News

The Fed’s Rate Cut Cushion Is Good News for Crypto

The Federal Reserve has plenty of room to start cutting interest rates.

Most investors don’t understand the real dynamic behind central bank interest-rate policies. But these drivers are key for setting the price of risk assets like cryptocurrencies and stocks higher and lower.

The consensus view of Wall Street is that the Federal Reserve will lower overnight borrowing costs from 5.33% today to 3.33% over the next 18 months. That means, it will cost less for households, businesses, and asset managers to borrow as money becomes more plentiful and readily available, and there will be more of it to invest.

The change will drive the value of assets priced in dollars, like bitcoin and ethereum higher. Let me explain.

Over the last few weeks, we’re seeing encouraging signs that our central bank can start lowering interest rates once more. The most important of these signals came out in mid-August, when the U.S. Bureau of Labor Statistics released its consumer price index (“CPI”) data for July. The numbers showed that inflation growth fell back below the 3% threshold for the first time since early 2021.

The shift was confirmed last week by Fed Chairman Jerome Powell. He said it’s time to start lowering interest rates, during a speech at the Kansas City Fed’s Annual EconomicSymposium in Jackson Hole, Wyoming. He noted inflation growth has slowed enough to allow for the change. He stated the return of supply chain normalcy and a rebound in labor supply have eased price pressures.

However, there’s a bigger factor at work. The real rate of interest has rebounded to levels not seen in almost two decades. The change tells our central bank it has a downside cushion to start cutting now. In other words, it can lower rates, still slow inflation, and support steady economic growth.

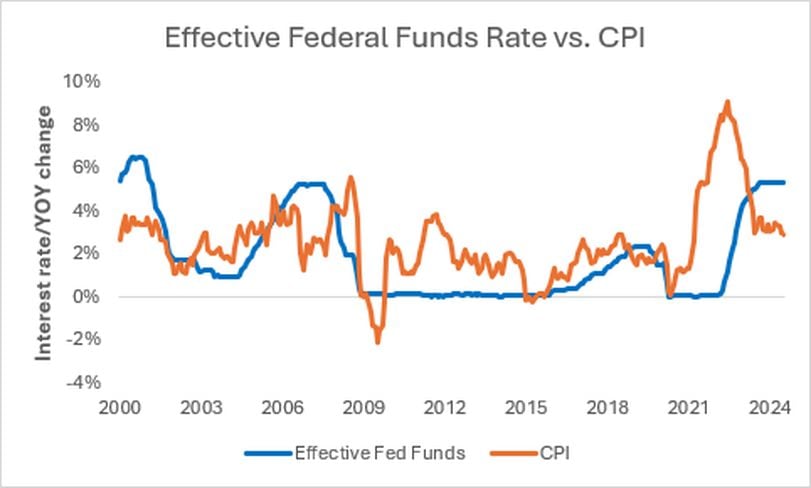

If you’re unfamiliar, the real rate of interest is a key gauge the Fed watches to see whether monetary policy is driving inflation higher or lower. Officials can see this by comparing the effective federal funds rate (the rate banks charge one another to borrow overnight) compared to CPI. If the difference is negative, policy is stimulating too much growth. And, if the spread is positive, it means rates are weighing on prices. Take a look here:

The chart above compares the effective fed funds rate (blue line) to CPI (orange line) since the year 2000. You’ll notice that during periods prior to rate cuts, the fed funds rate is typically above CPI. And, in periods prior to rate hikes, interest rates are below the pace of inflation growth.

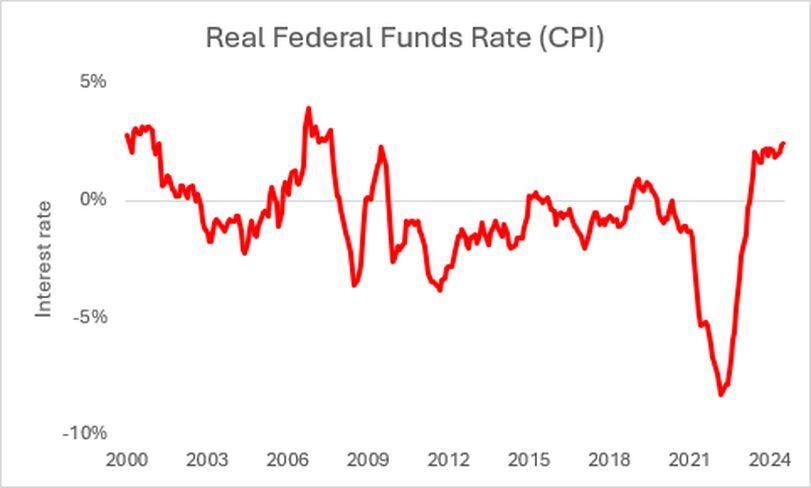

Now, to make it a little easier on the eye, I did the math on the two for you. I laid them out in the chart below.

The red line is the difference in the spread we discussed above. Notice to the far right, in June 2022, the real rate of interest was -8.3%. In other words, policy was so weak, it had no effect on prices. At the time, the effective fed funds rate was close to zero while inflation growth peaked at 9.1%. So, shortly thereafter, the Fed started a series of aggressive rate hikes to get price growth back under control.

If we look out to the far right of the above chart, we’ll notice the situation has greatly changed. After raising interest rates from 0% to a range of 5.3%, our central bank has changed the course of price growth. Since the peak made in June 2022 through this past July, CPI has dropped from 9.1% to 2.9%. In the process, the real rate of interest has jumped all the way back up to 2.4%. In other words, policy is weighing on prices.

Now, the real rate of interest hasn’t been this high since July 2007. That happened to be right before the Fed started cutting interest rates once more.

But how can we be sure that it can lower interest rates without stoking inflation growth once more?

Well, we can look at the average pace of CPI growth over the last six months, which happens to be 0.2%. We can then forecast what annualized growth will look like over the coming year based on the Bureau of Labor Statistics index data. Lastly, we can compare that to Wall Street’s implied federal funds rate for the coming year to see what the real rate of interest will look like.

As I mentioned at the start, money managers expect the Fed will cut rates rapidly. They’re anticipating the effective fed funds rate will fall from 5.3% today to as low as 3.7% by April 2025. That’s a massive shift in less than a year’s time.

However, inflation growth could also see a sharp drop over that same time frame. Based on the 0.2% average over the last six months, the annualized CPI rate could be at 1.9% when the April 2025 data is released. That would be the first time it’s below the Fed’s 2% target since February 2021.

More importantly, the changes mean the Fed could cut rates by 175 basis points over the next nine months, and still have a real interest rate of 1.8%. That tells us that despite a potential flurry of easing in a short period of time, monetary policy would still be weighing on price growth.

The change would be huge for economic sentiment. Purchases of houses and real estate made at high rates over the last couple of years could be refinanced, reducing the rate of interest payments for individuals and businesses; the cost of items like houses and cars would drop, making them more affordable; the burden of paying down items like credit cards would ease. The changes would provide institutions and individuals with more money to spend.

As all of this played out, it would change the mood from one of an economy on the brink of collapse to one that can sustain steady growth. The shift will support solid earnings growth for corporate America. And, the Fed would still have room to cut rates even more, if it felt the adjustment was necessary.

At the end of the day, steady economic growth, and improved consumer and corporate sentiment will encourage more investment in risk assets by both retail and institutional investors. In other words, the change will drive the prices of bitcoin and ETH higher.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc. or its owners and affiliates.