News

Bitcoin ETFs Log $250M Net Inflows, Highest Since July, After Rate Cut Signal at Jackson Hole

-

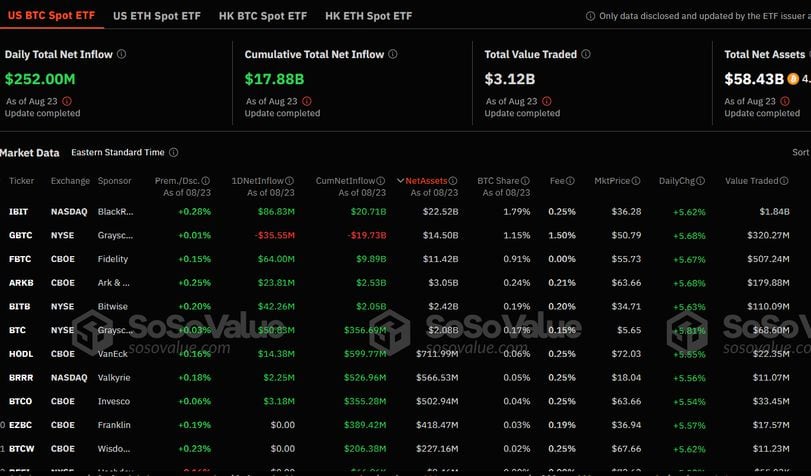

U.S.-listed spot bitcoin ETFs saw significant activity with over $252 million in net inflows and trading volumes exceeding $3.12 billion, driven by positive market sentiment following comments at the Jackson Hole symposium.

-

BlackRock's IBIT and Fidelity's FBTC led in inflows, while Grayscale's GBTC experienced outflows.

-

Federal Reserve Chair Jerome Powell's hints at loosening monetary policy at Jackson Hole led to a surge in bitcoin prices above $64,000, with expectations set for a potential rate cut at the next Fed meeting on September 17.

U.S.-listed spot bitcoin (BTC) exchange-traded funds (ETFs) recorded over $252 million daily net inflows on Friday, their highest level since July 23, as favorable comments at the Jackson Hole symposium buoyed risk assets, including bitcoin.

Trading volumes for the eleven ETFs crossed $3.12 billion to mark their highest level since July 19, SoSoValue data shows. BlackRock’s IBIT led trading activity and inflows at $1.2 billion and $83 million, respectively.

Fidelity’s FBTC was next with $64 million in inflows, while Bitwise’s BITB took in $42 million to cross the $2 billion AUM mark for the first time. Grayscale’s GBTC was the only product showing net outflows at $35 million. However, its mini bitcoin fund BTC was in the green with $50 million inflows.

Federal Reserve chair Jerome Powell confirmed signs that the public agency is set to loosen monetary policy at the Jackson Hole symposium on Friday, with bitcoin rallying above $64,000 afterward.

"The time has come for policy to adjust," Powell said in his speech. "The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

Crypto traders widely expect the Fed to deliver its first rate cut at its next policy meeting scheduled for September 17.

Tighter monetary policies typically dampen risk appetite in financial markets, while lower rates increase the allure of asset classes such as crypto as investors have cheaper access to capital pools.