News

The stock market chaos sparked by the yen last month could resume as rates rise in Japan, SocGen says

The stock market's chaotic yen carry trade unwind that fueled the worst sell-off in two years in August may not be over, according to Societe Generale.

The European bank pointed to the likelihood that Japan's central bank would continue to raise interest rates, a development that rocked markets in early August .

Investors panicked after the Japanese central bank issued a surprise rate hike in late July. The move sparked an unwind of the yen carry-trade, a popular strategy in which investors borrowed money at ultra-low rates in Japan to deploy in other assets, like US stocks.

The effects of that sell-off have subsided, with the major US indexes more than recovering their losses over the past month. But more turbulence could lay ahead as rates in Japan look poised to "normalize" after decades of deflation, according to SocGen global strategist Albert Edwards.

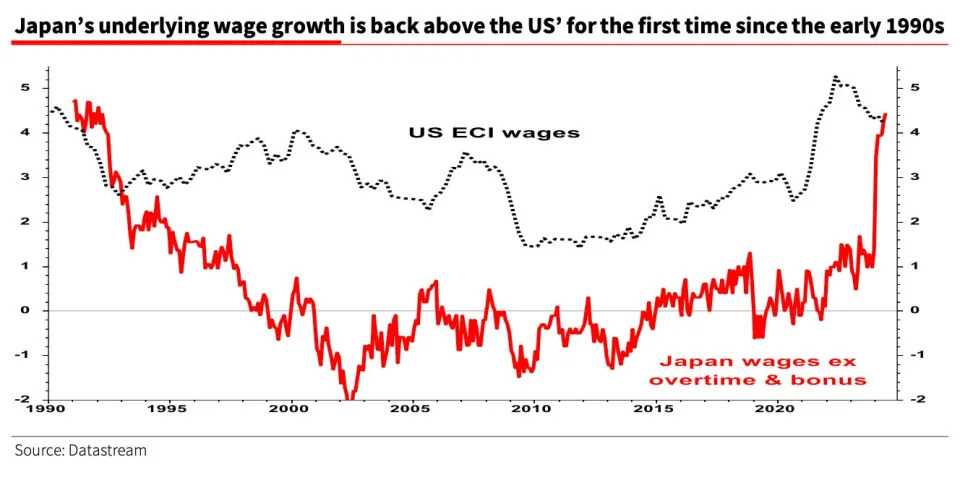

Japan's economy is also flashing promising signs that another rate increase is in order. Wage growth in Japan just surpassed wage growth in the US for the first time in over two decades, Edwards noted.

"We have always exhorted our readers to watch Japan closely as it has consistently been a forerunner of major market moves," Edwards said in a note to clients on Tuesday. "Any normalisation of Japanese interest rates would have a major market impact — not just in the short term (by unwinding the yen carry trade) but also in the longer term as higher Japanese interest rates would curtail the exporting of investment flows," he later added.

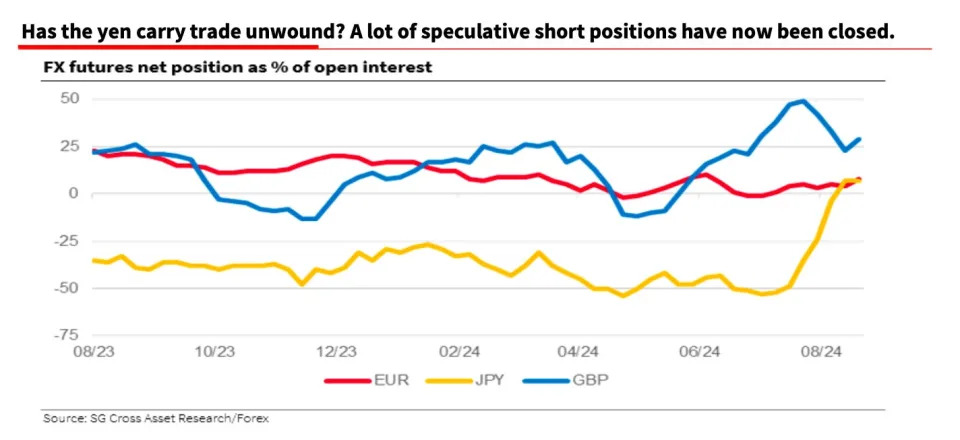

Some investors have already seized on that possibility, with a significant number of investors closing their short positions in the yen over the past few months. Net open interest rose in August, according to SocGen data, which indicates that most investors are no longer shorting the Japanese currency.

The US economic outlook, meanwhile, looks rocky, Edwards said, which could hurt US stocks. He pointed to softness in the US labor market over the past year and declining earnings optimism in the tech sector, which has accounted for the bulk of S&P 500 returns in recent years.

"Might the yen carry trade still have legs? We'll need to keep a close eye on the other side of the yen carry trade, where a tech price decline can also unwind the trade. We're watching falling US tech EPS optimism closely," Edwards added.

Edwards has been calling for a recession and a stock market crash in the US for months , even as many economists say that the economy generally remains on solid footing. GDP blew past expectations for the second quarter while inflation continued to cool. Hiring, meanwhile, remains positive, with the unemployment rate rising, but remaining close to multi-decade lows in July.

Read the original article on Business Insider