News

Bitcoin Yields as High as 45% on Offer in Pendle's New Pools

-

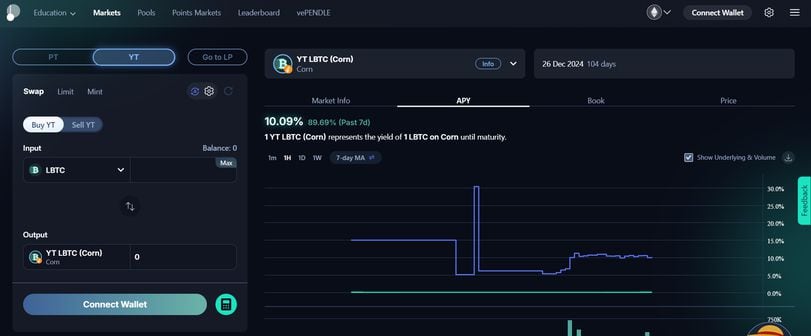

DeFi platform Pendle's new pools allows users to earn floating yields up to 45% and fixed yields of 10% on a bitcoin-based token.

-

The yields are achieved through staking service Lombard's LBTC token in collaboration with Ethereum layer-2 network Corn.

-

Pendle splits investments into principal tokens and yield tokens that can be traded separately, facilitating high-yield strategies by allowing users to trade future returns.

DeFi platform Pendle on Wednesday started offering pools with variable yields of as high as 45% on a bitcoin (BTC) -backed token in a move that expands the product’s fundamentals.

The offering, which can also provide fixed yields of an annualized 10%, allows users to deposit LBTC, a liquid-staking token issued by restaking startup Lombard, in a Pendle pool made by Ethereum layer-2 network Corn. Data shows the pool has attracted over $13 million in user deposits since going live. It matures on Dec. 26.

“We’ve seen major use cases with fixed yield for ETH, and we’re aiming to replicate the same success with BTC as well,” CEO TN Lee told CoinDesk in a Telegram message. “It’s going to be a busy few weeks for us as we roll out new pools and launches.”

Pendle's approach is to divide investments into a decentralized finance (DeFi) protocol, such as Compound or Aave, into two: the principle put up by the investor and the yield expected to be earned on that position in the form of token rewards. The split into a principal token (PT) and a yield token (YT) that can traded on the open market creates the high yields possible on Pendle’s pools.

Users can buy YT with LBTC, giving them increased exposure to the underlying yield and points from LBTC and Corn until maturity, at which point the YT will be worth zero. If they forego those rewards, they can elect to receive either the fixed yield or the floating yield, which comprises the points that can be monetized and future tokens that will be airdropped to LBTC holders.

Lombard is a restaking service that converts wrapped bitcoin (WBTC) to a Lombard Bitcoin (LBTC) token that can be used in DeFi applications to capture yield. Corn, another startup, is a network that uses bitcoin as the main token to pay usage fees.

Unwrapping the jargon : Liquid staking is a service that allows users to stake their crypto assets and receive a new token in exchange. Layer 2s are blockchains focusing on a specific use case atop a broader service blockchain. DeFi refers to using automated smart contracts to provide financial services, such as lending and borrowing to users. A pool can be considered a digital locker to store assets and earn returns, similar to bank accounts.

Pendle’s PENDLE tokens are up 11% in the past 24 hours, CoinGecko data shows, beating a 2% rise in bitcoin.