News

Why Is Nvidia Stock Down After Reporting Parabolic Growth?

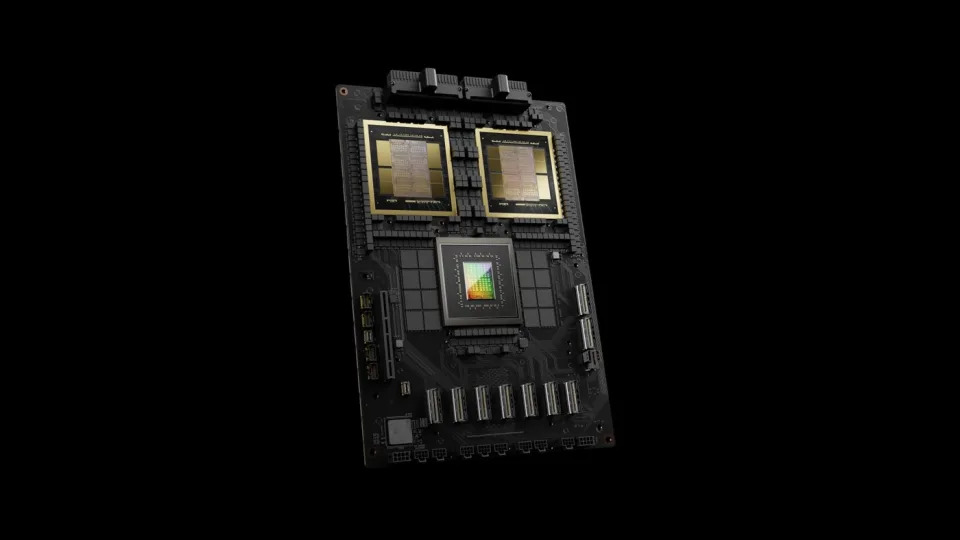

Expectations were high heading into Nvidia 's (NASDAQ: NVDA) fiscal 2025 second-quarter financial report. The company has become the de facto standard bearer for the artificial intelligence (AI) revolution. Its graphics processing units (GPUS) provide the computational horsepower necessary to create the large language models (LLMs) that make generative AI possible.

The surging demand for AI has propelled Nvidia's stock into the stratosphere. The stock has gained more than 150% so far this year and more than 750% since the accelerating adoption of AI kicked off early last year (as of this writing).

In recent weeks, however, investors have become concerned that Nvidia has simply come too far, too fast, and they are wondering whether the hectic pace of AI adoption could continue. Nvidia answered that question with a resounding "yes," but given the stock's parabolic gains, blockbuster results simply weren't enough.

By the numbers

In the second quarter, Nvidia generated record revenue of $30 billion, which surged 122% year over year and 15% quarter over quarter. This gave rise to adjusted earnings per share (EPS) of $0.68. The results sailed past analysts' consensus estimates for revenue of $28.6 billion and EPS of $0.64. Revenue also eclipsed management's forecast of $28 billion.

The headliner was Nvidia's data center segment -- which includes chips used for AI -- as revenue of $26.3 billion soared 154% year over year and 16% sequentially, fueled by strong AI adoption among cloud computing and hyperscale data center operators.

It wasn't just AI that fed Nvidia's growth, though the data center segment dwarfed results from the company's other segments (all segment gains year over year):

Nvidia's gross margin of 75.1% was up compared to 70.1% in the prior year quarter, largely due to the company's enormous pricing power. That said, the measure edged lower sequentially from 78.4% in Q1. The company had previously signaled margins would moderate throughout the remainder of the year. CFO Colette Kress cited inventory provisions for its Blackwell chips and product mix for the decline.

What the future holds

CEO Jensen Huang noted that demand for its current Hopper chip "remains strong," calling anticipation for its next-generation Blackwell architecture "incredible." He went on to note that in recent industry testing, Nvidia's Hopper H200 and the Blackwell B200 chips "swept" the MLPerf benchmark results for AI inference. Despite the best efforts of its rivals, Nvidia chips remain the gold standard for processing AI.

Media reports suggested that the new Blackwell chips might be delayed by as much as three months due to design flaws, but Nvidia put those fears to rest. "We shipped customer samples of our Blackwell architecture in the second quarter. We executed a change to the Blackwell GPU mask to improve production yield. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal 2026."

Another by-product of Nvidia's growth trajectory is the tremendous amount of cash the company is generating, as free cash flow more than doubled to $13.5 billion. As a result, Nvidia is increasing its returns to shareholders. The board of directors approved an additional $50 billion in share buybacks, adding to the $7.5 billion remaining on its existing authorization.

These factors have combined to fuel a robust outlook for the third quarter. Management is guiding for revenue of $32.5 billion, which would represent year-over-year growth of 80%. That's a deceleration from the triple-digit growth Nvidia has delivered in each of the past five quarters -- but investors have long known that growth of that magnitude couldn't continue indefinitely. Yet, the numbers show investors were seemingly disappointed.

Nvidia stock was down roughly 7% in after-hours trading (as of this writing,) but it's too early to tell what tomorrow will bring. Taking a step back, the company's results continue to defy the odds, but a deceleration in its parabolic growth rate was inevitable. Nvidia's star is still burning brightly, and the long-term investing thesis is intact.

Taken together, Nvidia's durable competitive advantage, strong results, and robust outlook show the company still has a long runway for growth ahead.

Before you buy stock in Nvidia, consider this: