News

Traders keep half an eye on CPI as jobs fear outweighs inflation

(Bloomberg) — For two years since the Federal Reserve started its aggressive fight against inflation, equity traders have been glued to their screens on days when the consumer price index was reported.

But things should be different on Wednesday when the latest CPI print hits. Why? Because with inflation heading down toward the Fed’s target and the central bank getting ready to cut interest rates, the reading is less crucial for the stock market. Instead, it’s all about a weakening employment landscape and whether the central bank can avoid a hard landing.

“The pivotal question for stock investors is whether the Fed waited too long to cut rates because recession risks are higher now than just two months ago,” said Eric Diton, president and managing director of the Wealth Alliance. “All of the sudden, inflation is no longer the big issue.”

The S&P 500 Index ( ^GSPC ) is coming off its worst week since Silicon Valley Bank collapsed in March 2023 as Big Tech shares sank, led by Nvidia Corp.’s ( NVDA ) 14% plunge. Volatility also made a comeback, with the Cboe Volatility Index, or VIX ( ^VIX ), rising from 15 on Aug. 30 to a high of almost 24 on Sept. 6.

Options traders are betting on more of that, but less than what the market has come to expect on CPI day. As of Friday morning they’d priced in move of 0.85% in either direction for the S&P 500 on Wednesday. If realized, that would be among the smallest CPI-day moves this year, data compiled by Piper Sandler show.

On the flip-side, traders had priced an implied move of 1.1% for the S&P 500 heading into Friday’s soft jobs report. That’s among the highest this year on an absolute level and 83% above the average implied daily move in 2024, according to data compiled by Susquehanna International Group. And the broad equities benchmark still managed to outdo the forecast, falling 1.7%.

“Stocks have had a heck of a run this year,” Diton said. “So why not take some profits?”

Attitude adjustment

Basically, the market’s thinking has been transformed now that rate cuts are considered a given but the strength of the economy seems less secure.

Fed Chair Jerome Powell all but proclaimed victory in the fight against inflation during his comments at the central bank’s symposium at Jackson Hole, Wyoming, on Aug. 23. Since then, more policymakers like New York Fed President John Williams, Chicago Fed President Austan Goolsbee and Fed Governor Christopher Waller have all indicated that cuts are needed — it’s the size that’s up for debate.

Now the Fed is turning to the other side of its dual mandate, maintaining maximum employment. Friday’s jobs report showed nonfarm payrolls rose by 142,000 last month, putting the three-month average at the lowest level since mid-2020, according to the Bureau of Labor Statistics.

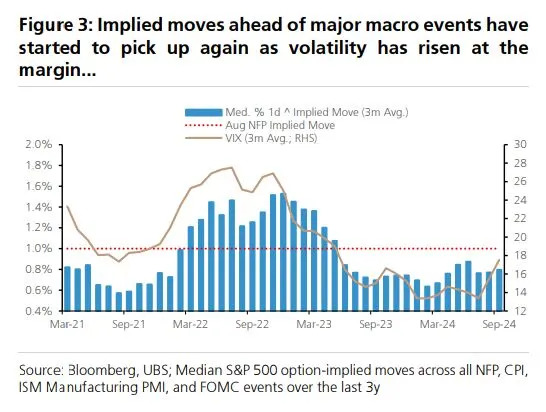

Looking ahead to the Fed’s Sept. 18 rate decision, swaps contracts are fully pricing in at least a quarter-point reduction. Meanwhile, implied moves ahead of major macro events tied to employment are picking up steam, with equity volatility metrics like skew remaining elevated as traders hedge for further downside risks for stocks, according to data compiled by UBS Group AG.

“Skew is signaling that there’s extra value in having downside protection for hedges,” said Rocky Fishman, founder of derivatives analytical firm Asym 500. “If things do end up disappointing from a macro perspective, the potential ride down for stocks may be more volatile this time around than previously thought.”

Investors have good reason to be more leery of employment figures than inflation data at this point. The S&P 500 posted its worst jobs day since 2022 last month, falling 1.8% on Aug. 2, a Friday, and another 3% on Aug. 5 off a weak labor report. Then, two weeks later, inflation figures came in broadly in line with estimates, and the S&P 500 rose just 0.4%, the smallest move for any CPI day since January.

Elevated risk

Traders are expecting higher volatility in the S&P 500 now, since out-of-the-money put options are in more demand relative to out-of-the-money calls, UBS data shows. Commodity trading advisers, or CTAs, which surf the momentum of asset prices through long and short bets in the futures market, see little room to add to their positions from here, according to UBS.

The VIX, which measures implied volatility of the benchmark U.S. equity futures via out-of-the-money options, is trading the low 20s, a level that doesn’t necessarily scream outright danger in an of itself. But it’s 52% above its average reading this year, and the volatility curve implies elevated risk for months to come.

With Fed officials in a quiet period ahead of their next policy decision, there won’t be any commentary before Sept. 18. However, the central bank’s latest Beige Book, which compiles information from business contacts in each of its 12 districts, revealed business contacts are more concerned about slowing growth than inflation. Still, there were no mentions of a “recession” and just 10 “inflation” references — a low for 2024, according to DataTrek Research.

While consensus expectations are for the US economy to remain sturdy, the Atlanta Fed’s GDPNow model shows some slowing, with a projection that third-quarter real GDP growth will climb to 2.1% annual rate, down from roughly 3% weeks ago.

It’s just one more signal that the Fed needs to cut rates before it’s too late to prevent a recession. If they don’t, investors who bid up stocks on expectations that policymakers will soon reduce borrowing costs may be forced to reckon with the old cliche, “Be careful what you wish for.”

This is particularly true if fear builds in the stock market that central bankers are failing to adequately fight an economic slowdown that will eventually hit corporate earnings, according to the Wealth Alliance’s Diton.

“Now everyone is watching every single data point on the economy and jobs,” he said. “If it continues to come in weak, there will continue to be more selling.”

—With assistance from Elena Popina.