News

Short-seller blasts Super Micro stock in latest report

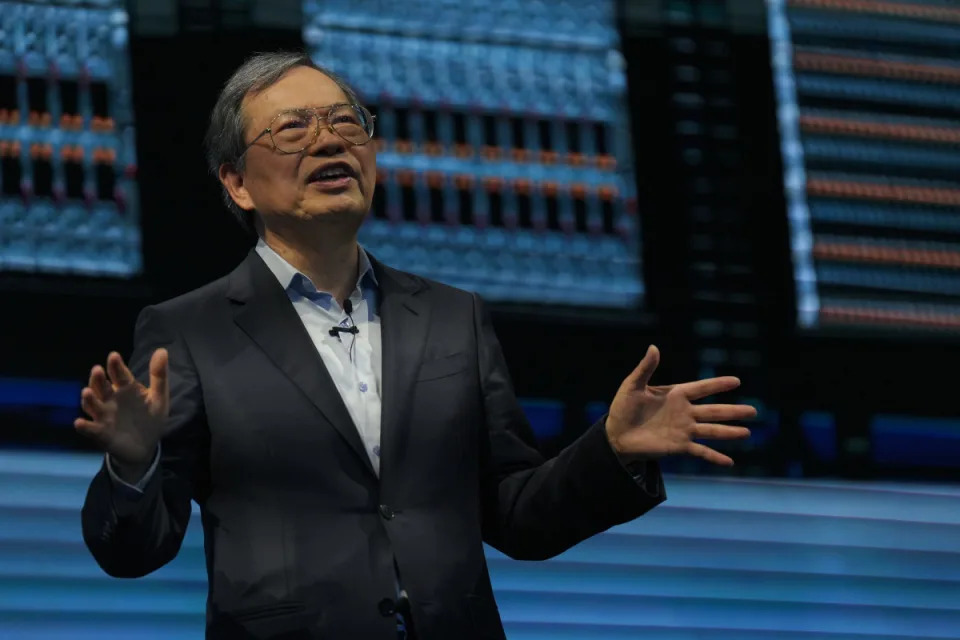

If there's one thing about Charles Liang, he likes to aim high.

The CEO and co-founder of Super Micro Computer ( SMCI ) believes his business, which specializes in high-end servers, is "well positioned to become the largest IT infrastructure company."

Related: Analysts overhaul Super Micro stock price targets after Q4 earnings

"For 30 years, we have been digitally building our company strength and foundation," Liang told analysts during the company's fourth-quarter earnings call on Aug. 8.

"As the only US-based scale AI platform designer and manufacturer, we have been shipping out winning products involving in volumes in volume to our partners for more than a quarter of a century," he added.

The company, which announced a 10-for-1 stock split, fell short of Wall Street’s earnings estimates. While revenue more than doubled to $5.31 billion, the company's margins fell as costs rose.

Nevertheless, Liang concluded his comments by saying, "Super Micro is in a great position to continue our growth momentum with our leading AI portfolio, our infrastructure readiness, and our ability to deliver products in a timely manner."

Shares of the company, which was added to the S&P 500 in March and Nasdaq in July, tumbled following the earnings report.

Several analysts adjusted their Super Micro Computer stock price targets and ratings, including Bank of America Securities’ Ruplu Bhattacharya who downgraded the company to neutral from buy and slashed his price target to $700 from $1,090, according to The Fly .

Turns out, they're not the only ones unimpressed.

SOPA Images/Getty Images

Hindenburg short report cites 'glaring accounting red flags'

Bhattacharya said that he saw the next several quarters remaining challenging in terms of margin as Super Micro navigates a competitive pricing environment, delayed shipment of Nvidia ( NVDA ) Blackwell GPU systems that require higher margin liquid-cooled racks, and ongoing issues with component availability.

Related: AI-stock darling to join Nasdaq-100

He also noted that valuation multiples across the sector have re-rated "meaningfully lower."

Those downbeat comments are nothing compared to what another research firm is saying.

