News

The US stock market’s tariff exposure is about to be laid bare

(Bloomberg) — President Donald Trump’s raft of tariffs is set to expose just how vulnerable the US stock market is to a trade war.

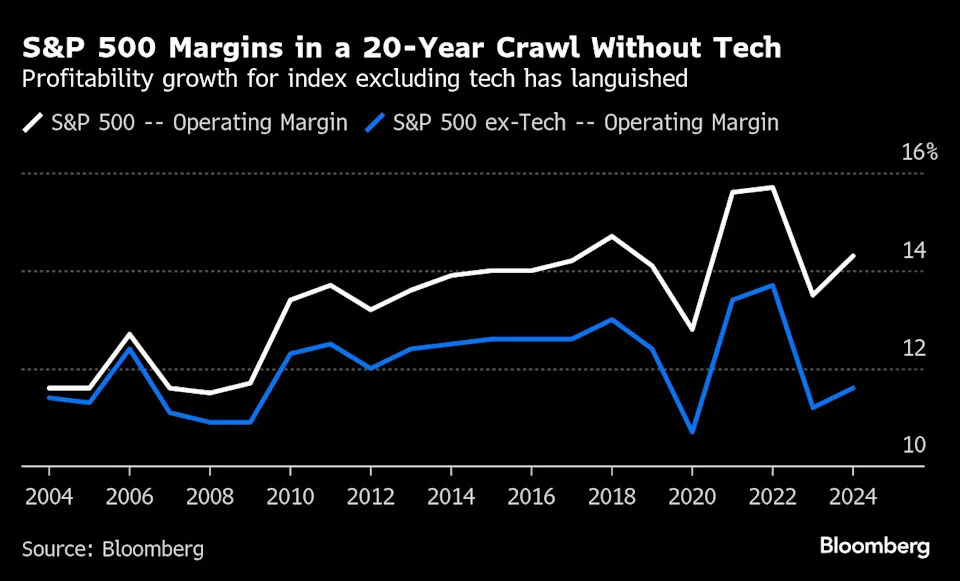

The track record of S&P 500 ( ^GSPC ) Index companies over the past two decades suggests their ability to withstand additional levies is fragile, at least by one measure. Nearly all of the margin growth eked out from corporate sales on the gauge since 2004 has come from the booming technology sector, according to Bloomberg Intelligence. Removing the group, profitability barely rose.

The consequences for the US economy and corporate profits from the proposed tariffs is one of the top concerns that investors have been grappling with this month. The first-quarter earnings season so far has shown that companies themselves are unsure of the fallout, further adding to the angst.

“Not only is the S&P 500’s ability to absorb the tariff shock weaker than it appears, I would argue that because of tech, the index is also more vulnerable to tariffs,” said Paul Nolte, market strategist and senior wealth manager at Murphy & Sylvest Wealth Management.

Before the Bell: China Mulls Some Exemptions, Stocks Set to Rise

While Trump and his administration are currently in talks with more than 50 countries, the average tariff rate stands at around 22.8% and could go as high as 32.6% depending on how negotiations resolve, Bloomberg Economics estimates. Such high levies are likely to be extremely disruptive for American businesses, raising their costs and squeezing profitability.

Thin Cushion

The unremarkable expansion of operating margins across the rest of the S&P 500 over the past two decades means, if tariffs turn into a major headwind, the majority of the remaining US companies in the index barely have any cushion left to absorb the impact and grow further.

S&P 500 companies are estimated by BI to have an operating margin of 16.4% in 2025, which drops to 13.5% when excluding technology, though the estimates likely don’t yet reflect the full impact of the potential new trade regime. The tech sector by itself is estimated to generate a margin of 34.1% this year.

“There was a reason why the mega-cap tech stocks were dominating the rally in 2023 and 2024 — they were making huge profits, while almost everybody else was floundering,” said Matt Maley, chief strategist at Miller Tabak + Co.

Maley sees more reason for caution with overall earnings estimates for the year being reined in. Analysts now estimate 2025 profits for the S&P 500 will rise 7.9%, down from an expectation of nearly 13% growth at the beginning of the year, data compiled by BI show.

“If the one area that was still driving increases losses steam, it’s going to catch a lot of investors off guard, even after this outsized decline,” Maley said, pointing to the recent selloff ignited by Trump’s tariffs on the country’s trade partners on April 2.

It’s a wake-up call for investors who have been enjoying the tremendous run in US stocks over the past few years, driven largely by technology companies. The group now wields a massive influence on the overall S&P 500 given its market-cap weighted composition.

Technology stocks themselves are also highly susceptible to declines in share prices given their still-steep valuations and risk dragging down the overall gauge, given the sector’s hefty weighting.

“Tariffs will hinder the benchmark’s largest earnings growth engine,” said Michael O’Rourke, chief market strategist at JonesTrading. “Tech will likely be the source of the largest margin drag within the index.”