News

Trump has unleashed chaos – but stock prices are defying gravity

In most quarters, the writing is already on the wall for the US economy .

Jamie Dimon, JP Morgan’s boss, has said that a recession is “likely”, while Larry Fink, his counterpart at BlackRock, has warned that the downturn may have already begun .

Such gloomy forecasts emerged after Donald Trump unleashed his global trade war, as many fear the US president’s tariffs will hammer growth and sting households.

However, even after trillions of dollars were wiped off stock markets, Wall Street is not running for cover just yet.

In fact, traders are gambling on the prospect of vast profits – even despite Trump’s outlandish and erratic policy announcements.

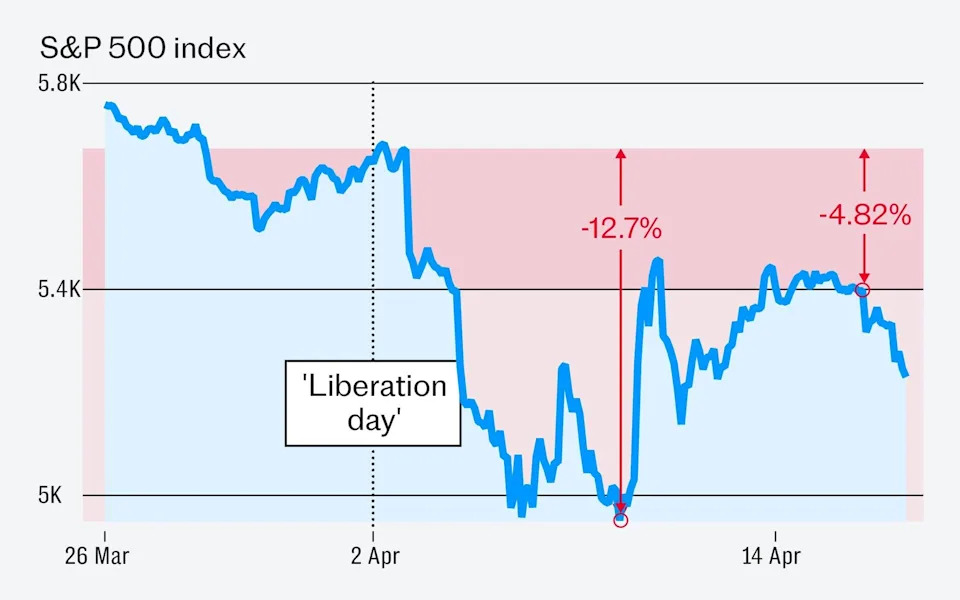

Since the S&P 500 plunged by more than 12pc in the aftermath of Trump’s “liberation day” tariffs announcement, Wall Street’s benchmark stock index has rebounded by nearly 8pc.

Even as Federal Reserve chair Jerome Powell warned that US tariffs risked stoking inflation and slowing growth, investors could not resist a chance to buy stocks. By the end of trading on Wednesday, the S&P 500 turned a decline of as much as 3.3pc into a drop of 2.2pc.

The FTSE 100 , which dropped by more than 10pc after Liberation Day, has since rallied to a 2.4pc loss over that period.

“You have to go back to 2022 to find valuations as attractive as they are today,” says Rory McPherson, chief investment officer at financial advisory Wren Sterling.

Stocks that appeared too expensive before Trump’s return to the White House have since become an enticing prospect once again, he said.

The so-called “magnificent seven” stocks – including the likes of Apple, Tesla and Nvidia – had offered returns of more than 270pc over the last two years, raising questions about how high they could go.

However, McPherson claims the recent sell-off has led to them now boasting “fair valuations”.

“I think markets are in a good position,” he said.

The key turning point for stocks came when Trump announced a 90-day pause on his most aggressive tariffs last week, signalling the first major climbdown in his trade war.

The S&P 500 has surged by 9pc since then, while the FTSE 100 has climbed more than 7pc.

Goldman Sachs said its monitors of market stress levels “have improved somewhat from peak stress last week”.

One of the key drivers of the return to relative calm has come from bond markets.

After returning to the White House, Trump tasked himself with bringing down the 10-year US Treasury bond yield, which is a key benchmark for the cost of government borrowing.

That yield dropped from more than 4.5pc to less than 4pc in the weeks after his January inauguration, indicating a significant victory for the president amid efforts to tackle a federal debt pile of more than $36 trillion .

However, this progress was nearly wiped out during the 10-year bond’s worst sell-off since 2001, as his sweeping tariffs fuelled fears of a financial crisis.

Pressure continued to build until Trump announced his 90-day tariff suspension.

“The reassuring thing for investors is that it showed that Trump does have a master, and that’s the bond market,” says McPherson.

“His debt service costs are directly related to that bond yield. And I think it’s reassuring for markets to see that he does respond to that, because he certainly hadn’t been responding to the equity market.”

Credit: Reuters

The rally in stocks also comes as Wall Street enters its first quarter corporate earnings season, kicked off by its biggest banks.

In a boost to confidence levels – JPMorgan Chase, Goldman Sachs, Morgan Stanley, Bank of America and Citigroup – achieved their best combined trading performance in more than a decade, as they capitalised on the turmoil in financial markets.

Trading revenues surged between them to nearly $37bn (£28bn), with all five banks announcing record performances for their stock trading desks.

Jane Fraser, Citigroup chief executive, said: “When all is said and done, and longstanding trade imbalances and other structural shifts are behind us, the US will still be the world’s leading economy, and the dollar will remain the reserve currency. ”

In an effort to build confidence, Trump has also bombarded his social media followers with messages to hang tough, at times controversially.

Democrat leaders have demanded an investigation into whether Trump enabled insider trading before his tariff reversal after posting “THIS IS A GREAT TIME TO BUY” on his Truth Social platform earlier that day.

However, recent economic figures have also raised hopes among investors. US inflation fell further than expected in March from 2.8pc to 2.4pc, prompting Trump to post to his 9.6m followers: “Just out: “INFLATION IS DOWN!!!”

This has led markets to predict that the US Federal Reserve, the central bank of the global reserve currency, will cut interest rates at least three more times this year.

Anna Leach, chief economist at the Institute of Directors, said: “We may see more interest rate cuts than previously expected this year, which would provide some welcome support to the economy.”

Traders could also be banking on an improvement in the global trading environment before the 90-day US tariff suspension is over, particularly after the White House said it is locked in talks with about 75 countries.

Mohit Kumar, chief Europe economist at investment bank Jefferies, is hopeful.

He predicts that Trump will strike agreements in the coming weeks. Japan, South Korea, India and the UK are all at the front of the queue.

He said: “In the near term, we see US administration’s objective function as trying to score easy wins by agreeing to deals with a number of countries, while trying to isolate China.”

If such an outcome appears likely, expect stock markets to keep defying gravity.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month with unlimited access to our award-winning website, exclusive app, money-saving offers and more.