News

The Anatomy of a Crypto Bull Market

Although crypto history is short, with Bitcoin celebrating its 15th birthday this year, we have already experienced three major cycles: 2011-2013, 2015-2017, and 2019-2021. The short cycle time is not surprising given the crypto market trades 24/7, about five times more than the equity market. The 2011-2013 cycle was predominantly about BTC, as ETH launched in 2015. Analyzing the past two cycles reveals patterns that help us understand the anatomy of a crypto bull market. With the market warming up to the U.S. election and improved liquidity outlook, history might rhyme again.

You're reading Crypto Long & Short , our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

BTC leads Altcoins into the Rally

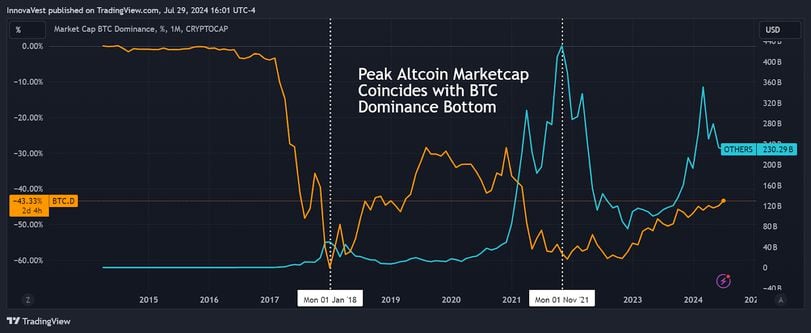

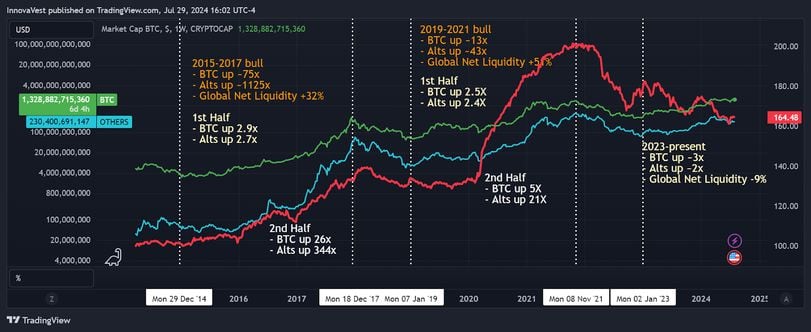

In both the 2015-2017 and 2019-2021 cycles, Bitcoin initially led the market surge, establishing confidence and setting the stage for a broader rally. As investor optimism grew, capital flowed into altcoins, driving a broad-based market rally. Altcoins’ market cap peaks often coincided with BTC’s market cap dominance bottom, indicating capital rotation from BTC to alts. Currently, BTC dominance is still climbing from the post-FTX low, suggesting more room for BTC to run before alts catch up.

Altcoins Significantly Outperform in Later Half of the Cycle

In both major cycles, altcoins significantly outperformed Bitcoin after an initial phase where their returns were comparable. This trend reflects investors' increased risk appetite and how reflexive the alts market can be with increased risk capital. In the second half of the 2015-2017 cycle, alts returned 344x versus BTC’s 26x. Similarly, in the second half of the 2019-2021 cycle, alts returned 16x versus BTC’s 5x. We are about halfway through the current cycle post-FTX, with alts slightly lagging behind BTC. This trend suggests a potential altcoin outperformance in the second half.

Macro Economic Influence

Crypto, like other risky assets, is highly correlated with global net liquidity conditions. In the past two cycles, global net liquidity increased by 30-50%. The recent Q2 selloff was partially driven by tightened liquidity conditions. However, as Q2 data confirmed a slowdown in inflation and growth, the trajectory for a Fed rate cut looks favorable.

The market now prices in a more than 95% chance of a rate cut in September, up from 50% at the beginning of Q3. Additionally, crypto policy is becoming central in the U.S. election, with Trump endorsing crypto, which may influence the new Democratic candidate. The past two cycles also overlapped with US elections and BTC halving events, adding to the rally potential.

Could This Time Be Different?

While history doesn’t repeat exactly, the rhyming nature of past cycles — initial Bitcoin dominance, subsequent altcoin outperformance, and macroeconomic influences—sets up for an altcoin rally. However, this time could be different. On the positive side, BTC and ETH have reached mainstream adoption through ETFs, with record inflows from retail investors and institutions.

On the cautious side, a larger and more diverse set of altcoins competes for investor capital, and many new projects have limited circulating supply due to airdrops, leading to future dilution. Only ecosystems with solid technology and the ability to attract builders and users may thrive in this cycle.