs and signaled a willingness to negotiate on trade.

The result was a surge so extreme that investors said it echoed prior incidents in which stocks rallied sharply in times of stress, only to tumble to steeper losses.

The Nasdaq gained more than 12% Wednesday for its biggest climb since January 2001, during a short-lived bounce in the dot.com bust. The S&P 500 added 9.5% for its best day since October 2008. The Dow’s 7.9% climb on Wednesday was its biggest daily gain in percentage terms since March 2020, when traders bid up shares before that April’s collapse.

Much of Wednesday’s gains were reversed Thursday as Trump further escalated economic conflict with China and it became clear on Wall Street that the trade war was far from over.

Friday also began on a down note, after the University of Michigan’s closely watched gauge of consumer sentiment nosedived from last month to register one of the weakest readings of the past decade on concerns about trade, employment and inflation.

But the declines didn’t last long. Solid first-quarter earnings from some of the country’s largest financial firms, including Morgan Stanley, JPMorgan Chase and BlackRock, offered a tailwind even as their executives warned that Trump’s trade restrictions put the economy at risk.

JPMorgan shares rose 4%. BlackRock and Morgan Stanley gained 2.3% and 1.4%, respectively.

Rising bond yields left investors newly worried about the country’s massive federal budget deficit, its dependence on foreign funding and its growing reliance on hedge funds, which have bought U.S. Treasurys with large amounts of debt. All of these challenges contributed to an aggressive selloff in Treasurys that only modestly slowed after Trump’s announcement.

The yield on the 10-year Treasury, a key reference for borrowing costs throughout the economy, posted its biggest one-week surge since November 2001—climbing half a percentage point to just under 4.5%. The yield on the 30-year bond had its sharpest weekly climb since April 1987, ending Friday at 4.873%.

The sight of stock and bond prices falling sharply in unison unnerved many investors, raising fears of a potential breakdown in the normal functioning of Treasurys, which are typically a haven in turbulent markets.

As prices of Treasurys plunged so too did the value of the dollar, with traders favoring other currencies such as the euro. Foreign central banks hold dollars in part because they like investing in Treasurys, which are typically easier to buy and sell than the bonds issued by other governments.

“The price action seemed nearly impossible,” said Michael Lorizio, a Treasurys trader at Manulife Investment Management. “It seemed like there was something I was missing.”

Many investors sought refuge instead in gold . Futures rose 2.1% to settle at a new all-time high of $3,222.20 a troy ounce, lifting mining stocks. Freeport-McMoRan added 6.4%. Newmont climbed 7.9% on Friday for a weekly gain of 24%.

Prices for oil, copper and other commodities also increased Friday, though they have been as volatile as stocks lately. Benchmark U.S. oil futures added $1.43 a barrel Friday to settle at $61.50. That is down 0.8% on the week but 14% lower this month.

Prices that low threaten the domestic oil industry’s ability to drill new wells profitably. But the declines in crude, as well as diesel and gasoline prices, has sent big fuel consumers, like fishing fleets and trucking firms, rushing to cap their prices with futures trades, said Charlie Macnamara, head of commodities at U.S. Bank.

“People are locking in those prices,” he said. “They’re trying to just go with certainty over chaos.”

Write to Ryan Dezember at ryan.dezember@wsj.com and Sam Goldfarb at sam.goldfarb@wsj.com