News

Bitcoin, Gold, S&P 500: Market Participants Hold Breath After US Elections

Investors recently absorbed US inflation figures, which came in line with expectations. As a result, the Fed will likely cut interest rates in December. However, since inflation had little impact on Bitcoin , gold , and the S&P 500 , market participants returned their focus to Trump’s election win.

The Trump trade has been bullish for Bitcoin and the S&P 500 index. On the other hand, gold has collapsed due to fears that the Fed will take longer to lower borrowing costs.

At the same time, the focus shifted to the upcoming US retail sales report, which might give more clues on future Fed moves.

Fundamental Analysis

Economists expect retail sales in the US to increase by 0.3% in October. This figure would drop from the previous reading of 0.4%. Similarly, core sales might ease from 0.5% to 0.3%. A better-than-expected jump in sales would indicate robust consumer spending. Therefore, the December Fed rate cut expectations would drop, boosting the dollar.

Meanwhile, gold, Bitcoin, and the S&P 500 would retreat. A higher likelihood of a Fed pause is bearish for gold as interest rates will remain high for longer. Meanwhile, BTC would fall due to a stronger dollar, and the S&P 500 would ease amid expectations of a less dovish Fed.

On the other hand, if sales miss forecasts, it will solidify bets for a December Fed rate cut, weighing on USD. Meanwhile, gold, Bitcoin, and the S&P 500 would rally at the prospect of lower borrowing costs in the US.

Bitcoin Technical Analysis

On the technical side, the Bitcoin price has paused after reaching a new peak at 93090.50. After a new high, the price made a bearish engulfing candle, indicating a surge in bearish momentum. This reversal signal comes after a steep bullish trend, where the price respected the 22-SMA as support.

However, bears have prompted a break below the SMA, showing an attempt to reverse the trend. The price must break below the 85500.94 support to start making lower lows and highs. At the same time, the RSI must break below 50 into bearish territory. A reversal might retest the 77068.10 support level as well.

Key Support Levels

Support 1: 85500.94, a recent 4-hour swing low

Support 2: 77068.10, a solid 4-hour resistance turned support

Key Resistance Levels

Resistance 1: 93090.50, the recent 4-hour swing high

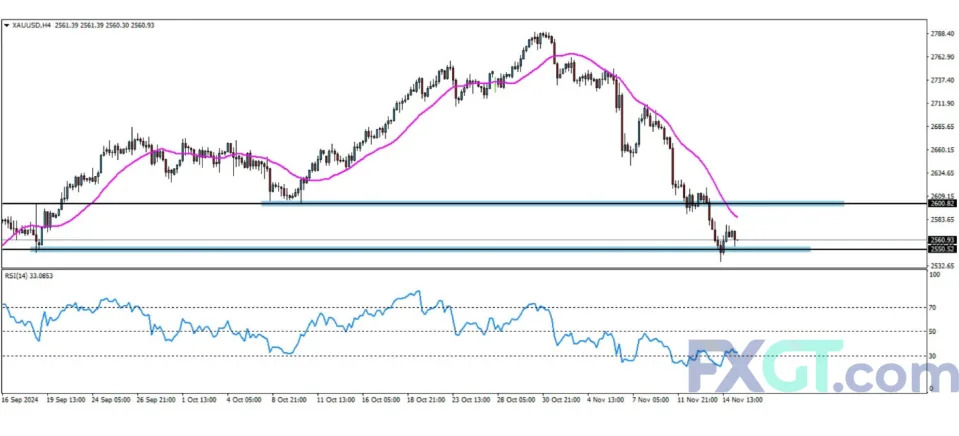

Gold Technical Analysis

The 4-hour gold chart shows a strong bearish trend, with the price making a series of lower highs and lows. At the same time, the price has respected the 22-SMA as resistance, falling every time after revisiting the line. Meanwhile, the RSI has traded in bearish territory below 50 since the trend reversed, suggesting solid momentum.

The gold price recently broke below the 2600.82 support level, solidifying the bearish bias. However, the decline has paused at the 2550.52 support level. As a result, bulls have resurfaced for a pullback.

Since the bearish bias is strong, the pullback might not surpass the 22-SMA. Moreover, bears will likely soon resurface to challenge the 2550.52 support. A break below would continue the downtrend with a lower low.

Key Support Levels

Support 1: 2550.52, a recent 4-hour swing low

Key Resistance Levels

Resistance 1: 2600.82, a 4-hour support turned resistance

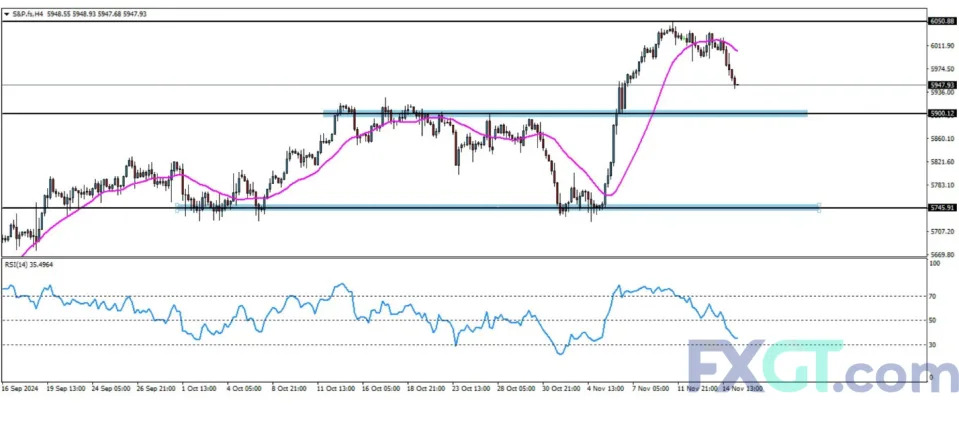

S&P 500 Technical Analysis

The S&P 500 price has broken below the 22-SMA, signaling a shift in sentiment from bullish to bearish. Nevertheless, bulls are in the lead on a larger scale since the price recently rose. At first, the bullish trend paused to consolidate between the 5745.91 support and the 5900.12 resistance.

However, bulls recently broke out of this range to make a new high at 6050.88. If the bullish trend is shallow, the price might drop to retest the recently broken range resistance before climbing higher. A break above 6050.88 would confirm a continuation of the bullish trend.

However, the price currently trades below the 22-SMA, with the RSI in bearish territory. If bears are ready to take charge, the S&P 500 price will continue dropping beyond the 5900.12 level to retest the 5745.91 support.

Key Support Levels

Support 1: 5900.12, a recent 4-hour resistance turned support

Support 2: 5745.91, a 4-hour swing low

Key Resistance Levels

Resistance 1: 6050.88, the recent 4-hour swing high

Final Thoughts

Market participants are still absorbing the recent change in US politics that could mean higher US inflation. At the same time, economic reports from the US continue shaping the outlook for the Fed’s December meeting. The retail sales report will increase market volatility if it comes above or below estimates.

This article is brought to you by FXGT.com . If you want to dive deep into forex, stocks, commodities, and crypto, FXGT.com market analysis provides expert analysis that filters market noise and reveals what matters most.

This article was originally posted on FX Empire