News

U.S. Onshore Oil Production Faces Economic Policy Challenges

US oil and gas operators have encountered an avalanche of economic policy changes from the Trump administration over the last week, creating market uncertainty in an already maturing industry. Rystad Energy expects onshore Lower-48 production will fall short of the record high output of 11.37 million barrels per day (bpd) of oil, achieved in November 2023, until at least June of this year. However, this outlook faces serious downside pressure should the recent price downturn hold, forcing operators to cut back on rig activity.

Consistent returns are top of mind for US producers looking to squeeze as many dollars as possible out of their barrels. For these tight oil players, decreased reinvestment rates result from fewer growth-oriented private players on the market along with their continued focus on disciplined spending and modest growth. Existing capital frameworks will be put to the test over the coming quarters, should President Trump’s tariff strategy lead to an economic recession and, by extension, oil demand destruction.

US oil operators face both significant subsurface and above ground risks as they plan their capital investment programs. While most oil plays are seeing deteriorating normalized productivity, US producers must also compete on a global market to meet an uncertain but likely decelerating demand outlook.

Matthew Bernstein, Vice President, North America Oil and Gas Research, Rystad Energy

Read the full Rystad Energy Shale Trends whitepaper here .

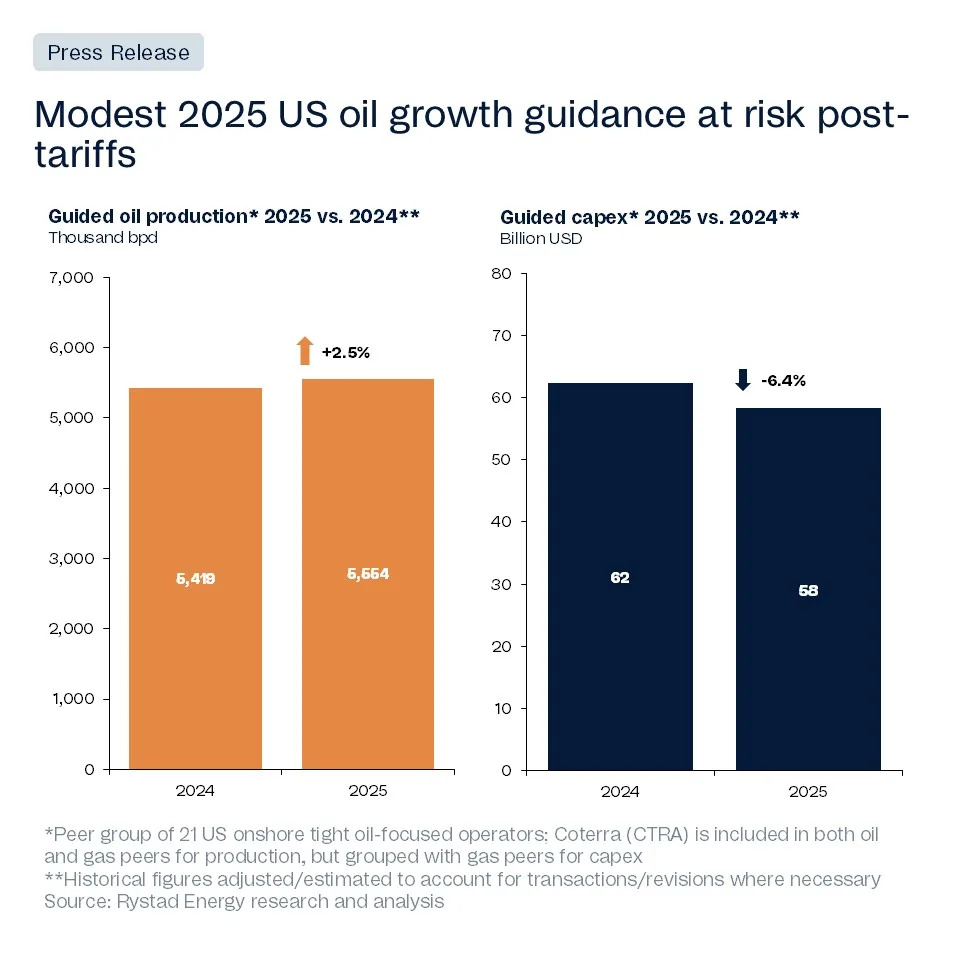

Even prior to the drop in prices following the president’s tariff rollout, exploration and production (E&P) management teams worried about policy unpredictability. Publicly traded firms guided plans to increase volumes by roughly 2.5% in 2025 while reducing spending by more than 6%. Much of this growth, which is now at risk due to the collapse in prices, is driven by some of the largest diversified public players and supermajors, capable of diverting cash flows from global operations to fund more growth-oriented programs in US tight oil, while still maintaining capital discipline at a corporate level. Although half-cycle breakeven prices of most wells being drilled today are in the $50 per barrel range, we estimate that public, tight oil E&Ps need more than another $9 per barrel to cover shareholder returns.

Rystad Energy has long maintained that presidents have very few supply-oriented policy measures at their disposal to increase US oil output. Doing this while also bringing down prices at the same time is even more unrealistic, as producers see WTI in the $70 per barrel range as supportive of only modest growth

Matthew Bernstein, Vice President, North America Oil and Gas Research, Rystad Energy

E&P executives also stressed the negative impact from steel tariffs on their cost structure and the extent to which higher input costs make it even harder to grow volumes in a soft oil market. However, relative to the price drop caused by the onset of tariffs, Rystad Energy sees the tariffs themselves as only having a minimal net impact on well costs.

Currently, we expect about 300,000 bpd of exit-to-exit growth in 2025, all in the Permian—a concentration that presents another risk. Permian natural gas prices remain weak, and our projections show that dry gas production in the basin has little or no growth potential in 2025.

By Rystad Energy

More Top Reads From Oilprice.com

Read this article on OilPrice.com