News

Google just lost a big antitrust trial. Now it has to face another.

Google ( GOOG , GOOGL ) lost a landmark antitrust trial this week, and now it has to defend itself against another perilous antitrust challenge that could inflict more damage.

Starting in September, the tech giant will square off against federal prosecutors and a group of states claiming that Google abused its dominance of search advertising technology that is used to sell, buy, and broker advertising space online.

That trial scheduled to take place inside a federal courtroom in Norfolk, Va. starts roughly one month after a federal judge in Washington D.C., found that Google’s search and ad businesses violated antitrust law. Google intends to appeal that decision, which was handed down Monday .

Juggling simultaneous defenses "will definitely create a strain on its resources, productivity, and most importantly, attention at the most senior levels," said David Olson, associate professor at Boston College Law School.

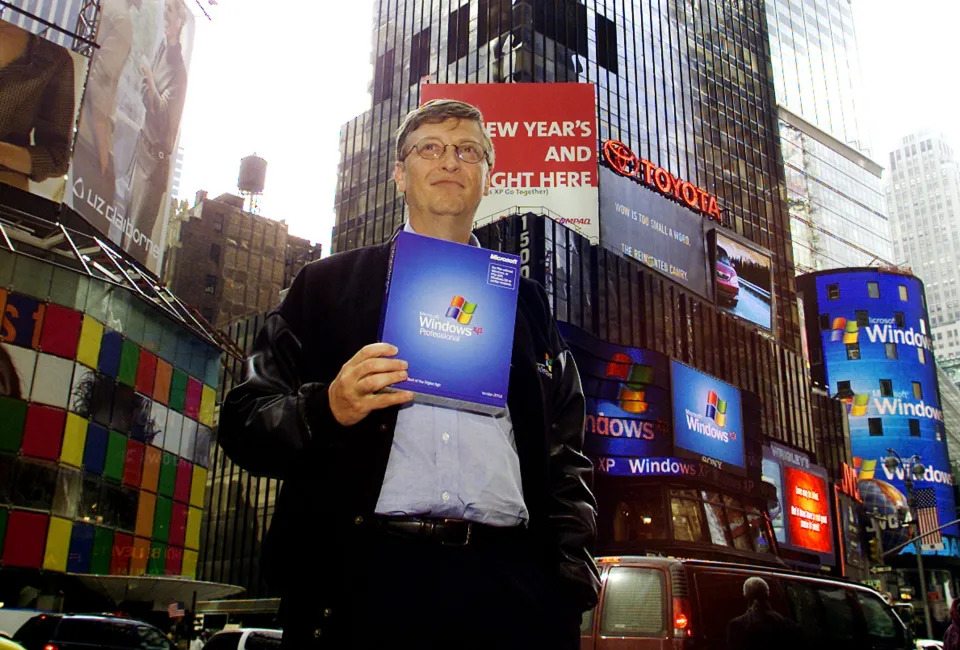

There could be parallels, Olson said, to what happened two decades ago to Microsoft ( MSFT ) after the US alleged that tech giant boxed out rivals by making its browser the default on its dominant Windows operating system.

That high-profile case in the 1990s resulted in a 2001 settlement that opened the door to broader competition in the internet browser software market.

Microsoft is widely considered to have lost its edge following protracted litigation with the DOJ, according to Olson, diverting attention from its core work and causing it to take a more risk-averse approach.

Its 2001 settlement — which required Microsoft to design its Windows operating system to interoperate with competing browsers — did create an opportunity for Google, then a startup formed by Stanford students Sergey Brin and Larry Page, to begin its period of meteoric growth in the 2000s.

The two cases targeting Google have the potential to inflict major damage to an empire amassed over the last two decades.

In the case decided this week, the government was able to successfully argue that Google broke the law as it became the dominant way most people searched for information on the web, abusing its power through contracts that secured its search engine as the default on computers and mobile devices.

The second case that begins next month began with a lawsuit filed in the US District Court for the Eastern District of Virginia by the Justice Department and eight states in December 2020, during former President Trump’s administration.

Prosecutors allege that since at least 2015 Google has thwarted meaningful competition and deterred innovation through its ownership of the entities and software that power the online advertising technology market.

Google owns most of the technology to buy, sell, and serve advertisements online.

Advertisers and publishers rely on Google’s suite of technologies — including its publisher ad server, DFT, also known as DoubleClick or GAM, and its ad exchange, ADX — to identify available opportunities for online ad placements and negotiate prices to buy and sell ads.

Google’s share of the US and global advertising markets — when measured either by revenue or impressions — exceeded 90% for "many years," according to the complaint.

The government prosecutors accused Google of siphoning off $0.35 of each advertising dollar that flowed through its ad tech tools.

The DOJ in its complaint even likened Google’s market position to a scenario where major banks also control the New York Stock Exchange.

"Because Google has such a powerful hand in each aspect of the ad tech industry, it alone has the power to use and deploy hidden levers to manipulate the overall system to its advantage," the complaint stated.

To stop Google's allegedly illegal conduct, the DOJ and states have asked a judge to force Google to divest certain ad tech entities.

At a minimum, the prosecutors want Google to divest its Ad Manager Suite, which would include its publisher ad server, DFT, and its ad exchange, ADX.

Alexis Keenan is a legal reporter for Yahoo Finance. Follow Alexis on X @alexiskweed .