News

Netflix’s (NASDAQ:NFLX) Q1 Earnings Results: Revenue In Line With Expectations But Full-Year Sales Guidance Slightly Misses Expectations

Streaming video giant Netflix (NASDAQ: NFLX) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 12.5% year on year to $10.54 billion. The company expects next quarter’s revenue to be around $11.04 billion, slightly above analysts’ estimates. Its GAAP profit of $6.61 per share was 16.8% above analysts’ consensus estimates.

Is now the time to buy Netflix? Find out in our full research report .

Netflix (NFLX) Q1 CY2025 Highlights:

Company Overview

Launched by Reed Hastings as a DVD mail rental company until its famous pivot to streaming in 2007, Netflix (NASDAQ: NFLX) is a pioneering streaming content platform.

Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Sales Growth

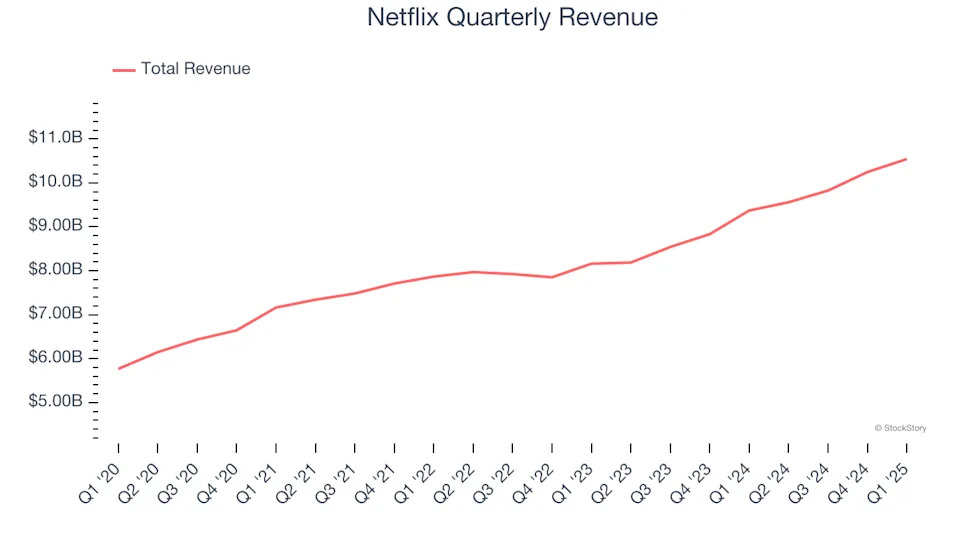

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Netflix grew its sales at a mediocre 9.7% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer internet sector, but there are still things to like about Netflix.

This quarter, Netflix’s year-on-year revenue growth was 12.5%, and its $10.54 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 15.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months, an acceleration versus the last three years. This projection is particularly healthy for a company of its scale and suggests its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

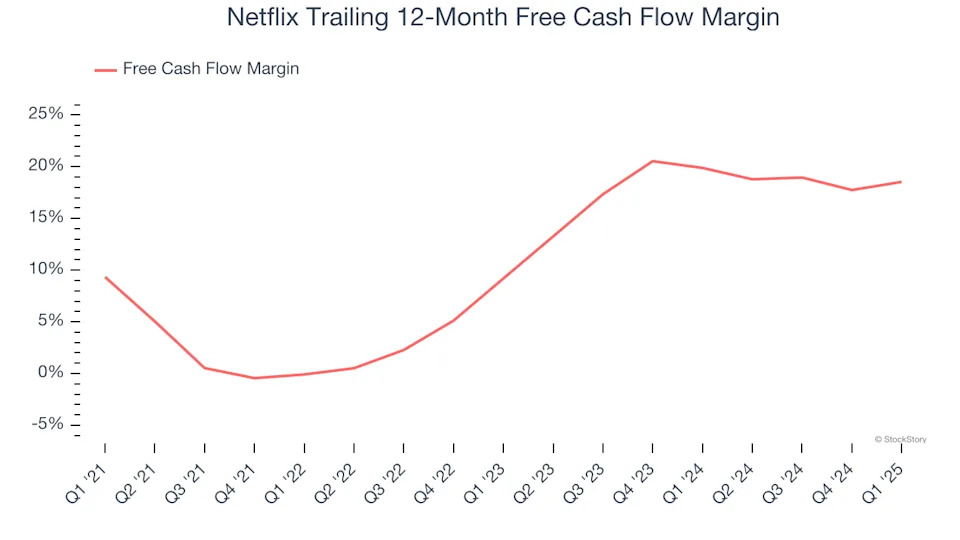

Netflix has shown robust cash profitability, driven by its cost-effective customer acquisition strategy that enables it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 19.2% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Netflix’s margin expanded by 18.6 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Netflix’s free cash flow clocked in at $2.66 billion in Q1, equivalent to a 25.2% margin. This result was good as its margin was 2.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from Netflix’s Q1 Results

We were impressed by Netflix’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad this quarter's EPS exceeded Wall Street’s estimates. On the other hand, its full-year revenue guidance slightly missed, but next quarter's guidance was slightly above. Given the macro uncertainty with President Trump's tariffs, the market likely weighed the shorter-term guidance higher. Overall, this quarter had some key positives. The stock traded up 2.1% to $995.31 immediately following the results.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free .