News

Ether Down Over 7.5% as ETHE Outflows Ramp Up

-

Ether is down over $7.5% and is trading above $3,100.

-

Ether's decline comes as ETHE outflows continue and tech giant Nvidia trades in the red.

Ether (ETH) is down over 7.5% in the first hours of East Asia's business day, trading hands above $3,100 as the market continues to be concerned about outflows from Grayscale's converted Ethereum Trust ETF (ETHE).

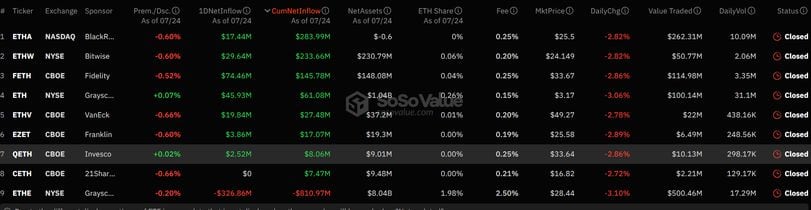

Market data from SoSoValue shows that ETHE had a net outflow of over $327 million on Wednesday, taking the total since inception to $800 million. This is similar to the first weeks of Grayscale other major crypto trust, GBTC, when it experienced heavy outflows during the first weeks of the bitcoin ETFs trading earlier this year.

Most of the other ETH ETFs continued in the green for flows during the Wednesday session, with BlackRock's ETHA leading the pack with $283.9 million for inflow, followed by Bitwise's ETHW, which registered $233.6 in inflow, and in third place Fidelity's FETH that clocked $145.7 million in inflow.

ETH is down 6% in the last month, but still up 72% in the last year.

Overall, Ether has outperformed the CoinDesk 20 (CD20), an index that tracks the largest digital assets, year-to-date, with the CD20 up 21.6% compared to ETH, which is up 35%.

ETH has continued to trade closely in line with Nvidia (NVDA), which is down over 6% today. Crypto prices have been strongly correlated with the chipmaker's stock for most of the year.

CORRECTION (July 25, 07:39 UTC): Corrects direction of ether's monthly move in fourth paragraph.

CORRECTION (July 25, 15:38 UTC): Corrects net outflows from Grayscale's Ethereum Trust ETF in subhead, second paragraph.