News

First Mover Americas: Crypto Market Stabilizes After Nursing Losses

This article originally appeared in First Mover , CoinDesk’s daily newsletter, putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day .

Latest Prices

Top Stories

The crypto market was little changed during the European morning, with the CoinDesk 20 Index (CD20) down by around 0.35%. Bitcoin dropped about 0.6% in 24 hours to around $66,000. The biggest gainer among crypto majors was XRP, which added more than 4.5% to over 64 cents. This is XRP's highest level since March 25 and comes amid a large scheduled token unlock and increased hopes for settlement of a long-running SEC-Ripple lawsuit . A Tuesday filing showed that the SEC intends to amend its complaint against crypto exchange Binance, including with respect to "Third Party Crypto Asset Securities," which traders are taking as a sign that the dispute could be coming to an end.

Spot ether ETFs snapped a four-day losing streak on Tuesday, recording a net $33 million of inflows on only the second day of positive flows since they listed on July 23. Ether ETFs have witnessed a cumulative net outflow of over $400 million. Grayscale’s ETHE has recorded the most losses at $1.84 billion, while BlackRock’s ETHA leads inflows at $618 million. The bitcoin equivalents, conversely, broke a four-day winning streak with $18 million of net outflows. SoSoValue data shows that Grayscale’s GBTC led outflows at $73 million. Products from Fidelity, Ark Invest, Bitwise, and VanEck saw outflows ranging from $2 million to $7 million. Blackrock’s IBIT was the only ETF that recorded inflows, adding nearly $75 million.

Nvidia is expected to see more significant price swings than bitcoin and ether . NVDA's 30-day options implied volatility, a gauge of anticipated price swings over four weeks, recently surged from an annualized 48% to 71%, according to Fintel. Deribit's bitcoin DVOL index, a measure of 30-day implied volatility, declined from 68% to 49%, according to charting platform TradingView. The ETH DVOL index fell from 70% to 55%. NVDA, a bellwether for AI, has emerged as a barometer of sentiment for both equity and crypto markets. Both bitcoin and NVDA bottomed out in late 2022 and have since exhibited a strong positive correlation. The correlation between 90-day prices on bitcoin and NVDA is currently 0.73.

Chart of the Day

-

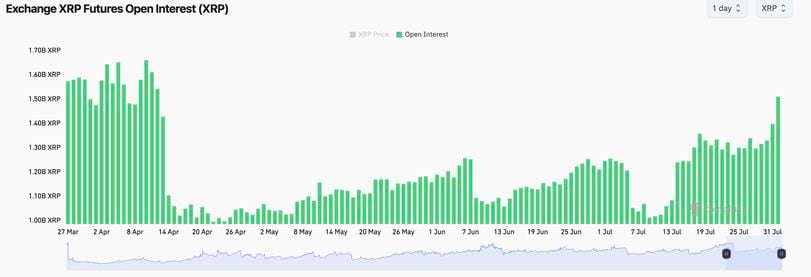

The number of active XRP perpetual futures contracts has surged to 1.5 billion XRP, the highest since April 20, and funding rates have been positive.

-

The increase shows rising demand for long positions or leveraged bets looking to profit from a price rally.

-

XRP has gained 34% this month.

- Omkar Godbole

Trending Posts

-

U.S. Strategic Bitcoin Reserve to Be Funded Partly by Revaluing Fed's Gold, Draft Bill Shows

-

Terra Blockchain Restarts After $4M Exploit

-

Anthony Pompliano: Bitcoin Will Be on U.S. Balance Sheet in 'Next 10, 15 Years' and Investing in Solana for Less Than a Dollar