News

Narrow Boom: The Mismatch of Token Supply and Demand in the Current Cycle

The consensus used to be that a rising BTC price resulted in a trickle-down wealth effect for ETH, and eventually would spillover into the long tail of “altcoins” — an endearing term commonly used to describe all the other crypto assets outside the Big Two “majors.” We saw this dynamic play out last cycle. When BTC and ETH were up, so was everything else.

Right now, the majors feel more disconnected than ever from the rest of the market, especially BTC. Despite its ~130% rise over the last 12 months, we haven’t seen the “Everything Rally” many were anticipating by now.

We’ve seen small pockets of outperformance — Solana, AI, memecoins — but a majority of the crypto market has largely underperformed.

You're reading Crypto Long & Short , our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Dispersion has been the tale of the tape this cycle — and it may very well continue.

-

For context, during the 2017 cycle, the total crypto market cap grew from around $40 billion to nearly $740 billion (~18x). The market cap of “altcoins” went from essentially zero to over $400 billion — with 90% of that growth occurring in 2H 2017 alone.

-

In the 2020-2021 cycle, the total market grew from a base of ~$280 billion to nearly $2.8 trillion (~10x), while the market cap of “altcoins” surged from ~$70 billion to $1 trillion (~15x).

-

But this cycle, the total crypto market has barely grown 2x — and the market cap of “altcoins” has grown even less. Even at the market’s March 2024 peak, total altcoin market cap was still ~$200 billion short of its November 2021 prior high.

All markets are simply a function of supply and demand. Crypto markets have grown considerably over the last several years, but so too has the aggregate supply of new tokens, and the crypto market is currently suffering from a substantial supply-side imbalance.

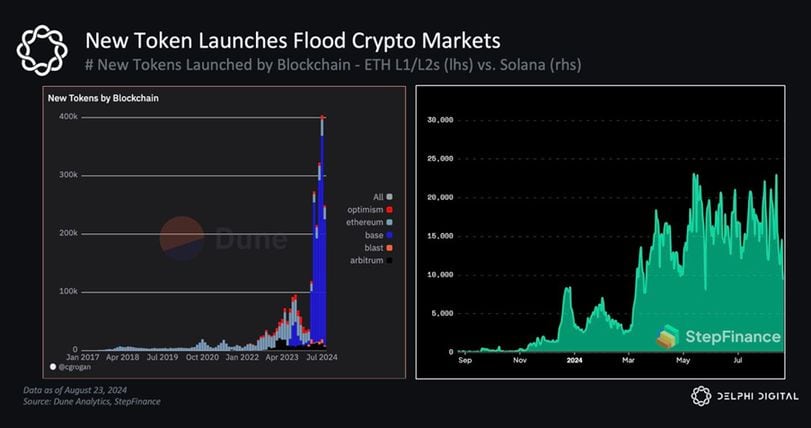

Today, the supply of new tokens is growing at the fastest pace this market has ever seen. The rise of DIY token launchpads (like pump.fun ) has sparked a surge in new tokens being launched, most of them memecoins.

At the same time, we’ve seen a growing number of token unlocks from large protocols and dApps start to flood the market, as vesting dates come due from the wave of VC investments a couple years ago. Private investment comes with the expectation of a return, and in crypto, that exit liquidity often comes in the form of selling tokens.

Meanwhile, we’ve seen a 50% year-over-year increase in the number of $1 billion market cap coins . More tokens at higher valuations means more capital is required to support their prices.

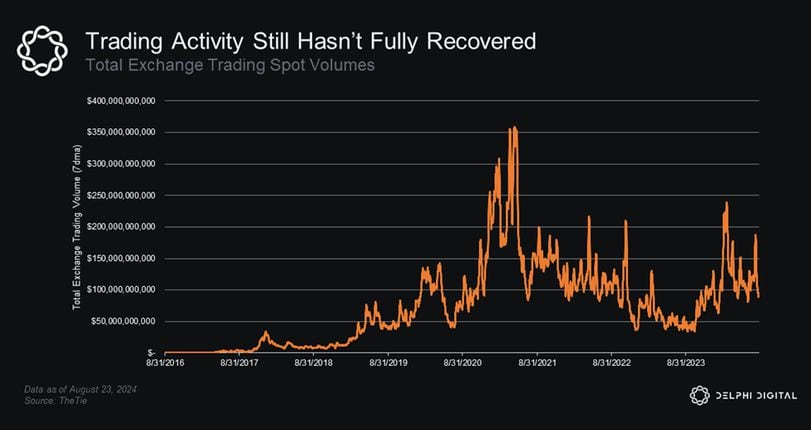

But so far and so far demand has not kept pace. For example, trading volumes on major exchanges have yet to recover back to last cycle’s prior highs.

Another major difference compared to last cycle is the lackluster growth in crypto credit and lending, which helped fuel the buying frenzy we saw in 2021. Crypto lending markets peaked in 2021-2022 amidst a backdrop of low interest rates and insatiable risk appetite. For context, Genesis’ loan book peaked in Q1 2022 at ~$15B after surging 62% year-over-year (total loan originations peaked at $50B the quarter before).

However, the collapse of many key institutional lenders (e.g. BlockFi, Celsius, Voyager, Genesis) hampered the speculative demand these same lenders helped fuel. Though we’ve started to see signs of a recovery, with new entrants like Coinbase’s institutional financing business, this area remains tepid compared to just a few years ago. In addition, today’s higher rate environment offers less incentive to move money on-chain into a choppy market, especially when the alternative is getting paid 5% on your cash or stablecoin holdings to wait and see.

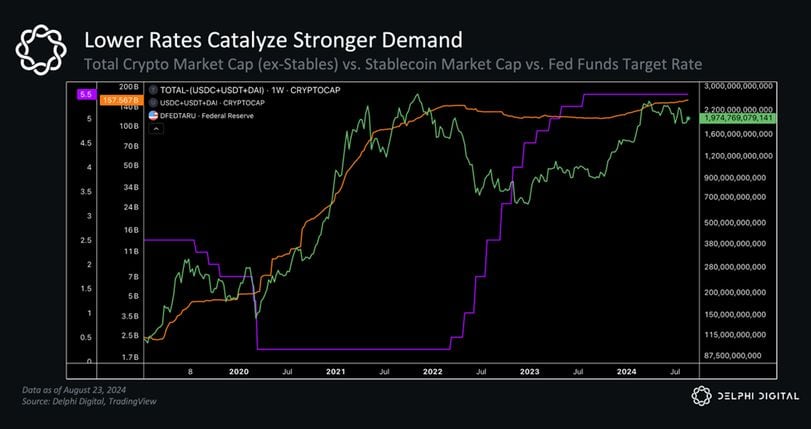

As the almighty Fed starts to cut rates — the market unanimously expects — we’d expect to see risk sentiment and credit conditions improve as the risk-reward of bringing capital on-chain turns more favorable. Lower rates can also reignite growth in total stablecoin market cap, which is a decent proxy for rising demand as on-chain activity picks up.

This could light a fire under demand that the crypto market desperately needs right now. Whether or not this will be the spark that ignites the “Everything Rally” many are hoping for though remains to be seen.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.