Super Micro shares fell on Aug. 27 after short-seller Hindenburg Research released a scathing report on the San Jose, CA-based company,

Following a three-month investigation, Hindenburg said that it “found glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

"All told, we believe Super Micro is a serial recidivist," the firm said in its report. "It benefitted as an early mover but still faces significant accounting, governance, and compliance issues and offers an inferior product and service now being eroded away by more credible competition."

The report, which the company said included interviews with former senior employees and industry experts and a review of litigation records, international corporate and customs records, cited evidence of "accounting manipulation, sibling self-dealing and sanctions evasion."

Hindenburg noted that in 2018, SuperMicro was temporarily delisted from Nasdaq for failing to file financial statements.

By August 2020, the Securities and Exchange Commission charged the company with “widespread accounting violations,” mainly related to more than $200 million in improperly recognized revenue and understated expenses, which resulted in artificially elevated sales, earnings, and profit margins.

"Less than 3 months after paying a $17.5 million SEC settlement, Super Micro began re-hiring top executives that were directly involved in the accounting scandal, per litigation records and interviews with former employees," the report said.

A former salesperson told Hindenburg that “almost all of them are back. Almost all of the people that were let go that were the cause of this malfeasance.”

In another instance, a former salesperson described pushing products to distributors based on made-up demand forecasts, completing a partial shipment, and then later coming up with an excuse for why the rest didn’t happen.

The report said that disclosed and undisclosed related parties pose accounting risks relating to revenue recognition and reported margins.

A former executive told Hindenburg that “basically it’s a governance issue and just kind of shows you that Charles doesn’t give a shit what you think…you’re right to worry, though, that you just never know what’s lurking.”

"We found that Super Micro’s relationships with both disclosed and undisclosed related parties serve as fertile ground for dubious accounting,” the report said.

Market technician: 'buyer beware'

Disclosed related party suppliers Ablecom and Compuware, controlled by Liang’s brothers, have been paid $983 million in the last three years. Ablecom is also partly owned by Liang and his wife.

Meanwhile, exports of SuperMicro’s high-tech components to Russia have spiked roughly three times since the invasion of Ukraine in 2022, apparently violating U.S. export bans, according to Hindenburg’s review of more than 45,000 import and export transactions.

More AI Stocks:

Almost two-thirds of Super Micro’s exports to Russia since the invasion correspond to “high priority” components that the Russian military may be diverting to the battlefield, per U.S. government warnings, the report said.

Super Micro did not respond to requests for comments. Shares were off 2.7% to $18.66 at last check and SuperMicro shares are down nearly 40% year-to-date.

TheStreet Pro’s Bruce Kamich, who has used technical analysis to evaluate stocks for fifty years, had warned investors to “keep your powder dry” months ago regarding SuperMicro. Now, he says the company's stock price has been on a downward trend since reaching a high in March, and indications are "that sellers of SMCI have been more active than buyers."

“I see a setup that suggests we are going to see weaker prices in the weeks ahead,” he said. “Prices are trading below the cresting 40-week moving average line.”

Kamich said that he has “no special insights about the Hindenburg Research report on SMCI,” but noted that “the trend of price has been for several months now, and I don't see the conditions for a bottom.”

“Buyer beware,” he said.

Hindenburg Research is famous for its short reports

Hindenburg Research has a history of taking on corporate targets.

Last year, Hindenburg charged that Icahn Enterprises ( IEP ) had been using inflated asset valuations, citing “Ponzi-like economic structures” at the holding company and alleging that activist investor and billionaire Carl Icahn had used money from new investors to pay out dividends to old ones.

Icahn and his company entered into a $2 million settlement with the SEC. The regulator charged the famed corporate raider with neglecting to disclose the big loans he took out, using Icahn Enterprises shares as collateral.

Hindenburg accused Swiss tech company Temenos ( TMSNY ) of accounting irregularities and earnings manipulation.

In a 2021 report entitled “The Lordstown Motors Mirage,” Hindenburg said that the startup was "an electric vehicle SPAC with no revenue and no sellable product, which we believe has misled investors on both its demand and production capabilities.”

Lordstown Motors later filed for bankruptcy and emerged from its restructuring as Nu Ride in March.

Related: Veteran fund manager sees world of pain coming for stocks