News

This 50-year-old Seattle woman found out she owns $18M in a single stock, but has ‘no idea’ what to do with it

Imagine checking a long-forgotten account and discovering it’s worth multiple millions of dollars. That’s what happened to Sarah, a 50-year-old mom from Seattle, recently.

Sarah, who says she’s been homeschooling for 20 years, happened to check her employee benefits account from a tech giant where she used to work.

Don't miss

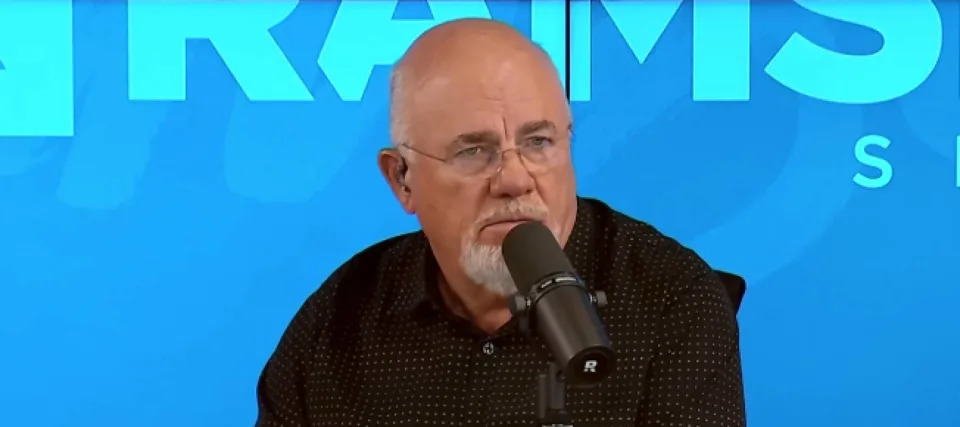

The account had gone from barely worth anything to roughly $18 million at current market price, she told Dave Ramsey during a recent episode of The Ramsey Show. Although she didn’t reveal which company it was, some commenters speculated that it could be Nvidia, the tech giant that has surged tremendously over the past two years.

Regardless, this sudden multimillionaire says she has “no idea” what to do with her unexpected windfall. Ramsey offered some advice.

Diversify and withdraw in a tax-conscious way

Having much of your net worth tied up in a single stock is “scary and unwise,” says Ramsey. He recommends offloading some of the shares and investing her money elsewhere. However, given the magnitude of the fortune, selling even a fraction of the account would likely push Sarah into the top tax bracket.

He suggests speaking with an expert tax planner or investment adviser to minimize the tax bill. However, he insists on diversifying away from a single stock as soon as possible. “If I’m you, even if it costs me some money I would rather have the safety than I would the extra 20%,” Ramsey told her.

According to the Internal Revenue Service, the highest possible capital gains tax rate for someone in the highest tax bracket is 20%, making that the maximum (federal) tax bill Sarah would face. Depending on where you live, you may also face state taxes on your capital gains. For Sarah, in Washington State, that’s another 7%.

However, single stocks, particularly in the tech sector, are notoriously volatile. Etsy has lost 34% over the course of 2024, for example, while Facebook’s parent company Meta Platforms lost a whopping 70% of its value in 2022.

Read more: Rich, young Americans are ditching the stormy stock market — here are the alternative assets they're banking on instead

This is why financial experts recommend diversification , even if one stock has been a big winner.

Besides diversification, Sarah’s story offers another lesson for regular investors: the value of longer time horizons .

Time in the market is better than timing the market

“Time in the market beats timing the market," is a commonly repeated axiom in the financial industry. It’s based on evidence that most investors struggle to find the right stock, at the time, at the right price. Instead, a longer time horizon allows a basket of high-quality investments to compound over time and deliver returns.

Legendary investor Warren Buffett once said that timing the market was “both impossible and stupid.” Instead, in a 2015 interview with The Street, he said “the point is to buy something you like at a price you like, and then hold it for 20 years. You should not look at it day to day.”

According to the Official Data Foundation , if you invested $10,000 in the S&P 500 in 2004, it would be worth $71,640 by November 2024. That’s not a life-changing fortune, but it does show the power of compound growth over longer time horizons.

Most investors could take a page out of Sarah’s book and “buy and forget” high-quality stocks, preferably for several decades. Before long, you'll also be wracking your brain to figure out what to do with your riches.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.